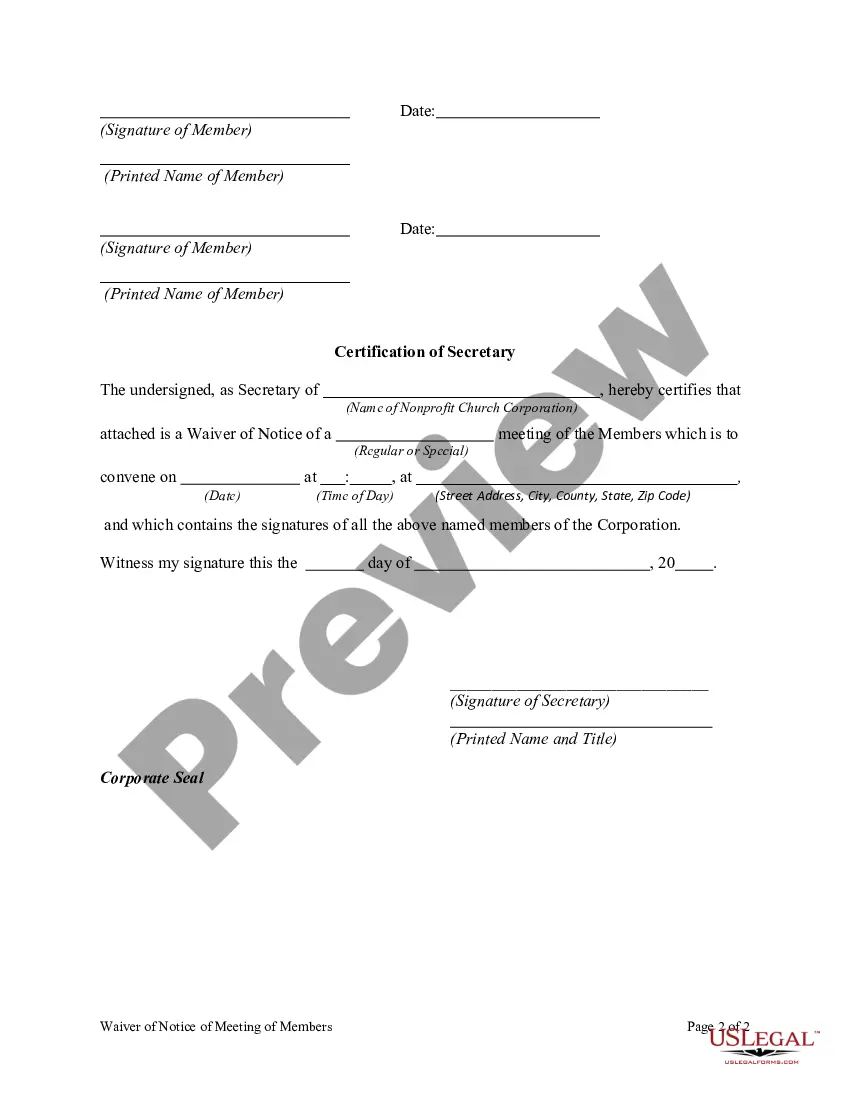

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

New Hampshire Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

You can spend hours online searching for the valid format that meets the state and federal specifications you require.

US Legal Forms offers a vast selection of legitimate templates that can be reviewed by professionals.

You can effortlessly obtain or create the New Hampshire Waiver of Notice of Meeting of members of a Nonprofit Church Corporation through their services.

If available, utilize the Preview button to review the format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Subsequently, you can complete, modify, generate, or sign the New Hampshire Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

- Every legal template you purchase is yours to keep indefinitely.

- To receive an additional copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are utilizing the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for your county/area of choice.

- Examine the form overview to confirm that you have chosen the appropriate template.

Form popularity

FAQ

The phrase 'notice of presentation waived' refers to a situation where members of a Nonprofit Church Corporation agree to forgo the formal notification process for a meeting. This means that members acknowledge the meeting details informally, eliminating the need for written notice. In New Hampshire, this waiver facilitates more efficient planning and can strengthen member engagement by allowing timely discussions without administrative delays.