New Hampshire Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

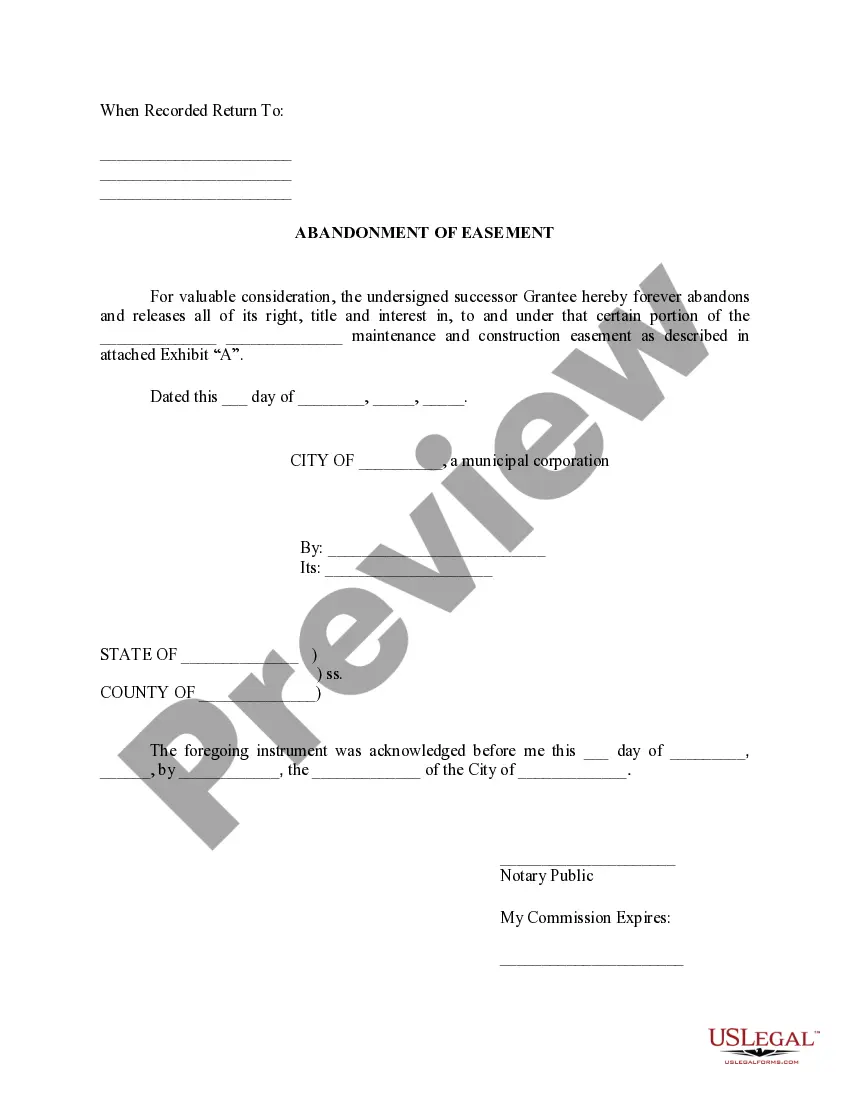

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

If you wish to finalize, download, or generate valid document templates, utilize US Legal Forms, the most extensive collection of legal forms available online. Employ the site's user-friendly and efficient search feature to find the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to acquire the New Hampshire Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Wife's Passing with just a few clicks.

If you are a current US Legal Forms user, Log In to your account and click the Download option to retrieve the New Hampshire Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Wife's Passing. You can also access forms you previously saved in the My documents section of your account.

Every legal document format you purchase is yours indefinitely. You have access to all forms you saved in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, print the New Hampshire Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Wife's Passing with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are utilizing US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of your legal form format.

- Step 4. Once you have located the form you need, click the Purchase Now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Hampshire Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Wife's Passing.

Form popularity

FAQ

The marital deduction is unlimited. The correct answer is a. An outright specific bequest of property from a U.S. citizen to his resident alien spouse does not qualify for the marital deduction.

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

A marital deduction trust can take one of two forms, either a life estate coupled with a general power of appointment given to the spouse or a Qualified Terminable Interest Property (QTIP) trust.

There are three types of marital trusts: a general power of appointment, a qualified terminable interest property (QTIP) trust, and an estate trust. A martial trust protects the assets and benefits of a surviving spouse and children.

Most A Trusts are actually also QTIP Trusts. However, for it to be a QTIP Trust, only the surviving spouse can be the beneficiary of the trust during his or her lifetime, and the trust is required to pay all income generated by the trust (e.g. dividends and interest) to the surviving spouse at least annually.

You can establish a marital trust with the help of an attorney who specializes in estate planning. The trust document must specify all assets and property held in the trust. This can include nearly anything of value. That includes stocks, bonds, mutual funds, cash and physical property.

A SLAT is an irrevocable trust where the spouse is a permitted beneficiary. It allows married clients to take advantage of the high gift tax exemption amount while also allowing for continued access to the gifted trust assets, if needed, while removing any appreciation on the gift from each spouse's taxable estate.

If you're married with kids, naming a spouse as a primary beneficiary is the go-to for most people. This way, your partner can use the proceeds of the policy to help provide for your kids, pay the mortgage, and ease economic hardship that your death may bring. This is true even if one spouse is a stay-at-home parent.

This technique is novel because normally, gifts between spouses qualify for the federal estate and gift tax marital deduction and must be included in the spouse's estate at death. Gifts made to an Irrevocable Spousal Trust are not taxed in the survivor's estate.

The assets that are not transferred into the bypass trust will fund the marital trust and will be included in the taxable estate of the second spouse to die. However, because of the unlimited marital deduction, the assets that are placed in this trust will not be taxed in the estate of the first spouse to die.