New Hampshire Subrogation Agreement between Insurer and Insured

Description

How to fill out Subrogation Agreement Between Insurer And Insured?

Are you presently in a place that you need to have papers for possibly business or individual functions just about every working day? There are a lot of legal papers templates available on the net, but discovering kinds you can rely on is not simple. US Legal Forms provides 1000s of type templates, much like the New Hampshire Subrogation Agreement between Insurer and Insured, that happen to be published in order to meet federal and state specifications.

In case you are currently informed about US Legal Forms internet site and also have a merchant account, basically log in. Next, you may acquire the New Hampshire Subrogation Agreement between Insurer and Insured web template.

Should you not come with an accounts and need to begin using US Legal Forms, abide by these steps:

- Get the type you want and make sure it is for the appropriate town/area.

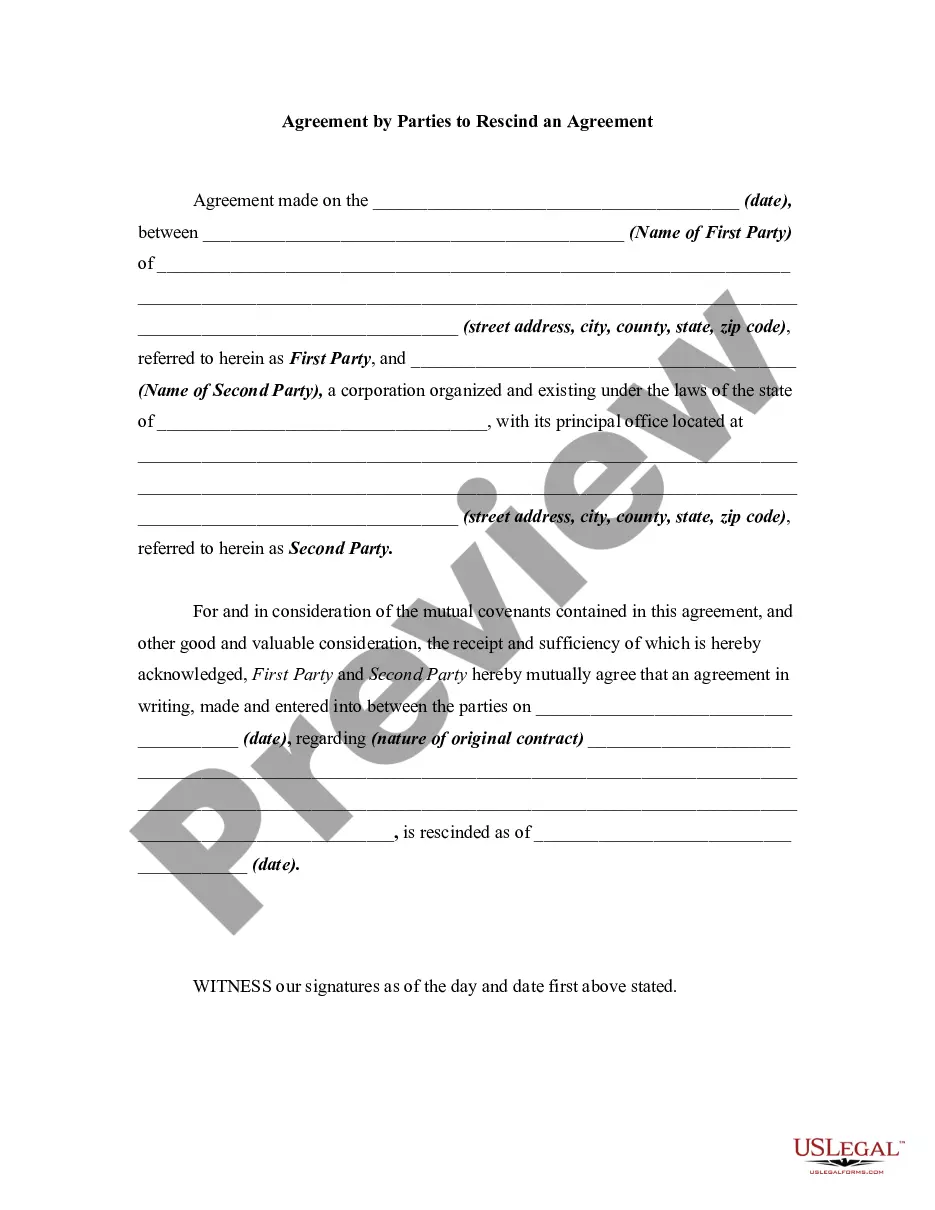

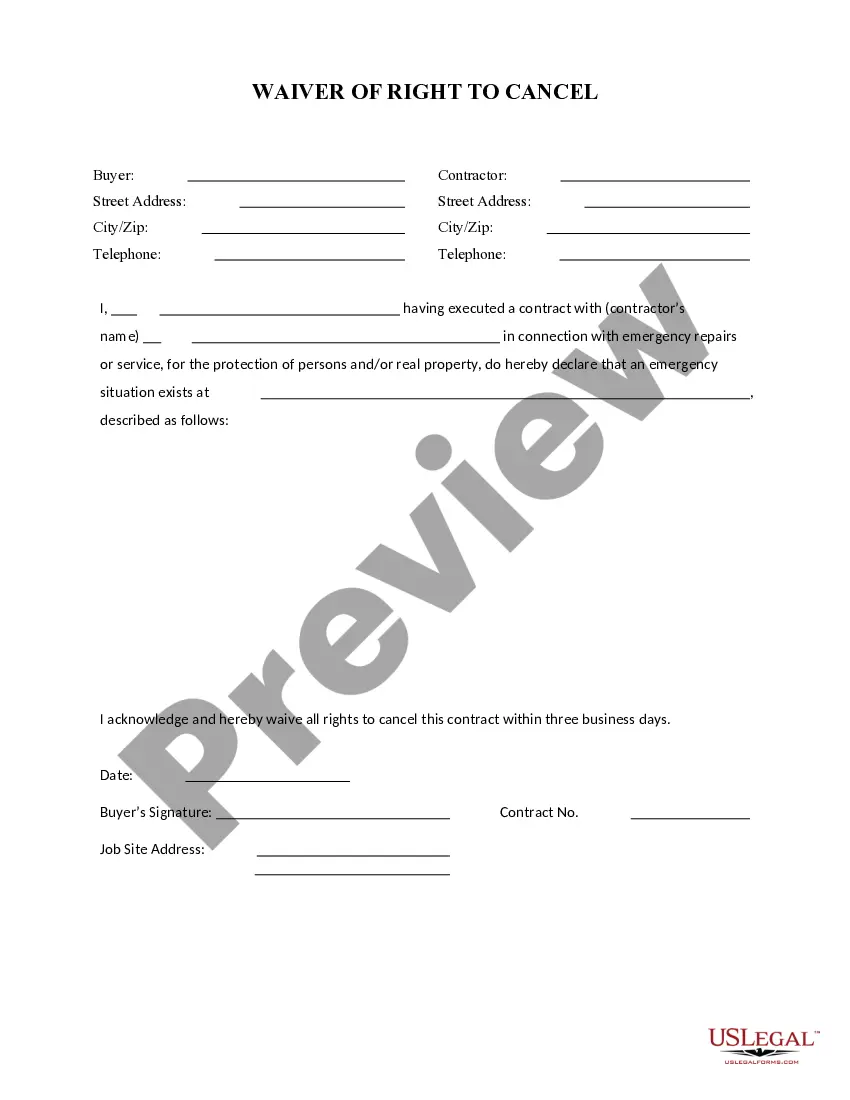

- Take advantage of the Review option to analyze the shape.

- Read the outline to ensure that you have selected the right type.

- In the event the type is not what you are searching for, take advantage of the Look for industry to obtain the type that meets your needs and specifications.

- When you discover the appropriate type, simply click Get now.

- Select the costs plan you desire, fill out the necessary details to produce your bank account, and purchase an order using your PayPal or charge card.

- Pick a practical file formatting and acquire your backup.

Get all the papers templates you possess purchased in the My Forms menus. You may get a further backup of New Hampshire Subrogation Agreement between Insurer and Insured any time, if needed. Just select the essential type to acquire or print out the papers web template.

Use US Legal Forms, the most comprehensive collection of legal varieties, to conserve time and stay away from mistakes. The services provides expertly made legal papers templates that you can use for a range of functions. Create a merchant account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

What is Subrogation? Subrogation in insurance is a legal right of the insurance company to legally pursue a third-party responsible for the damages/insurance loss caused to the insured. Subrogation is done to recover the claim amount insurance company pays to the insured for the damages.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

Subrogation refers to the right of an insurance company to recover money it paid to or on behalf of its insureds due to the actions of at-fault third parties.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

Generally, in most subrogation cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party's insurance company. Subrogation is most common in an auto insurance policy but also occurs in property/casualty and healthcare policy claims.

An insurer may attempt to subrogate against an additional insured for completed operations injuries caused by the insured if the additional insured endorsement provides coverage only for ongoing operations injuries.