Subject: Explanation for Denial of Cash Advances — New Hampshire Dear [Applicant's Name], We would like to sincerely thank you for your recent request for a cash advance with our financial institution. Your trust in our services is greatly appreciated. However, after careful review of your application, we regret to inform you that we are unable to grant your request at this time. This letter aims to explain the reasons behind our decision, ensuring transparency and fairness. New Hampshire Code (RSA) 399-A:9 governs the regulations regarding cash advances within the state. As responsible lenders, we are committed to adhering to these guidelines to protect consumer interests, maintain financial stability, and mitigate any potential risks associated with lending. Here are a few possible reasons that might have contributed to the denial of your cash advance application: 1. Inadequate Credit History: We assess each applicant's creditworthiness based on their credit history, including factors such as outstanding debts, payment history, and credit scores. If your credit report reflects a history of late payments, high credit utilization, or records of default, it may negatively impact your eligibility for a cash advance. 2. Insufficient Income: Before approving any application, we evaluate an applicant's income to ensure they can comfortably repay the advanced amount within the agreed-upon terms. If your income falls below our predetermined threshold or is deemed insufficient to meet the repayment obligations, approval may be denied. 3. Existing Debt Burden: If our review indicates that you already have a significant amount of outstanding debt, including other cash advances or loans, it may raise concerns regarding your ability to take on additional financial obligations. This factor could lead to a denial or may require further in-depth evaluation. 4. Employment Stability: Consistent employment and a reliable source of income bolster the confidence we place in our borrowers. In cases where an applicant's employment history is short-term, inconsistent, or does not demonstrate a stable income, it can impact our assessment and contribute to the denial. While we understand that this decision might be disappointing, we encourage you to utilize this opportunity to improve your financial standing. Here are a few recommendations to help in future cash advance applications: 1. Enhance your Credit Score: By paying bills on time, reducing outstanding debts, and responsibly managing current credit lines, you can gradually strengthen your credit score. 2. Review your Income and Expenses: Evaluate your income and expenses critically to ensure that your cash advance request aligns with your financial capabilities. Decreasing existing debt burdens may increase the likelihood of approval. 3. Maintain a Stable Employment History: Sustaining stable employment for a considerable period demonstrates financial responsibility and increases the chances of future cash advance approvals. Please note that this denial does not prevent you from applying for a cash advance in the future. We encourage you to use our services responsibly, ensuring that the timing aligns with your financial capacity. If you have any further inquiries or wish to discuss your application denial, please do not hesitate to contact our customer service representatives at [Customer Service Number] or visit one of our branches. We will be more than willing to clarify any questions you may have. Thank you for considering our institution for your financial needs. We appreciate your understanding and look forward to continuing to serve your financial interests in the future. Sincerely, [Your Name] [Your Title/Position] [Financial Institution's Name]

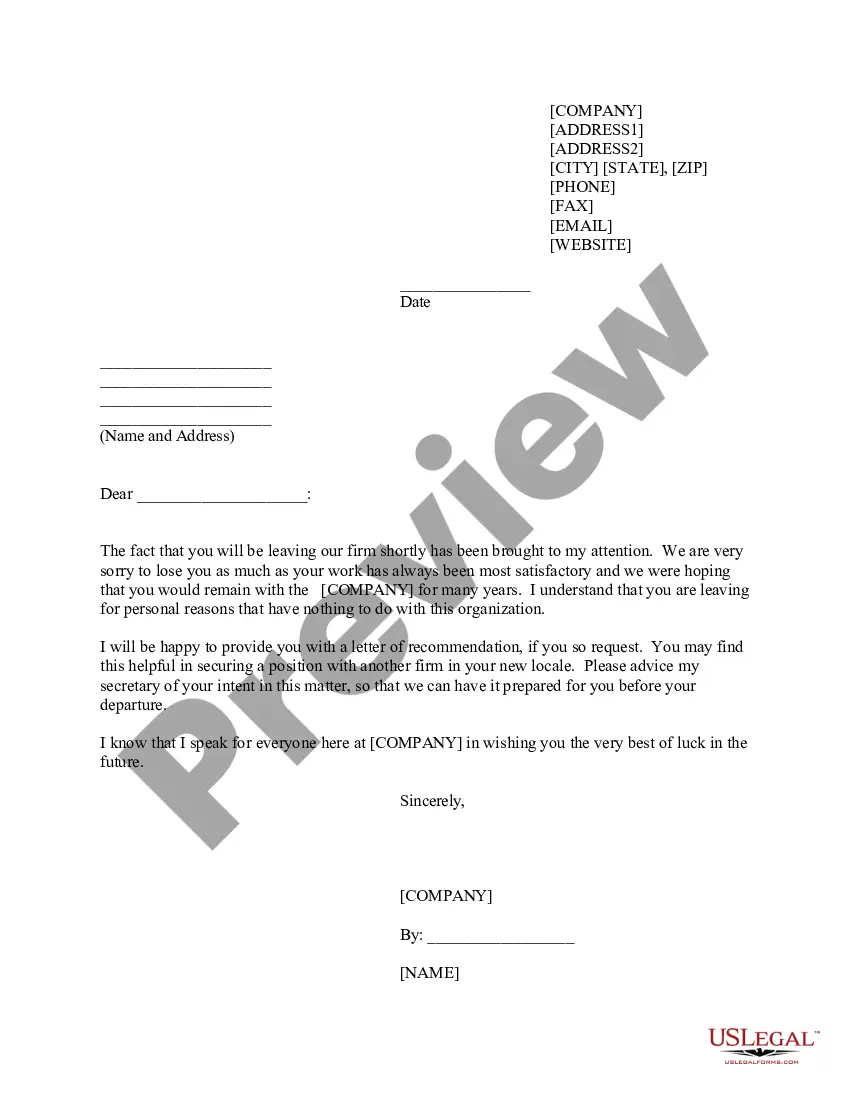

New Hampshire Sample Letter for Denial of Cash Advances

Description

How to fill out New Hampshire Sample Letter For Denial Of Cash Advances?

If you need to complete, obtain, or print legal record layouts, use US Legal Forms, the biggest assortment of legal kinds, which can be found on the web. Make use of the site`s simple and easy convenient lookup to find the paperwork you will need. Numerous layouts for business and personal reasons are categorized by types and says, or keywords and phrases. Use US Legal Forms to find the New Hampshire Sample Letter for Denial of Cash Advances in a couple of click throughs.

If you are currently a US Legal Forms client, log in for your profile and click the Acquire button to get the New Hampshire Sample Letter for Denial of Cash Advances. You can also accessibility kinds you in the past acquired in the My Forms tab of your profile.

Should you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form to the proper metropolis/country.

- Step 2. Use the Review method to check out the form`s articles. Never overlook to learn the description.

- Step 3. If you are not happy together with the form, take advantage of the Look for industry near the top of the monitor to find other variations of your legal form web template.

- Step 4. Once you have found the form you will need, click on the Buy now button. Choose the prices prepare you prefer and put your qualifications to register to have an profile.

- Step 5. Method the financial transaction. You should use your credit card or PayPal profile to finish the financial transaction.

- Step 6. Choose the structure of your legal form and obtain it in your device.

- Step 7. Comprehensive, edit and print or sign the New Hampshire Sample Letter for Denial of Cash Advances.

Every single legal record web template you purchase is yours for a long time. You have acces to each and every form you acquired within your acccount. Click the My Forms portion and decide on a form to print or obtain yet again.

Remain competitive and obtain, and print the New Hampshire Sample Letter for Denial of Cash Advances with US Legal Forms. There are millions of skilled and express-certain kinds you can use for your personal business or personal requirements.