The New Hampshire Assignment of LLC Company Interest to Living Trust is a legal document used to transfer ownership of a Limited Liability Company (LLC) to a living trust. This assignment allows the owner or member of the LLC to transfer their interest in the company to a trust, ensuring a smooth transition of ownership and providing the benefits of trust management. This type of assignment is commonly used in estate planning and asset protection strategies. By transferring the LLC interest to a living trust, the owner can avoid probate and ensure their wishes are carried out after their passing. It also provides flexibility in managing the LLC, as the trustee of the living trust can make decisions on behalf of the trust and its beneficiaries. There may be different types or variations of the New Hampshire Assignment of LLC Company Interest to Living Trust. These variations may include: 1. Single-Member LLC Assignment to Living Trust: When the LLC is solely owned by one member, this assignment allows the member to transfer their ownership interest to their living trust. 2. Multi-Member LLC Assignment to Living Trust: In cases where the LLC has multiple members, each member can individually assign their membership interest to their respective living trust. 3. Partial Assignment of LLC Interest: This type of assignment involves transferring only a portion of the LLC interest to the living trust. It allows the owner to retain some ownership while still benefiting from the trust-related advantages. 4. Full Assignment of LLC Interest: This assignment involves transferring the entire ownership interest in the LLC to the living trust. It effectively removes the owner's direct ownership and vests all control and management duties in the trust. 5. Revocable vs. Irrevocable Living Trust Assignment: The assignment can be made to either a revocable or irrevocable living trust. A revocable trust allows the owner to amend or revoke the trust during their lifetime, while an irrevocable trust is generally more secure and provides additional asset protection benefits. When completing the New Hampshire Assignment of LLC Company Interest to Living Trust, it is important to provide accurate information about the LLC, its members, and the living trust. It is advisable to seek legal advice to ensure compliance with New Hampshire state laws and to properly structure the assignment to meet individual needs and goals. Overall, the New Hampshire Assignment of LLC Company Interest to Living Trust serves as a valuable tool for LLC owners who wish to pass on their interests while enjoying the advantages of a living trust in managing and protecting their assets.

New Hampshire Assignment of LLC Company Interest to Living Trust

Description

How to fill out New Hampshire Assignment Of LLC Company Interest To Living Trust?

Have you been in the placement that you need documents for sometimes company or individual reasons virtually every time? There are a variety of lawful file templates accessible on the Internet, but finding types you can trust isn`t simple. US Legal Forms gives thousands of form templates, just like the New Hampshire Assignment of LLC Company Interest to Living Trust, that are created in order to meet federal and state needs.

Should you be currently knowledgeable about US Legal Forms web site and get an account, basically log in. Next, it is possible to acquire the New Hampshire Assignment of LLC Company Interest to Living Trust format.

If you do not have an profile and would like to begin using US Legal Forms, abide by these steps:

- Get the form you will need and ensure it is for your appropriate town/region.

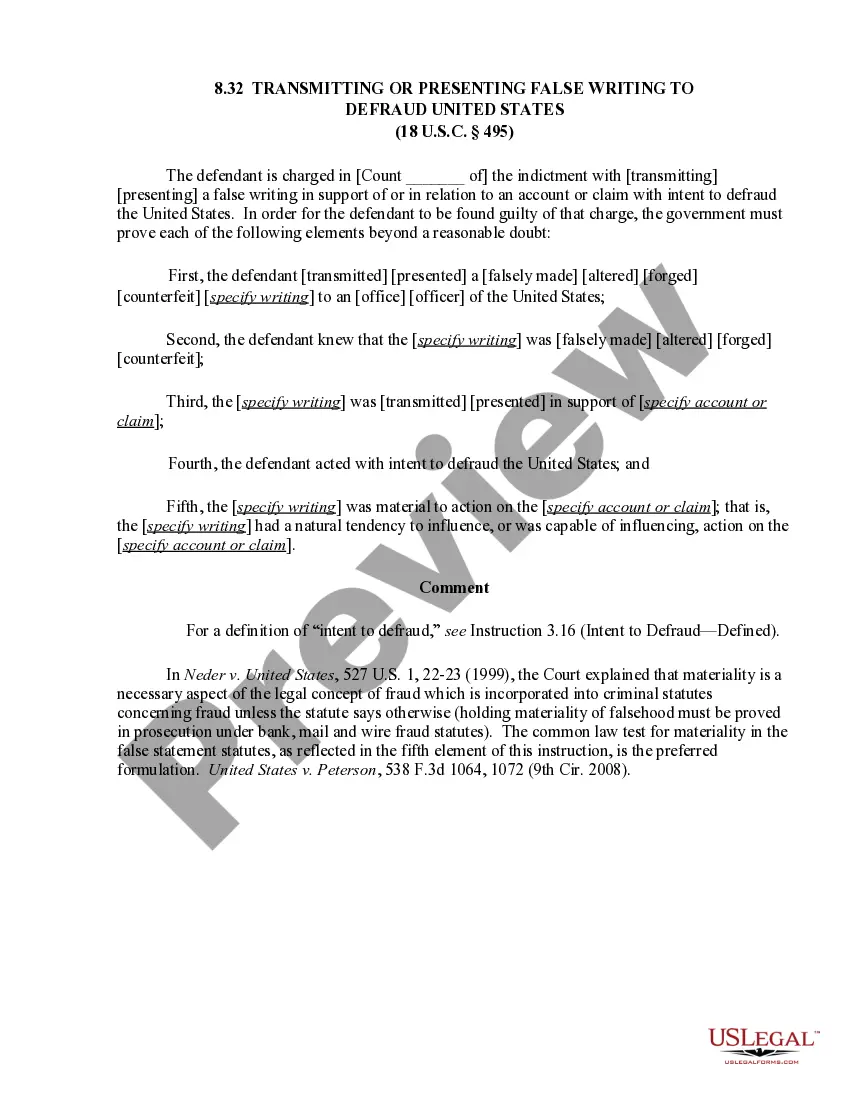

- Take advantage of the Preview switch to examine the form.

- Look at the information to actually have chosen the proper form.

- If the form isn`t what you`re trying to find, make use of the Look for industry to find the form that meets your needs and needs.

- When you obtain the appropriate form, simply click Buy now.

- Choose the prices plan you want, submit the specified details to make your account, and purchase an order utilizing your PayPal or bank card.

- Decide on a practical paper format and acquire your duplicate.

Find each of the file templates you possess purchased in the My Forms food selection. You can obtain a extra duplicate of New Hampshire Assignment of LLC Company Interest to Living Trust any time, if necessary. Just go through the necessary form to acquire or printing the file format.

Use US Legal Forms, one of the most extensive variety of lawful varieties, to conserve efforts and prevent mistakes. The services gives skillfully created lawful file templates that can be used for an array of reasons. Generate an account on US Legal Forms and begin generating your lifestyle easier.