New Hampshire Seller's Affidavit of Nonforeign Status

Description

How to fill out Seller's Affidavit Of Nonforeign Status?

It is possible to spend hours on the Internet searching for the lawful file design that meets the federal and state demands you require. US Legal Forms gives thousands of lawful varieties which are examined by experts. You can easily down load or produce the New Hampshire Seller's Affidavit of Nonforeign Status from the support.

If you currently have a US Legal Forms account, you may log in and then click the Download key. Next, you may total, revise, produce, or sign the New Hampshire Seller's Affidavit of Nonforeign Status. Every single lawful file design you buy is your own property for a long time. To have yet another backup of any obtained kind, visit the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms site the very first time, adhere to the simple recommendations under:

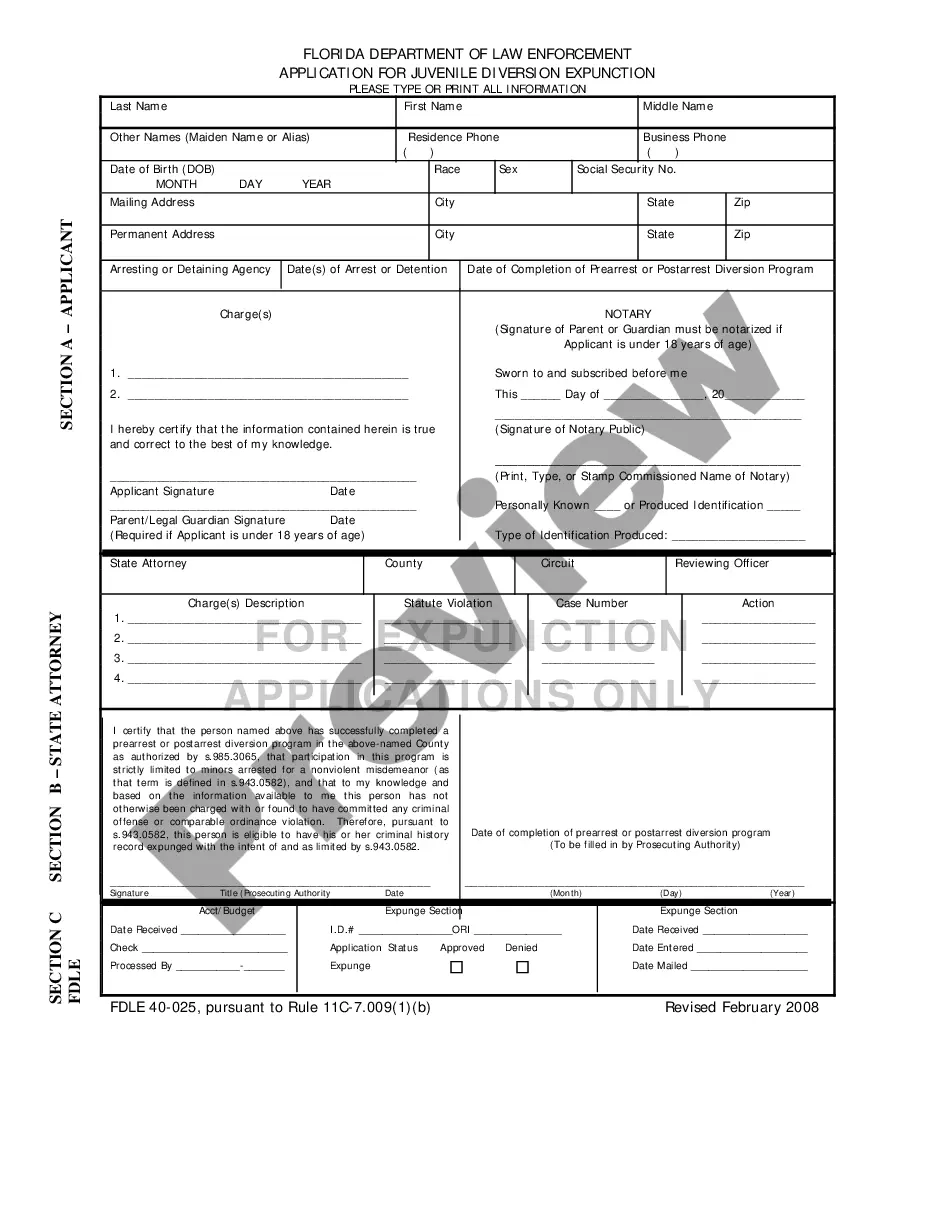

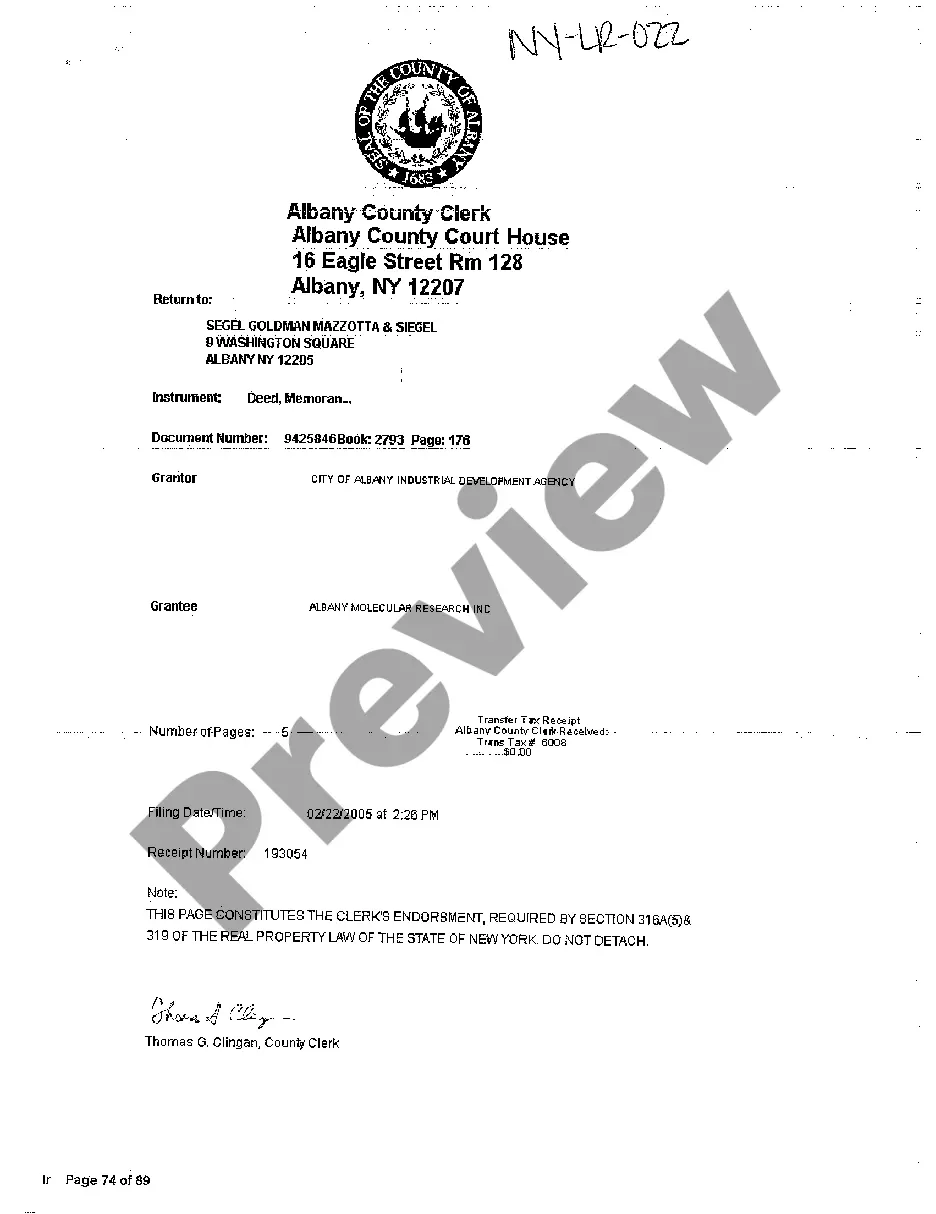

- First, make certain you have chosen the correct file design for the region/metropolis that you pick. See the kind description to make sure you have picked the proper kind. If readily available, utilize the Review key to search through the file design at the same time.

- If you wish to discover yet another edition of your kind, utilize the Look for area to get the design that suits you and demands.

- When you have located the design you need, click Acquire now to continue.

- Select the costs strategy you need, enter your qualifications, and sign up for a free account on US Legal Forms.

- Full the transaction. You may use your credit card or PayPal account to purchase the lawful kind.

- Select the file format of your file and down load it in your product.

- Make adjustments in your file if required. It is possible to total, revise and sign and produce New Hampshire Seller's Affidavit of Nonforeign Status.

Download and produce thousands of file themes while using US Legal Forms web site, that offers the most important assortment of lawful varieties. Use expert and status-certain themes to deal with your company or personal needs.

Form popularity

FAQ

If the transferor is an entity, the FIRPTA Certification must be signed by a responsible officer in the case of a corporation, by a general partner in the case of a partnership, and by a trustee, executor, or equivalent fiduciary in the case of a trust or estate.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

A FIRPTA affidavit, also known as Affidavit of Non-Foreign Status, is a form a seller purchasing a U.S. property uses to certify under oath that they aren't a foreign citizen. The form includes the seller's name, U.S. taxpayer identification number and home address.

With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign.

In order to avoid issues with FIRPTA, the seller will sign an Affidavit and certify status. Otherwise, various pesky IRS forms, such as Form 8288 may be required.