New Hampshire Sample Letter for Closing of Estate with no Distribution

Description

How to fill out Sample Letter For Closing Of Estate With No Distribution?

Finding the right lawful file design can be quite a struggle. Needless to say, there are a lot of layouts accessible on the Internet, but how do you find the lawful kind you will need? Make use of the US Legal Forms internet site. The support delivers 1000s of layouts, including the New Hampshire Sample Letter for Closing of Estate with no Distribution, which can be used for enterprise and personal requires. All of the forms are checked by experts and fulfill state and federal demands.

In case you are currently registered, log in to your profile and click the Obtain button to obtain the New Hampshire Sample Letter for Closing of Estate with no Distribution. Use your profile to appear with the lawful forms you may have bought earlier. Proceed to the My Forms tab of your own profile and obtain yet another backup from the file you will need.

In case you are a fresh customer of US Legal Forms, listed here are straightforward instructions that you can adhere to:

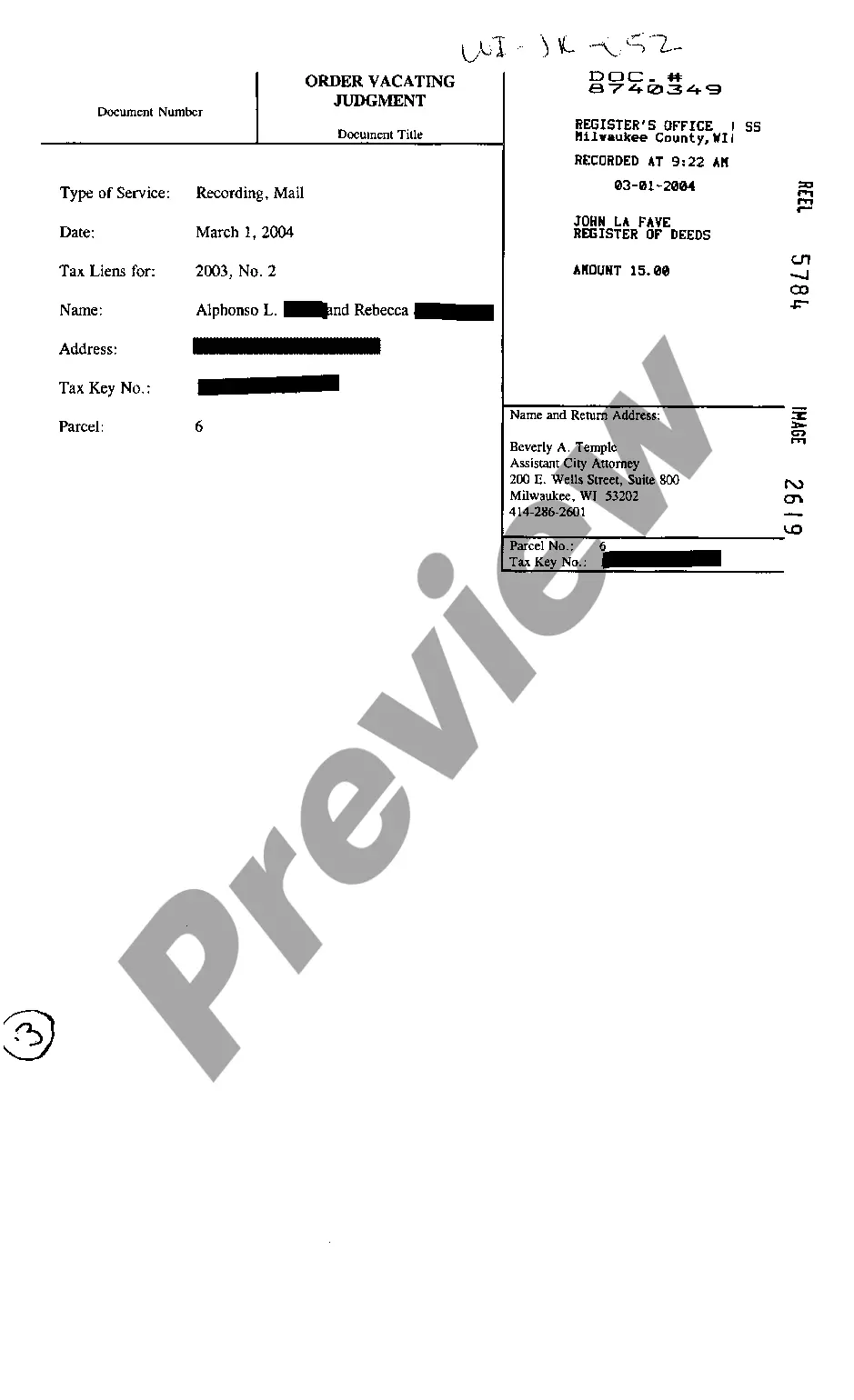

- Initial, ensure you have selected the proper kind for your metropolis/region. It is possible to look over the shape while using Review button and read the shape description to make certain this is basically the right one for you.

- In case the kind is not going to fulfill your preferences, use the Seach area to get the appropriate kind.

- Once you are sure that the shape is acceptable, click on the Acquire now button to obtain the kind.

- Opt for the prices plan you desire and enter in the essential details. Make your profile and pay money for the order utilizing your PayPal profile or credit card.

- Pick the data file formatting and obtain the lawful file design to your product.

- Complete, revise and print and indicator the acquired New Hampshire Sample Letter for Closing of Estate with no Distribution.

US Legal Forms is the largest catalogue of lawful forms that you will find numerous file layouts. Make use of the service to obtain appropriately-manufactured paperwork that adhere to state demands.

Form popularity

FAQ

CLOSING THE ESTATE You must file it, along with a filing fee, with the Circuit Court Probate Division for its approval. Once the final account is accepted by the court, you should make the final distribution of assets.

The Estate Settlement Timeline: There is no specific deadline for this in New Hampshire law, but it is generally best to do so within 30 days to prevent unnecessary delays in the probate process.

In New Hampshire, probate can take at least six months to allow creditors to file claims against the estate. On average, the probate process can take up to a year and a half. During the NH probate process, heirs are not able to access the money their loved ones wanted them to have.

Creditors have a certain time frame, typically six months from the date of appointment of the executor or administrator, to file their claims for payment. If the estate has enough assets, the debts are paid. If not, creditors are generally paid on a pro-rata basis.

General Information: A creditor of an estate is a person or entity (business or organization) to whom the decedent owed money. ?Decedent? is the term used to refer to the person who died.

A will, or a last will and testament, is a legal document that describes how you would like your property and other assets to be distributed after your death.