A New Hampshire Revocable Trust for the Lifetime Benefit of Trust or and Surviving Spouse is a legal arrangement that provides financial security and flexibility for individuals in the state of New Hampshire. This type of trust is specifically designed to benefit the trust or during their lifetime, and after their death, ensure ongoing support and provisions for their surviving spouse. The primary purpose of this trust is to protect and manage the trust or's assets to provide for their needs and comforts during their lifetime. It allows them to retain control and access to their assets while enjoying the peace of mind that comes with knowing their spouse will be provided for when they pass away. This is particularly beneficial in situations where the trust or wants to ensure the financial stability and well-being of their surviving spouse, even after they are no longer present. One of the key features of the New Hampshire Revocable Trust for the Lifetime Benefit of Trust or and Surviving Spouse is the inclusion of an annuity. The annuity aspect ensures a steady stream of income for both the trust or and the surviving spouse. It helps to maintain a comfortable lifestyle for both parties and may be customized to fit their specific financial goals and needs. There may be different variations or types of this trust, each tailored to the unique circumstances of the trust or. Some common variations include: 1. Irrevocable New Hampshire Trust with an Annuity: This type of trust cannot be modified or revoked once it is established. It provides a higher level of asset protection while still allowing for regular annuity payments to the trust or and the surviving spouse. 2. Joint New Hampshire Revocable Trust with an Annuity: This type of trust is established by a couple, typically married, to benefit both individuals during their lifetimes. After the death of either spouse, the trust continues to provide for the surviving spouse with annuity payments. 3. Special Needs New Hampshire Revocable Trust with an Annuity: This trust is designed to provide ongoing financial support and care for a disabled or special needs beneficiary. It ensures that the trust or's assets are managed appropriately and that the annuity payments can help cover the unique needs of the beneficiary. Overall, the New Hampshire Revocable Trust for the Lifetime Benefit of Trust or and Surviving Spouse with Annuity offers a practical and efficient way to secure financial stability for individuals and their spouses in New Hampshire. It creates a flexible framework for managing assets, while still providing for the ongoing needs and support of the surviving spouse.

New Hampshire Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

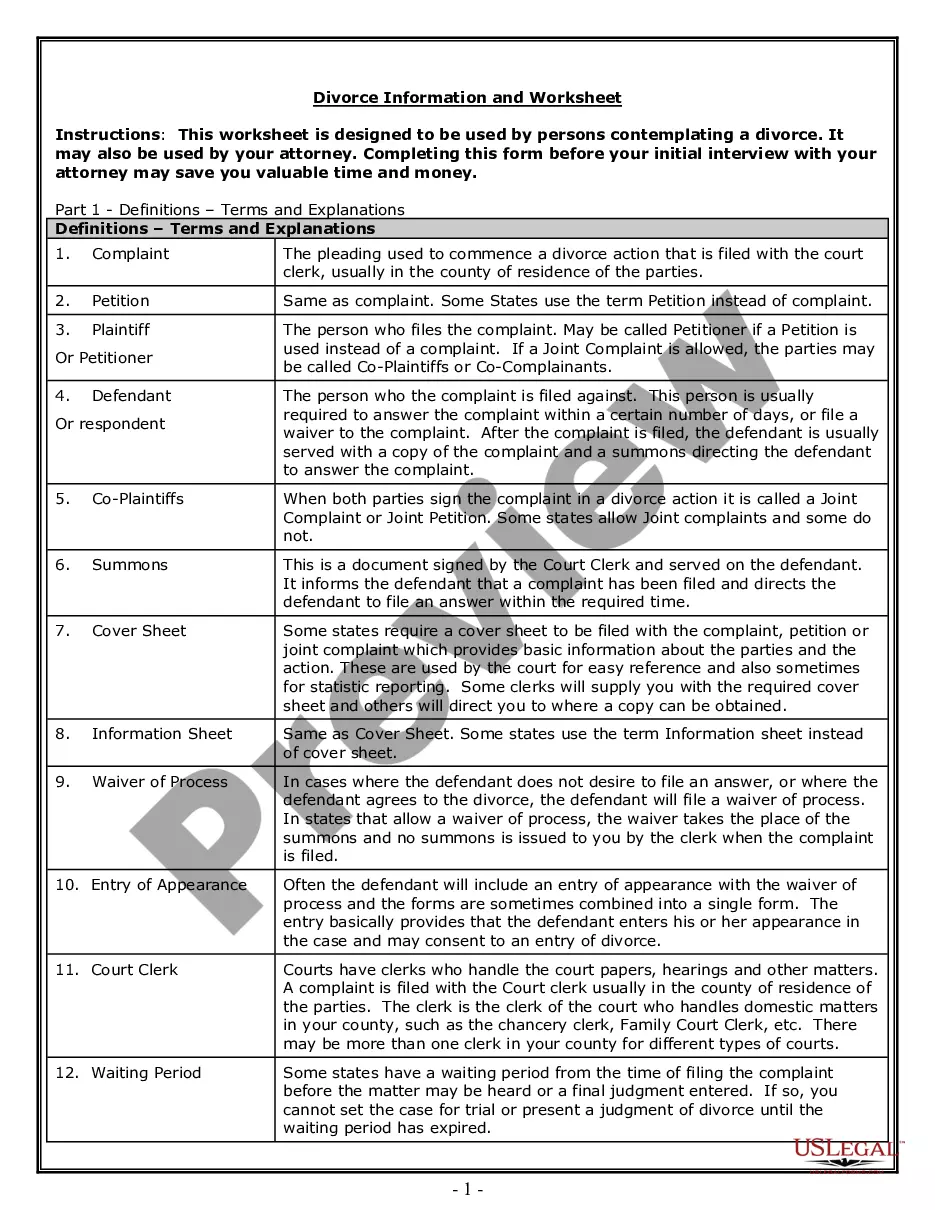

How to fill out New Hampshire Revocable Trust For Lifetime Benefit Of Trustor For Lifetime Benefit Of Surviving Spouse After Death Of Trustor's With Annuity?

You are able to spend hrs on the web attempting to find the legitimate document template that suits the state and federal requirements you need. US Legal Forms offers a large number of legitimate varieties that are analyzed by pros. It is simple to download or print the New Hampshire Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity from your service.

If you currently have a US Legal Forms bank account, you are able to log in and click on the Download option. Following that, you are able to comprehensive, modify, print, or sign the New Hampshire Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity. Each legitimate document template you buy is your own property eternally. To get an additional copy of the purchased develop, proceed to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms web site the first time, keep to the easy recommendations beneath:

- Very first, ensure that you have chosen the right document template to the county/metropolis that you pick. Read the develop description to ensure you have picked the proper develop. If accessible, take advantage of the Review option to search with the document template at the same time.

- If you wish to discover an additional model in the develop, take advantage of the Look for area to discover the template that suits you and requirements.

- When you have found the template you desire, just click Purchase now to carry on.

- Find the costs program you desire, key in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the deal. You can utilize your credit card or PayPal bank account to cover the legitimate develop.

- Find the structure in the document and download it for your gadget.

- Make alterations for your document if possible. You are able to comprehensive, modify and sign and print New Hampshire Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity.

Download and print a large number of document web templates making use of the US Legal Forms website, that offers the largest collection of legitimate varieties. Use skilled and state-specific web templates to handle your company or personal demands.

Form popularity

FAQ

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

What Happens When One Spouse Dies. While both spouses are alive, they typically act as co-trustees and manage the trust together. Upon the death of the first spousealso known as the decedent spousethe surviving spouse generally becomes the sole grantor/trustee and continues to manage the trust based on its terms.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

A SLAT allows the donor spouse to transfer up to the donor spouse's available exemption amount without a gift tax. When the donor spouse dies, the value of the assets in the SLAT is excluded from the donor spouse's gross estate and are not subjected to the federal estate tax.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property. You can make a valid living trust online, quickly and easily, with Nolo's Online Living Trust.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.