New Hampshire Partnership Agreement for Startup: A Comprehensive Guide Introduction: A New Hampshire Partnership Agreement for Startup is a legally binding contract that outlines the terms and conditions of a partnership between two or more individuals or entities intending to establish and operate a startup in the state of New Hampshire. This agreement provides clarity and structure regarding the roles, responsibilities, contributions, profit-sharing, decision-making, and dissolution of the partnership. It is crucial for startup founders to draft a well-defined partnership agreement to mitigate future conflicts and ensure the business's smooth operation. Types of New Hampshire Partnership Agreement for Startup: 1. General Partnership Agreement: A general partnership agreement is the most common type of partnership agreement for startups in New Hampshire. In this form of partnership, all partners share equal responsibilities and liabilities for the business's activities and debts. Decisions and profits are typically shared equally among partners, unless stated otherwise in the agreement. This type of partnership does not provide limited liability protection, meaning each partner's personal assets may be at risk in case of any legal disputes or financial obligations. 2. Limited Partnership Agreement: A limited partnership agreement allows for two types of partners: general partners and limited partners. General partners have unlimited liability for the business's debts and obligations, while limited partners have limited liability, protecting their personal assets to a certain extent. Limited partners primarily invest capital and do not participate actively in the startup's daily operations or decision-making. This type of partnership is often chosen when one or more partners want to invest in the business without exposing their personal assets to excessive risk. 3. Limited Liability Partnership Agreement (LLP): A limited liability partnership agreement creates a partnership structure that offers personal asset protection against the actions of other partners, while still enabling all partners to actively participate in managing the startup. Each partner's liability is limited to their own actions, protecting their personal assets from the partnership's debts and obligations arising from the actions of other partners. Laps are frequently adopted by professionals, such as lawyers, accountants, or architects, who want to operate as a partnership while enjoying the benefits of limited liability. Key Elements of a New Hampshire Partnership Agreement for Startup: 1. Name and Purpose: The agreement should state the legal name of the partnership, the nature of the business, and its goals and objectives. 2. Capital Contributions: Partners' individual contributions, whether in cash, property, or services, should be clearly documented, along with the corresponding ownership percentages or units. 3. Profit Sharing and Loss Allocation: Details on how profits and losses will be distributed among partners should be outlined, including the method of calculation and frequency of distributions. 4. Management and Decision-Making: The agreement should specify the decision-making process, the authority granted to each partner, and the roles and responsibilities of partners in managing the startup. 5. Partner Withdrawal or Death: Procedures to handle partner withdrawal, retirement, or death should be defined, including how the partnership will continue or be dissolved under such circumstances. 6. Dispute Resolution: Methods for resolving disputes, such as mediation or arbitration, should be outlined to maintain harmony and avoid costly litigation. Conclusion: To establish a successful startup in New Hampshire, entrepreneurs must carefully consider the type of partnership agreement that aligns with their business objectives. The chosen agreement, whether a general partnership agreement, limited partnership agreement, or limited liability partnership agreement, will shape the legal and financial landscape of the startup. Seeking professional legal advice while drafting the agreement is highly recommended ensuring compliance with relevant state laws and to protect the rights and interests of all partners involved.

New Hampshire Partnership Agreement for Startup

Description

How to fill out New Hampshire Partnership Agreement For Startup?

US Legal Forms - one of the most significant libraries of lawful varieties in the States - provides a wide array of lawful document web templates you can download or printing. Utilizing the web site, you can find a huge number of varieties for business and personal purposes, categorized by types, says, or keywords and phrases.You can find the most recent types of varieties much like the New Hampshire Partnership Agreement for Startup within minutes.

If you have a monthly subscription, log in and download New Hampshire Partnership Agreement for Startup through the US Legal Forms local library. The Down load switch will appear on every single type you perspective. You have access to all previously acquired varieties from the My Forms tab of your own accounts.

In order to use US Legal Forms the first time, allow me to share straightforward instructions to help you get started off:

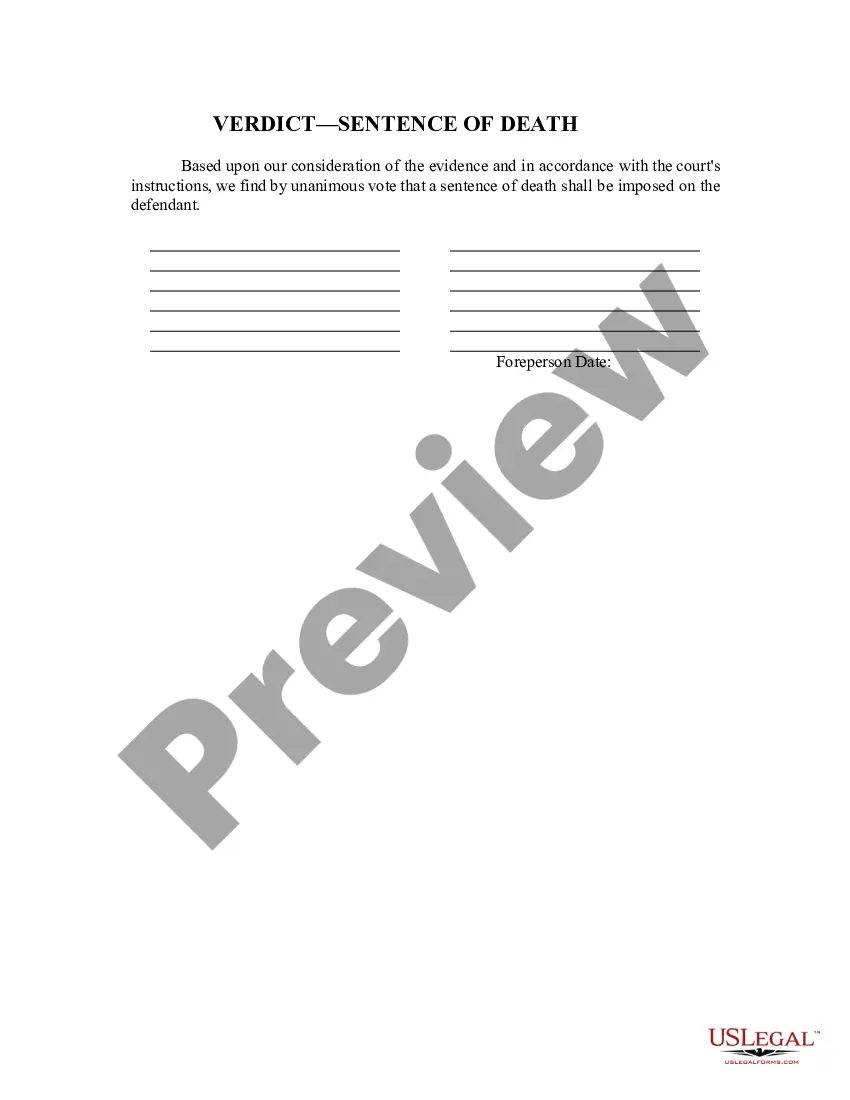

- Make sure you have chosen the best type for the town/county. Go through the Review switch to examine the form`s content material. Read the type explanation to ensure that you have chosen the correct type.

- When the type does not fit your demands, take advantage of the Lookup area at the top of the screen to find the one that does.

- Should you be satisfied with the form, confirm your choice by visiting the Purchase now switch. Then, pick the pricing prepare you prefer and offer your references to sign up on an accounts.

- Approach the financial transaction. Make use of bank card or PayPal accounts to accomplish the financial transaction.

- Pick the format and download the form on your gadget.

- Make modifications. Load, change and printing and indicator the acquired New Hampshire Partnership Agreement for Startup.

Every web template you put into your money does not have an expiration particular date and it is yours forever. So, if you wish to download or printing another version, just proceed to the My Forms area and click in the type you will need.

Get access to the New Hampshire Partnership Agreement for Startup with US Legal Forms, one of the most considerable local library of lawful document web templates. Use a huge number of expert and express-particular web templates that meet your small business or personal demands and demands.