A New Hampshire LLC Operating Agreement is a legal document that outlines the rights, responsibilities, and obligations of members of a Limited Liability Company (LLC) formed by a married couple in the state of New Hampshire. This agreement is crucial for married couples seeking to establish an LLC together, as it helps govern the operations and management of their business. In New Hampshire, there are various types of LLC Operating Agreements designed specifically for married couples. These agreements can be tailored to suit the unique needs and goals of the couple. 1. Basic New Hampshire LLC Operating Agreement for Married Couple: This agreement outlines the fundamental provisions of the LLC, including the couple's ownership percentage, decision-making authority, and profit-sharing arrangements. It also addresses how the couple's personal assets will be protected in the event of liabilities or legal disputes involving the LLC. 2. Membership Interest Assignment Agreement: This agreement allows married couples to assign their membership interests in the LLC to each other. This becomes relevant if the couple wishes to transfer or sell their respective ownership interests in the business. 3. Buy-Sell Agreement: A Buy-Sell Agreement establishes a mechanism for the orderly transfer of ownership interests in the event of divorce, death, disability, retirement, or other significant life events. It protects both spouses' interests and ensures a smooth transition of ownership should such circumstances occur. 4. Spousal Consent Agreement: In cases where only one spouse actively participates in the business, a Spousal Consent Agreement may be necessary. This agreement affirms the non-participating spouse's acknowledgment and consent to the active spouse's involvement in the LLC. It also acknowledges that the non-participating spouse understands potential risks and liabilities inherent in the business. 5. Operating Agreement Addendum — Marriage Dissolution Amendment: This addendum addresses the specific procedures and guidelines to be followed if the couple decides to dissolve their LLC due to marriage dissolution or divorce. It outlines how assets, liabilities, and profits will be divided between the spouses, and how the business will be wound down in such circumstances. When creating a New Hampshire LLC Operating Agreement for Married Couples, it is essential to include key provisions such as the LLC's purpose, management structure, member meetings, voting rights, capital contributions, distribution of profits and losses, dispute resolution mechanisms, and limitations of liability. The agreement should be drafted with the assistance of an experienced attorney to ensure compliance with New Hampshire state laws and to protect the couple's interests. Remember, this content serves purely as informational and should not be considered legal advice. It is advisable to consult a qualified attorney who specializes in business law and understands the intricacies of operating agreements in New Hampshire.

Nh Llc Operating Agreement

Description

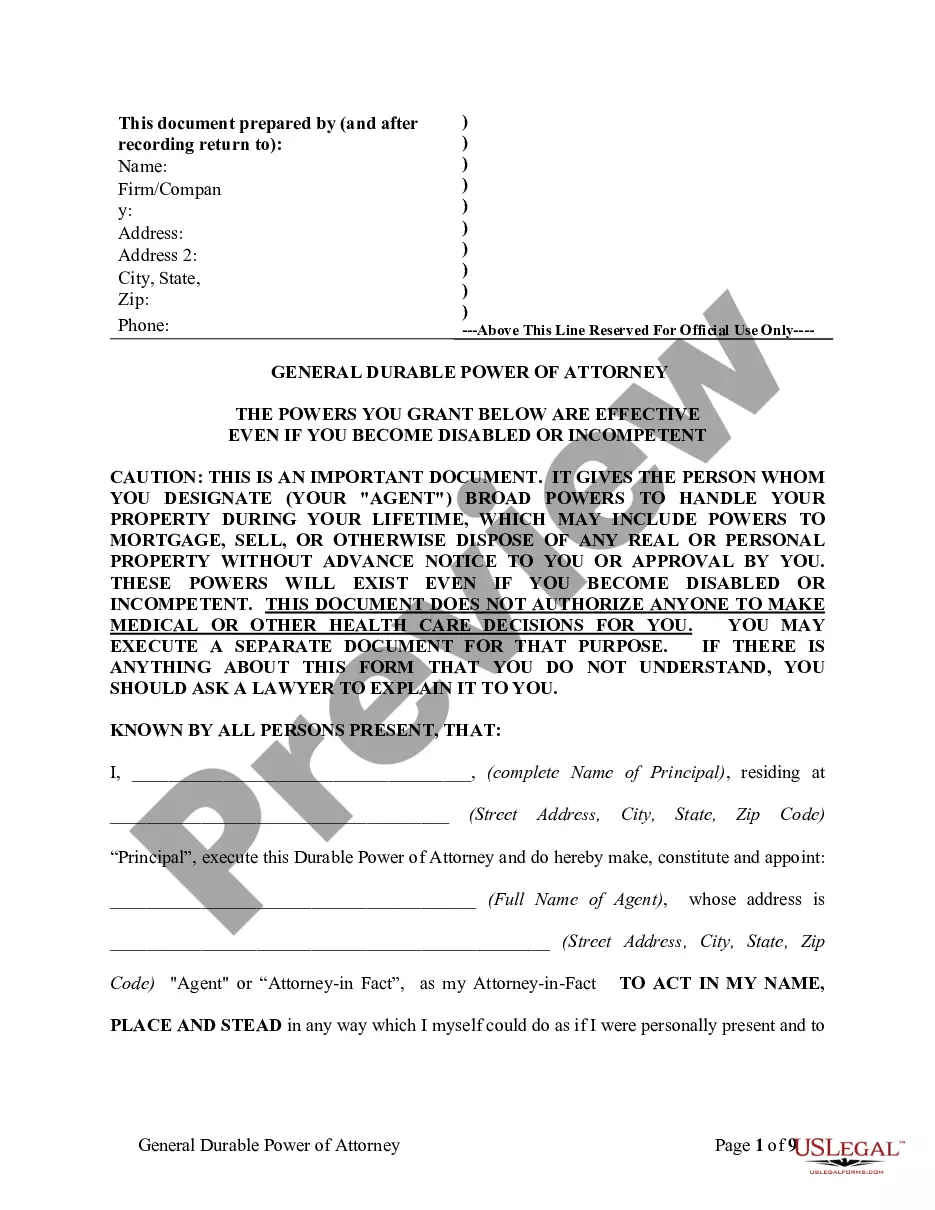

How to fill out New Hampshire LLC Operating Agreement For Married Couple?

If you have to complete, obtain, or produce authorized file themes, use US Legal Forms, the greatest collection of authorized forms, that can be found on the Internet. Make use of the site`s easy and practical research to get the papers you require. Various themes for business and specific functions are categorized by classes and suggests, or keywords. Use US Legal Forms to get the New Hampshire LLC Operating Agreement for Married Couple within a number of click throughs.

In case you are already a US Legal Forms consumer, log in in your accounts and click the Down load option to find the New Hampshire LLC Operating Agreement for Married Couple. You can also gain access to forms you formerly acquired in the My Forms tab of the accounts.

If you are using US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that correct metropolis/region.

- Step 2. Make use of the Review option to examine the form`s content. Never neglect to see the description.

- Step 3. In case you are not satisfied using the form, use the Lookup discipline towards the top of the display screen to locate other versions of the authorized form template.

- Step 4. After you have discovered the form you require, click on the Buy now option. Choose the pricing program you favor and add your references to sign up for the accounts.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Select the format of the authorized form and obtain it on your product.

- Step 7. Complete, change and produce or indication the New Hampshire LLC Operating Agreement for Married Couple.

Each and every authorized file template you buy is your own property for a long time. You possess acces to every single form you acquired inside your acccount. Click on the My Forms segment and pick a form to produce or obtain once again.

Remain competitive and obtain, and produce the New Hampshire LLC Operating Agreement for Married Couple with US Legal Forms. There are thousands of professional and status-certain forms you can use for your personal business or specific requirements.

Form popularity

FAQ

Every New Hampshire LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Single-member LLC Ownership A Single-member LLC has one owner (member) who has full control over the company. The LLC is its own legal entity, independent of its owner. Multi-member LLC Ownership A Multi-member LLC has two or more owners (members) that share control of the company.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

New Hampshire currently is one of just five states that does not charge sales tax. Consequently, unlike LLCs that sell goods in most other states, if your LLC sells goods in New Hampshire you don't need to worry about paying sales tax to the state.

Every New Hampshire LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

How to Form an LLC (5 steps)Step 1 Choose Your State.Step 2 Select a Name.Step 3 Select a Registered Agent.Step 4 File for Your LLC (Articles of Organization)Step 5 Write the LLC Operating Agreement.Step 1 Name Your LLC.Step 2 State of Jurisdiction (Choose Your State)Step 3 Select Type.More items...