Dear [Estate Administrator], I hope this letter finds you well. As an attorney specializing in estate law, I am writing to provide you with information and guidance regarding the estate process in the state of New Hampshire. New Hampshire has specific laws and regulations that govern the distribution of assets and settling of debts upon the death of an individual. Firstly, let me outline the basic steps involved in the administration of an estate in New Hampshire. Upon the death of a person, their assets and liabilities need to be identified and accounted for. This includes their real estate, bank accounts, investments, personal property, and any outstanding debts such as mortgages, loans, or credit card balances. To initiate the estate administration process, it is necessary to file an application with the New Hampshire Probate Court. This court oversees the settlement of estates and ensures that the assets are distributed in accordance with the decedent's wishes, as outlined in their will or, in the absence of a will, according to the state's intestacy laws. The Probate Court may require certain documentation to be submitted along with the application. This typically includes the original will, if one exists, a certified copy of the death certificate, a list and valuation of the assets, and a list of potential beneficiaries or heirs. It is important to gather all these documents before proceeding with the application. Once the court grants administration of the estate, the appointed executor, or personal representative, will be responsible for managing the estate's assets, paying off debts and taxes, and distributing the remaining assets to the beneficiaries. It is crucial to keep detailed records of all financial transactions and decisions made during the administration process. In New Hampshire, there are two types of estate administration: informal and formal. Informal administration is suitable when the estate is simple, and there are no disputes or challenges expected among the heirs. This process is less formal and time-consuming, allowing for a quicker distribution of assets. On the other hand, formal administration is required when the estate is complex, there are potential disputes arising, or when court supervision is necessary to resolve issues. The court will closely monitor the formal administration process to ensure fairness and equity. Additionally, it is worth noting that New Hampshire has an estate tax, which is imposed on the value of an individual's estate upon their death. If the estate's value exceeds the current estate tax exemption threshold, it may be subject to this tax. Proper estate planning and consultation with an experienced attorney can help minimize the impact of estate taxes and ensure the efficient transfer of wealth to future generations. In conclusion, the estate administration process in New Hampshire may seem complex and overwhelming, but with the support of a knowledgeable attorney, it can be navigated smoothly. Whether you are pursuing informal or formal administration, it is essential to comply with the state's legal requirements and maintain open communication with the Probate Court. Please feel free to reach out to me should you require any further information or assistance with your specific estate situation. I am here to guide you through this process and help ensure the successful settlement of the estate. Sincerely, [Your Name] [Your Title] [Law Firm Name]

New Hampshire Sample Letter for Estate - Correspondence from Attorney

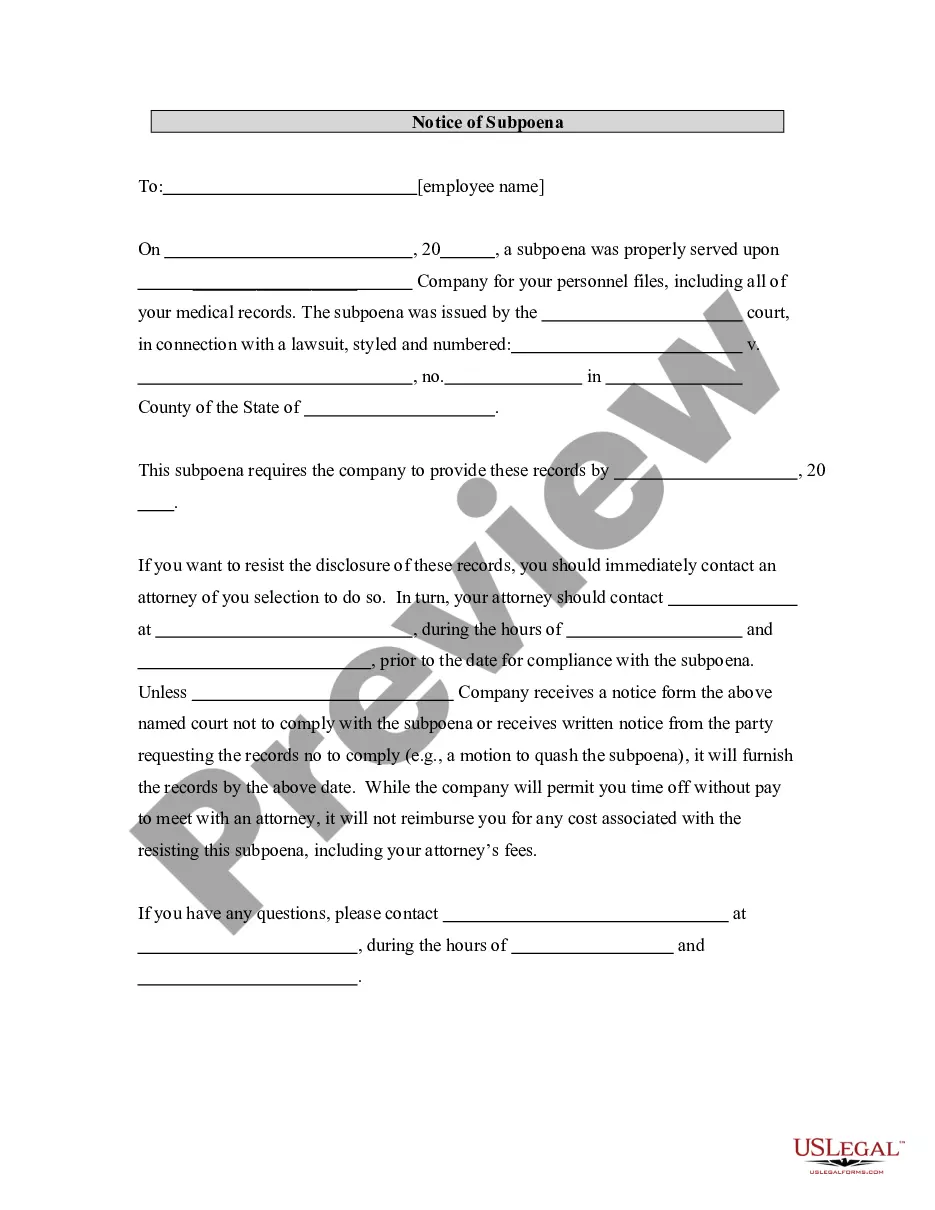

Description

How to fill out New Hampshire Sample Letter For Estate - Correspondence From Attorney?

Discovering the right legitimate file template might be a have difficulties. Of course, there are a variety of layouts available on the net, but how can you find the legitimate form you need? Use the US Legal Forms site. The assistance provides a huge number of layouts, like the New Hampshire Sample Letter for Estate - Correspondence from Attorney, which you can use for business and personal needs. Each of the types are checked out by professionals and satisfy state and federal specifications.

If you are presently listed, log in for your bank account and click on the Obtain button to find the New Hampshire Sample Letter for Estate - Correspondence from Attorney. Utilize your bank account to look from the legitimate types you have acquired in the past. Proceed to the My Forms tab of your respective bank account and get an additional copy from the file you need.

If you are a fresh user of US Legal Forms, listed below are straightforward directions that you should stick to:

- First, make sure you have chosen the proper form for the city/county. You can examine the form utilizing the Preview button and browse the form description to make certain it is the right one for you.

- In the event the form does not satisfy your requirements, make use of the Seach field to find the correct form.

- When you are certain the form is proper, click the Acquire now button to find the form.

- Opt for the pricing strategy you desire and enter the essential details. Create your bank account and pay money for an order with your PayPal bank account or bank card.

- Select the document structure and obtain the legitimate file template for your gadget.

- Complete, change and produce and signal the obtained New Hampshire Sample Letter for Estate - Correspondence from Attorney.

US Legal Forms may be the greatest catalogue of legitimate types that you can see different file layouts. Use the company to obtain appropriately-created files that stick to state specifications.