Dear [Lender's Name], I am writing to express my interest in purchasing a loan through your esteemed financial institution. Having thoroughly reviewed the options available in the market, I believe that engaging in a loan purchase agreement with your bank would provide me with several advantageous opportunities to meet my financial goals. Specifically, I am interested in exploring the New Hampshire Sample Letter for Purchase of Loan, a type of loan that is tailored to meet the unique needs of individuals residing or doing business in the state of New Hampshire. New Hampshire, often referred to as the "Granite State," is a captivating region renowned for its picturesque landscapes, charming towns, and thriving economy. As a prospective borrower, I believe that the New Hampshire Sample Letter for Purchase of Loan can serve as a crucial financial tool to support my aspirations within this dynamic economic environment. This innovative loan product embodies the principles of flexibility, financial empowerment, and adaptability, ensuring that borrowers can access funds required for personal or business purposes while benefiting from favorable terms and conditions carefully designed for the New Hampshire market. The New Hampshire Sample Letter for Purchase of Loan offers several distinct variations, each dedicated to addressing specific financial needs within the state. These variations include but are not limited to: 1. Personal Loans: Available to individuals seeking financial assistance for personal reasons, this loan option offers competitive interest rates, fixed or variable repayment terms, and flexible loan amounts. Whether it's funding education expenses, consolidating debts, covering medical bills, or undertaking home improvements, personal loans cater to the diverse needs of residents in New Hampshire. 2. Small Business Loans: Entrepreneurs and small business owners in New Hampshire can benefit greatly from this loan type, providing the capital necessary for expansion, equipment purchases, inventory replenishments, or working capital requirements. These loans offer competitive interest rates, convenient repayment options, and the potential for additional business support services, ensuring the success and growth of enterprises across various industries. 3. Housing Loans: Catering to the housing needs of individuals in New Hampshire, this loan variant is specifically designed to facilitate the purchase or refinancing of residential properties. With attractive interest rates and suitable repayment terms, housing loans enable prospective homeowners to achieve their dreams of owning a property in the state. 4. Agricultural Loans: Recognizing the importance of agriculture in the state's economy, this loan type caters to the unique needs of farmers and agricultural businesses in New Hampshire. Accessible capital helps these entities to purchase or upgrade equipment, expand their operations, or invest in sustainable farming practices, benefiting both the agricultural sector and the state's economy as a whole. In conclusion, the New Hampshire Sample Letter for Purchase of Loan offers a comprehensive suite of loan options, tailored to meet the financial aspirations of individuals, entrepreneurs, homeowners, and farmers in this thriving state. By engaging in a loan agreement with your bank, I believe I can leverage these opportunities to achieve my goals and contribute positively to the growth and development of New Hampshire. I humbly request further information, including the necessary application procedures, required documentation, and any specific eligibility criteria pertaining to the New Hampshire Sample Letter for Purchase of Loan. Please do not hesitate to reach out to discuss this matter further. I eagerly anticipate the potential financial partnership with your esteemed institution. Thank you for your time and consideration. Sincerely, [Your Name]

New Hampshire Sample Letter for Purchase of Loan

Description

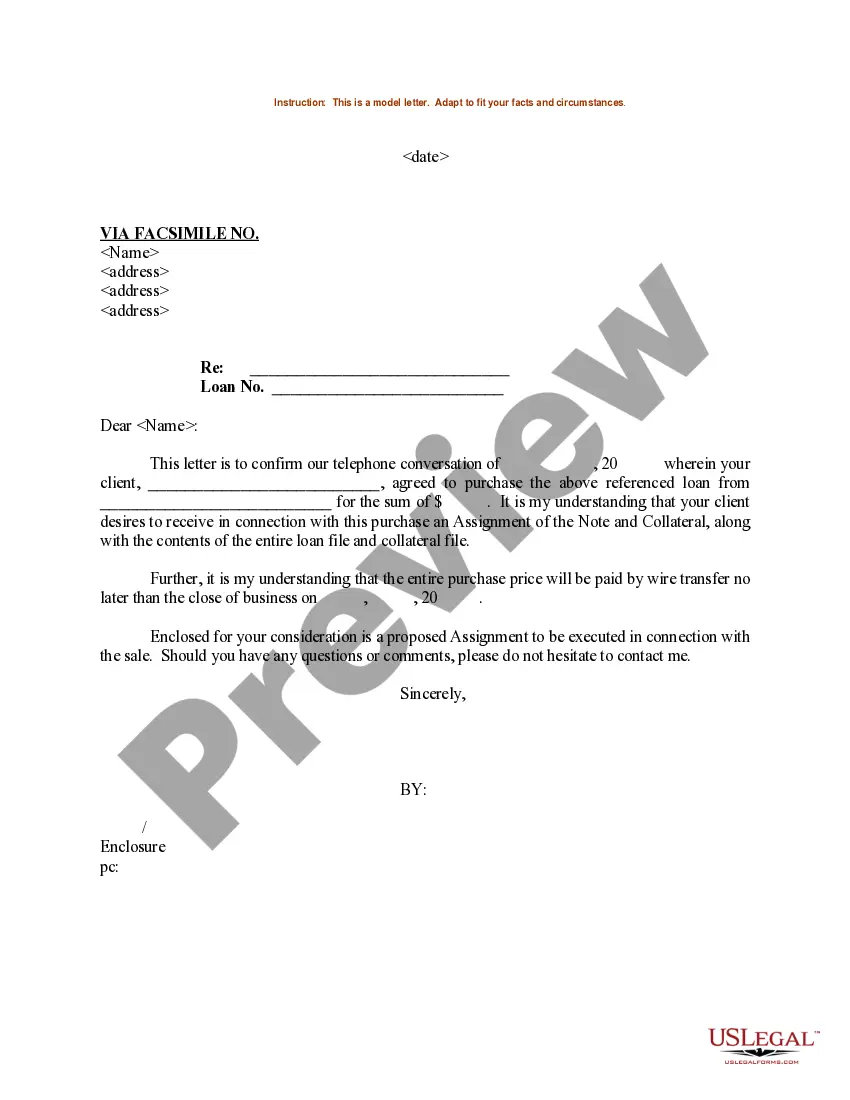

How to fill out Sample Letter For Purchase Of Loan?

You may devote several hours on the web searching for the lawful papers web template which fits the state and federal demands you want. US Legal Forms offers a huge number of lawful types which are examined by pros. It is possible to down load or print out the New Hampshire Sample Letter for Purchase of Loan from my services.

If you currently have a US Legal Forms accounts, you can log in and click on the Obtain option. After that, you can total, edit, print out, or sign the New Hampshire Sample Letter for Purchase of Loan. Each lawful papers web template you purchase is the one you have forever. To obtain an additional version of the bought form, go to the My Forms tab and click on the related option.

If you are using the US Legal Forms web site initially, follow the simple instructions below:

- Initial, be sure that you have selected the right papers web template for that state/metropolis of your choice. Look at the form information to ensure you have chosen the proper form. If accessible, make use of the Review option to check throughout the papers web template as well.

- In order to discover an additional version of your form, make use of the Lookup field to get the web template that suits you and demands.

- After you have identified the web template you need, simply click Purchase now to continue.

- Select the rates prepare you need, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You can utilize your Visa or Mastercard or PayPal accounts to pay for the lawful form.

- Select the formatting of your papers and down load it for your gadget.

- Make alterations for your papers if possible. You may total, edit and sign and print out New Hampshire Sample Letter for Purchase of Loan.

Obtain and print out a huge number of papers themes while using US Legal Forms Internet site, which offers the greatest selection of lawful types. Use specialist and status-specific themes to handle your small business or specific needs.

Form popularity

FAQ

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

The letter of explanation may also be called an LOE or LOX. Forms you fill out for a mortgage or refinance don't offer space to explain what you believe may be considered a problem or you may not even be aware there is an issue.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

An underwriter's job is to assess your financials and decide whether you're a good candidate for a home loan. The information the underwriter sees doesn't always tell your entire financial story. An underwriter may request a letter of explanation from you if they're unsure about something they see.

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

Commonly referred to as an 'LOE' or 'LOX,' letters of explanation are often requested by lenders to gain more specific information on a mortgage borrower and their situation. An LOX can necessary when there is inconsistent, incomplete, or unclear information on a loan application.

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.