The New Hampshire Security Agreement between Dealer and Distributor is a legally binding contract that outlines the terms and conditions of the security arrangement between a dealer and a distributor. This agreement ensures that both parties are protected and have a clear understanding of their obligations and rights. Keywords: New Hampshire Security Agreement, Dealer, Distributor, legally binding contract, terms and conditions, security arrangement, obligations, rights. There are several types of New Hampshire Security Agreements that can be established between a dealer and a distributor, depending on the specific nature of their business relationship. Some common types of agreements include: 1. Collateral Security Agreement: This type of agreement involves the provision of collateral by the dealer to secure the distributor's interests. Collateral can be any valuable asset owned by the dealer, such as equipment, inventory, or real estate. The agreement will detail the rights and responsibilities of both parties regarding the collateral and its usage. 2. Financial Security Agreement: In this type of agreement, the dealer agrees to provide financial security to the distributor to ensure the fulfillment of their obligations. Financial security can be in the form of a letter of credit, personal guarantee, or a cash deposit. The agreement will specify the amount of security required and the terms under which it can be accessed by the distributor. 3. Performance Security Agreement: This agreement focuses on ensuring the dealer's performance in meeting certain predetermined criteria. It may require the dealer to provide a performance bond or guarantee to the distributor, assuring that the contracted services or products will be delivered as per the agreed-upon terms. The agreement will outline the conditions under which the security can be utilized, such as in case of non-performance or breach of contract. 4. Confidentiality and Non-Disclosure Agreement: This type of security agreement protects the confidential information and trade secrets shared between the dealer and the distributor. It establishes clear guidelines on the use, disclosure, and protection of confidential information during the course of their business relationship. This ensures that both parties maintain the confidentiality of sensitive business information and prevents unauthorized disclosure to third parties. In conclusion, the New Hampshire Security Agreement between Dealer and Distributor is a comprehensive contract that safeguards the interests of both parties involved. It provides a legal framework for establishing clear terms and conditions regarding the security arrangements, obligations, and rights of the dealer and the distributor. By entering into such an agreement, both parties can ensure a harmonious and secure business relationship.

New Hampshire Security Agreement between Dealer and Distributor

Description

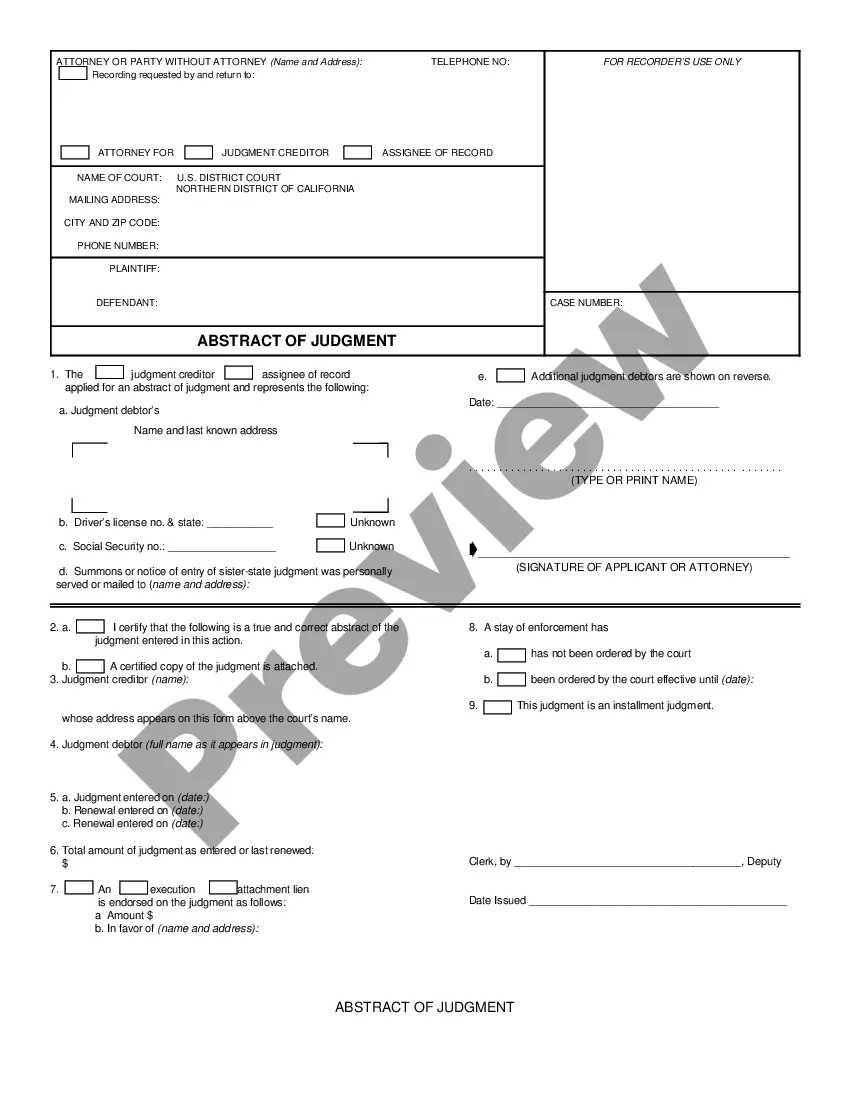

How to fill out New Hampshire Security Agreement Between Dealer And Distributor?

Choosing the right lawful papers design might be a have a problem. Obviously, there are tons of layouts available on the net, but how do you obtain the lawful kind you will need? Utilize the US Legal Forms web site. The support offers thousands of layouts, like the New Hampshire Security Agreement between Dealer and Distributor, that you can use for enterprise and personal requires. Each of the forms are checked out by pros and meet state and federal demands.

In case you are previously registered, log in for your profile and click the Acquire button to find the New Hampshire Security Agreement between Dealer and Distributor. Utilize your profile to check throughout the lawful forms you possess bought in the past. Visit the My Forms tab of your own profile and obtain an additional duplicate of your papers you will need.

In case you are a brand new user of US Legal Forms, listed here are straightforward directions so that you can comply with:

- Initial, ensure you have selected the correct kind for your personal area/state. You can look through the form using the Preview button and study the form information to make certain this is the right one for you.

- In the event the kind fails to meet your needs, make use of the Seach field to find the proper kind.

- When you are certain that the form is suitable, click on the Get now button to find the kind.

- Opt for the prices prepare you want and enter in the essential info. Make your profile and purchase the order making use of your PayPal profile or charge card.

- Choose the submit file format and obtain the lawful papers design for your gadget.

- Full, revise and produce and indication the acquired New Hampshire Security Agreement between Dealer and Distributor.

US Legal Forms is the most significant collection of lawful forms where you can find different papers layouts. Utilize the company to obtain expertly-created papers that comply with state demands.