Title: Understanding the New Hampshire Inquiry of Credit Cardholder Concerning Billing Error Introduction: In the state of New Hampshire, consumers are provided with specific legal rights when it comes to addressing billing errors on their credit card statements. Known as the "New Hampshire Inquiry of Credit Cardholder Concerning Billing Error," this process allows cardholders to dispute and rectify any inaccuracies or discrepancies found on their billing statements. This article will offer a detailed description of the New Hampshire Inquiry of Credit Cardholder Concerning Billing Error, its significance, and the various types of inquiries that can be made. 1. Definition and Purpose: The New Hampshire Inquiry of Credit Cardholder Concerning Billing Error refers to a formal request made by a credit cardholder to investigate and correct any billing errors identified on their credit card statement. This process is governed by New Hampshire consumer protection laws and regulations, aiming to safeguard the rights and interests of consumers, ensuring fair and accurate billing practices by credit card issuers. 2. Types of New Hampshire Inquiries of Credit Cardholder Concerning Billing Error: a) Unauthorized charges: This type of inquiry involves addressing charges made on the credit card account without the cardholder's consent or knowledge. b) Incorrect amount: Cardholders may raise an inquiry when the billed amount does not match the actual cost of the goods or services purchased. c) Duplicate charges: Instances where the same transaction appears multiple times, resulting in duplicate charges on the credit card statement. d) Fraudulent activity: Any suspicious activity on the credit card statement, such as fraudulent transactions, can prompt cardholders to launch an inquiry. e) Misrepresented services: This type of inquiry is relevant when the credit cardholder believes that the services rendered do not match the advertised or agreed-upon terms. 3. Initiating the Inquiry: To launch a New Hampshire Inquiry of Credit Cardholder Concerning Billing Error, cardholders must follow certain essential steps: a) Alert the credit card issuer: Cardholders should notify the credit card issuer promptly about the billing error or dispute, preferably in writing, to initiate the inquiry process. b) Provide necessary documentation: Supporting evidence, including copies of receipts, invoices, or any other relevant documents, should be provided to substantiate the claim. c) Detailed explanation: Cardholders should clearly explain the billing error, the type of error identified, and the corrective action desired. d) Timely response: Credit card issuers are required to respond to the inquiry within a specific timeframe set forth by New Hampshire consumer protection regulations. Conclusion: The New Hampshire Inquiry of Credit Cardholder Concerning Billing Error is a legal procedure that empowers consumers to challenge inaccuracies and discrepancies on their credit card statements. By understanding the different types of inquiries that can be made, cardholders can exercise their rights effectively and ensure fair billing practices. It is crucial for all credit cardholders in New Hampshire to familiarize themselves with these processes to protect their financial well-being and maintain a trustworthy credit card system.

New Hampshire Inquiry of Credit Cardholder Concerning Billing Error

Description

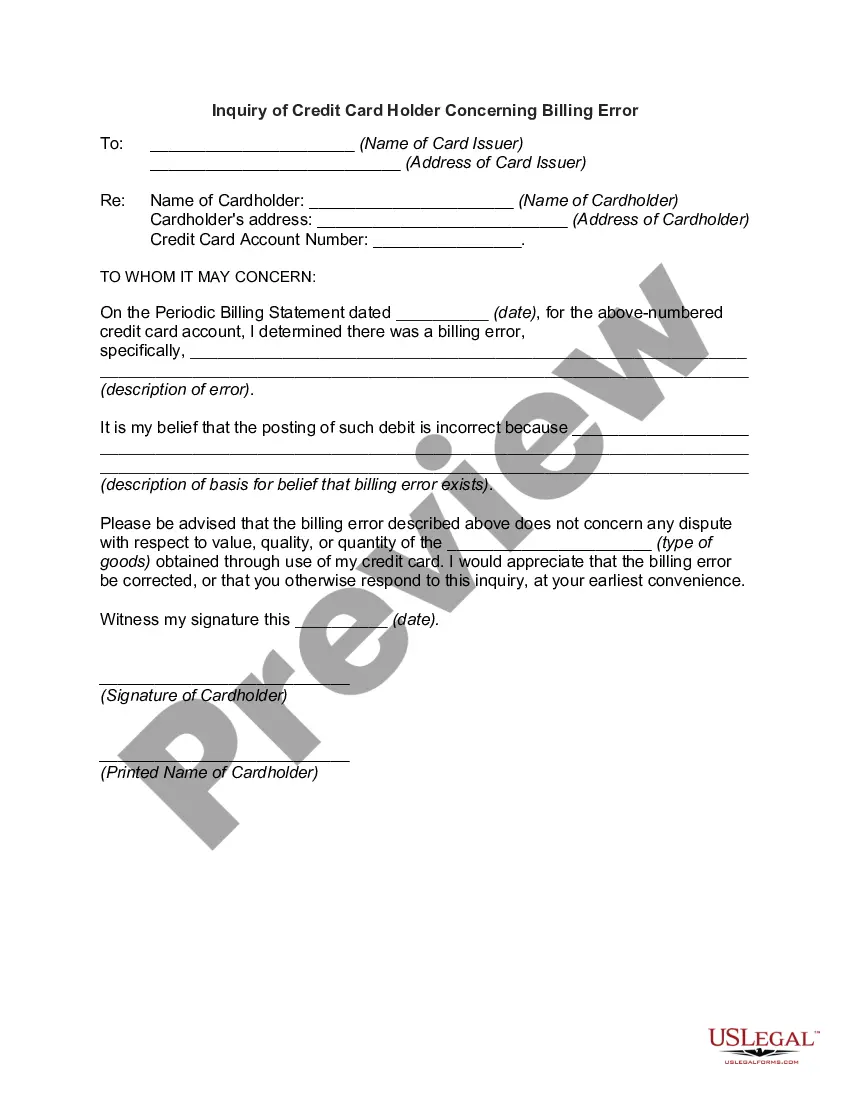

How to fill out New Hampshire Inquiry Of Credit Cardholder Concerning Billing Error?

US Legal Forms - one of the largest libraries of legitimate varieties in America - delivers a wide range of legitimate file layouts you may download or print. Making use of the site, you will get a huge number of varieties for enterprise and person reasons, sorted by types, states, or keywords.You can get the newest types of varieties such as the New Hampshire Inquiry of Credit Cardholder Concerning Billing Error in seconds.

If you already have a registration, log in and download New Hampshire Inquiry of Credit Cardholder Concerning Billing Error through the US Legal Forms catalogue. The Download switch will show up on each type you see. You have accessibility to all formerly saved varieties inside the My Forms tab of your bank account.

If you would like use US Legal Forms the first time, listed here are simple directions to help you began:

- Be sure you have chosen the best type for your personal town/area. Click the Preview switch to examine the form`s articles. Read the type outline to ensure that you have chosen the correct type.

- In the event the type doesn`t match your specifications, utilize the Look for industry at the top of the monitor to discover the one which does.

- When you are content with the form, confirm your decision by simply clicking the Acquire now switch. Then, opt for the costs plan you favor and offer your credentials to sign up for an bank account.

- Procedure the deal. Use your Visa or Mastercard or PayPal bank account to complete the deal.

- Find the structure and download the form on your product.

- Make changes. Load, revise and print and sign the saved New Hampshire Inquiry of Credit Cardholder Concerning Billing Error.

Each design you put into your account does not have an expiration particular date and is yours for a long time. So, if you wish to download or print an additional copy, just check out the My Forms segment and then click around the type you will need.

Obtain access to the New Hampshire Inquiry of Credit Cardholder Concerning Billing Error with US Legal Forms, probably the most considerable catalogue of legitimate file layouts. Use a huge number of specialist and express-specific layouts that satisfy your business or person needs and specifications.