Title: Understanding New Hampshire Prenuptial Property Agreements with Business Operated by Spouse as Community Property Introduction: A prenuptial property agreement is a legally binding contract entered into by individuals prior to their marriage. In the state of New Hampshire, specific provisions can be made within a prenuptial property agreement when one spouse operates a business, designating it as community property. This detailed description will explore the intricacies of the New Hampshire Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property, shedding light on its purpose, benefits, and different types available. Types of New Hampshire Prenuptial Property Agreements with Business Operated by Spouse as Community Property: 1. New Hampshire Division of Marital Property Agreement: This prenuptial property agreement enables spouses to designate the business operated by one spouse as community property, subject to equitable division in case of a divorce. It outlines the specific terms and conditions governing the division of assets, profits, and liabilities related to the business. 2. New Hampshire Business Protection Prenuptial Agreement: This agreement focuses primarily on protecting the business interests of the spouse operating the business. It ensures that the business remains separate property, guarding against potential claims from the other spouse in the event of a divorce. It may include provisions to establish the ownership and control of the business solely with the spouse operating it. Key Aspects of a New Hampshire Prenuptial Property Agreement: 1. Identification and Valuation of the Business: The agreement includes a detailed description of the business operated by one spouse, specifying its assets, liabilities, income, and future growth prospects. Valuation methods may be outlined to determine the business's worth at the time of marriage and in the event of a divorce. 2. Community Property Designation: The agreement explicitly designates the business as community property, subject to equitable division in case of divorce. It should outline the provisions for distributing the business assets, including ownership rights, control, and profit sharing arrangements. 3. Safeguarding Business Interests: To protect the interests of the business-operating spouse, the agreement may contain clauses to prevent the other spouse from making claims or interfering in the management of the business. It might include restrictions on selling, transferring, or encumbering business assets without the consent of the operating spouse. 4. Debt and Liability Allocation: The document should address how business-related debts and liabilities will be divided in the event of a divorce. It may also detail the responsibilities of each spouse regarding the business's ongoing financial obligations and potential implications on the division of community property. Conclusion: A New Hampshire Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property provides spouses with the flexibility to protect their business interests and establish clear guidelines for asset division in the event of a divorce. By customizing these agreements to their unique circumstances, couples can secure a mutually beneficial arrangement that safeguards their business while ensuring equitable treatment for both parties. Consulting with a qualified attorney is crucial to ensure compliance with New Hampshire laws and tailor the agreement to the specific needs of each couple.

New Hampshire Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property

Description

How to fill out New Hampshire Prenuptial Property Agreement With Business Operated By Spouse Designated To Be Community Property?

Choosing the right lawful document design could be a battle. Naturally, there are a lot of web templates available online, but how would you get the lawful kind you need? Use the US Legal Forms website. The service offers thousands of web templates, including the New Hampshire Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property, which you can use for business and private requires. All of the forms are checked by pros and meet federal and state requirements.

In case you are presently registered, log in to the account and click the Down load switch to have the New Hampshire Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property. Make use of account to appear throughout the lawful forms you may have purchased formerly. Check out the My Forms tab of your respective account and get another copy from the document you need.

In case you are a whole new consumer of US Legal Forms, listed here are straightforward directions that you should follow:

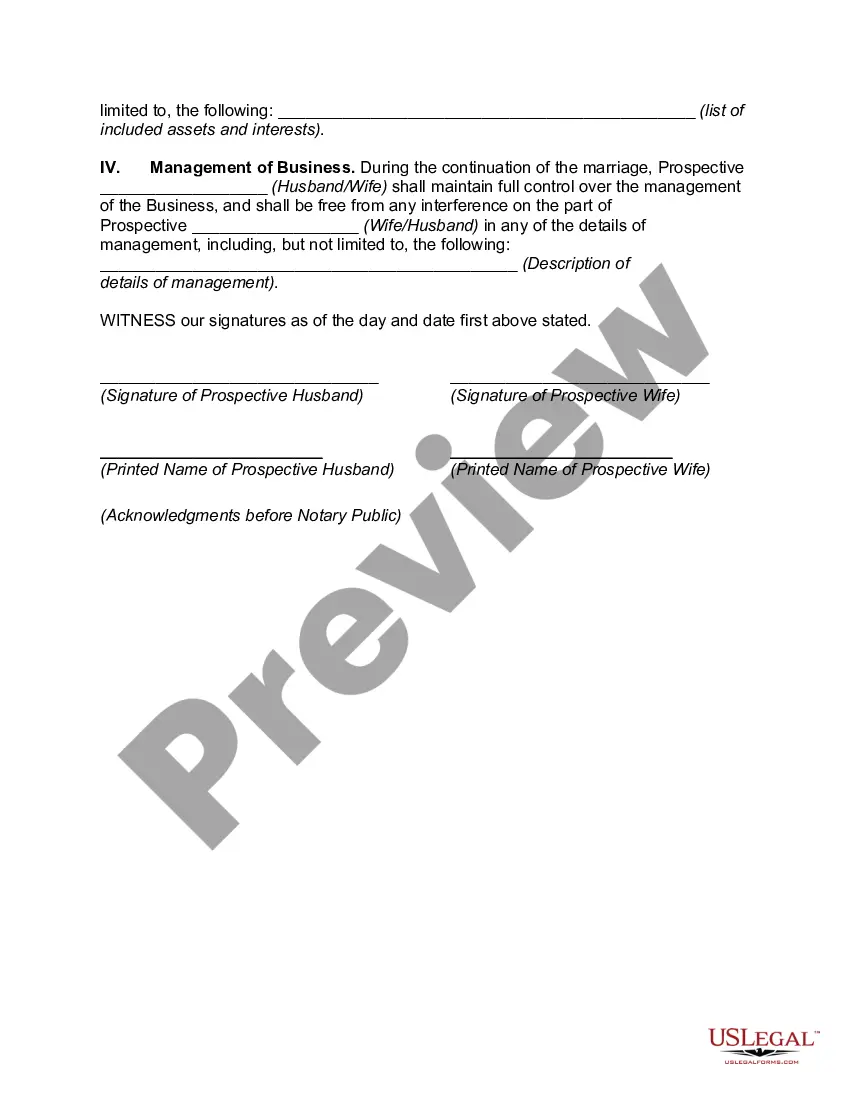

- First, ensure you have chosen the correct kind for your metropolis/region. You can examine the form while using Review switch and read the form description to make sure it will be the best for you.

- If the kind does not meet your requirements, take advantage of the Seach discipline to obtain the appropriate kind.

- Once you are certain that the form is acceptable, click the Buy now switch to have the kind.

- Select the pricing strategy you would like and type in the needed information. Design your account and purchase the transaction making use of your PayPal account or credit card.

- Choose the submit format and download the lawful document design to the system.

- Full, revise and produce and sign the acquired New Hampshire Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property.

US Legal Forms may be the biggest catalogue of lawful forms for which you can discover numerous document web templates. Use the company to download skillfully-produced documents that follow state requirements.