A New Hampshire Joint-Venture Agreement is a legally binding contract between two or more parties who collaborate to undertake a real estate project with the intent of speculating on its future value and potential profit. This agreement outlines the terms, responsibilities, and obligations of all parties involved in the joint venture, ensuring a clear understanding of each party's rights and liabilities. The New Hampshire Joint-Venture Agreement — Speculation in Real Estate typically includes the following key elements: 1. Identification of Parties: The agreement begins by clearly stating the names and addresses of all parties involved in the joint venture, including the primary investor(s) and any other adventurers or stakeholders. 2. Purpose and Scope: The agreement defines the objective of the joint venture, outlining the specific real estate project or speculation activity the parties are undertaking. It can be buying undeveloped land for future development, investing in existing properties for renovation, or engaging in any other form of real estate speculation. 3. Capital Contributions: The agreement specifies the financial commitments of each party, including the amount of initial capital each party will contribute towards the joint venture. This can include cash, property, or other assets being brought into the project. 4. Profit and Loss Allocation: The agreement establishes how profits or losses resulting from the joint venture will be shared among the parties. This section may outline a predetermined percentage or formula for distributing returns based on the individual contributions or involvement of each party. 5. Decision-Making Authority: The agreement defines the decision-making process within the joint venture, including how major decisions will be made and whether any party has veto power. Additionally, it may establish the roles and responsibilities of each party, such as management, financing, or marketing. 6. Term and Termination: This section outlines the duration of the joint venture and specifies the conditions under which it can be terminated. It may also include provisions for extensions or renewals if necessary. 7. Confidentiality and Non-Disclosure: To protect the interests of all parties involved, this section ensures that sensitive information shared during the joint venture remains confidential and prohibits any party from disclosing or using such information for personal gain or outside ventures. 8. Dispute Resolution: The agreement includes mechanisms for resolving disputes that may arise during the joint venture, such as arbitration or mediation procedures, aiming to avoid expensive litigation and maintain a harmonious working relationship. Types of New Hampshire Joint-Venture Agreement — Speculation in Real Estate: 1. Land Development Joint Venture: Involves partnering to acquire and develop raw land or vacant properties for residential, commercial, or industrial use. 2. Fix-and-Flip Joint Venture: Focuses on purchasing undervalued properties, renovating them, and quickly selling them at a higher price to realize profits. 3. Rental Property Joint Venture: Involves acquiring income-generating properties for long-term rental purposes, aiming to generate consistent cash flow and potential appreciation. 4. Commercial Real Estate Joint Venture: Partners collaborate to invest in various types of commercial properties, such as office buildings, retail centers, or industrial warehouses, to capitalize on higher returns to the commercial sector. By carefully crafting a New Hampshire Joint-Venture Agreement for speculation in real estate, parties involved can mitigate risks, clarify expectations, and maximize the potential for significant financial gains while working towards a common goal.

New Hampshire Joint-Venture Agreement - Speculation in Real Estate

Description

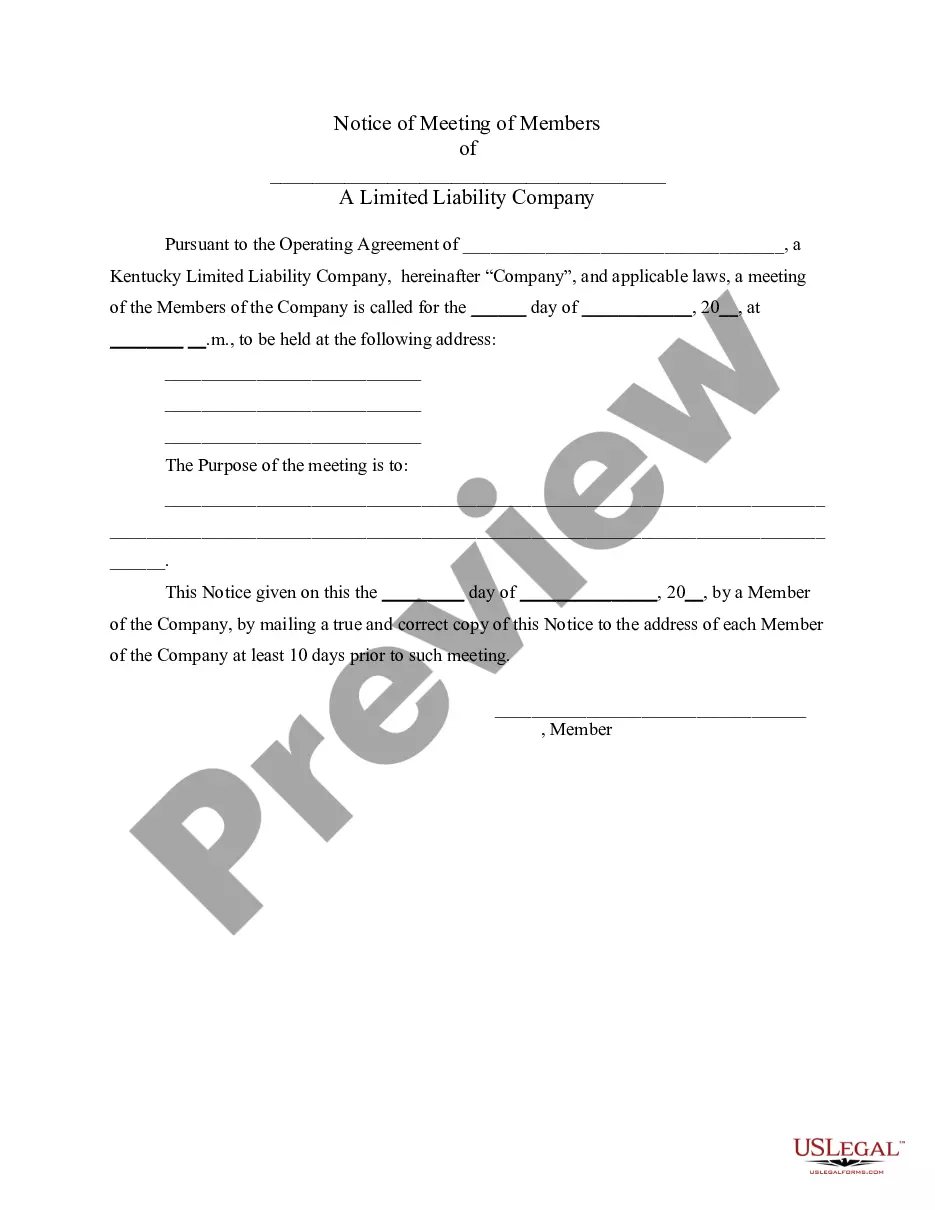

How to fill out New Hampshire Joint-Venture Agreement - Speculation In Real Estate?

Choosing the right legitimate papers web template might be a struggle. Obviously, there are a lot of web templates accessible on the Internet, but how would you obtain the legitimate form you need? Utilize the US Legal Forms site. The support provides 1000s of web templates, like the New Hampshire Joint-Venture Agreement - Speculation in Real Estate, that you can use for company and private requirements. All of the forms are checked by professionals and meet federal and state needs.

When you are currently signed up, log in to your accounts and click on the Download button to find the New Hampshire Joint-Venture Agreement - Speculation in Real Estate. Use your accounts to search with the legitimate forms you might have purchased in the past. Proceed to the My Forms tab of your accounts and have yet another duplicate of your papers you need.

When you are a fresh user of US Legal Forms, listed here are straightforward instructions that you can adhere to:

- First, make certain you have selected the correct form to your town/region. It is possible to examine the shape while using Preview button and study the shape explanation to make certain it is the right one for you.

- If the form will not meet your expectations, take advantage of the Seach area to find the correct form.

- Once you are certain that the shape is acceptable, go through the Buy now button to find the form.

- Opt for the rates strategy you would like and enter the required details. Make your accounts and buy an order making use of your PayPal accounts or charge card.

- Select the file file format and down load the legitimate papers web template to your gadget.

- Full, change and print and indication the acquired New Hampshire Joint-Venture Agreement - Speculation in Real Estate.

US Legal Forms is definitely the largest catalogue of legitimate forms in which you can see different papers web templates. Utilize the company to down load skillfully-created paperwork that adhere to condition needs.