New Hampshire Aging Accounts Payable

Description

How to fill out Aging Accounts Payable?

Finding the appropriate official document template can be quite challenging.

Certainly, there are numerous templates available online, but how can you get the official form you need.

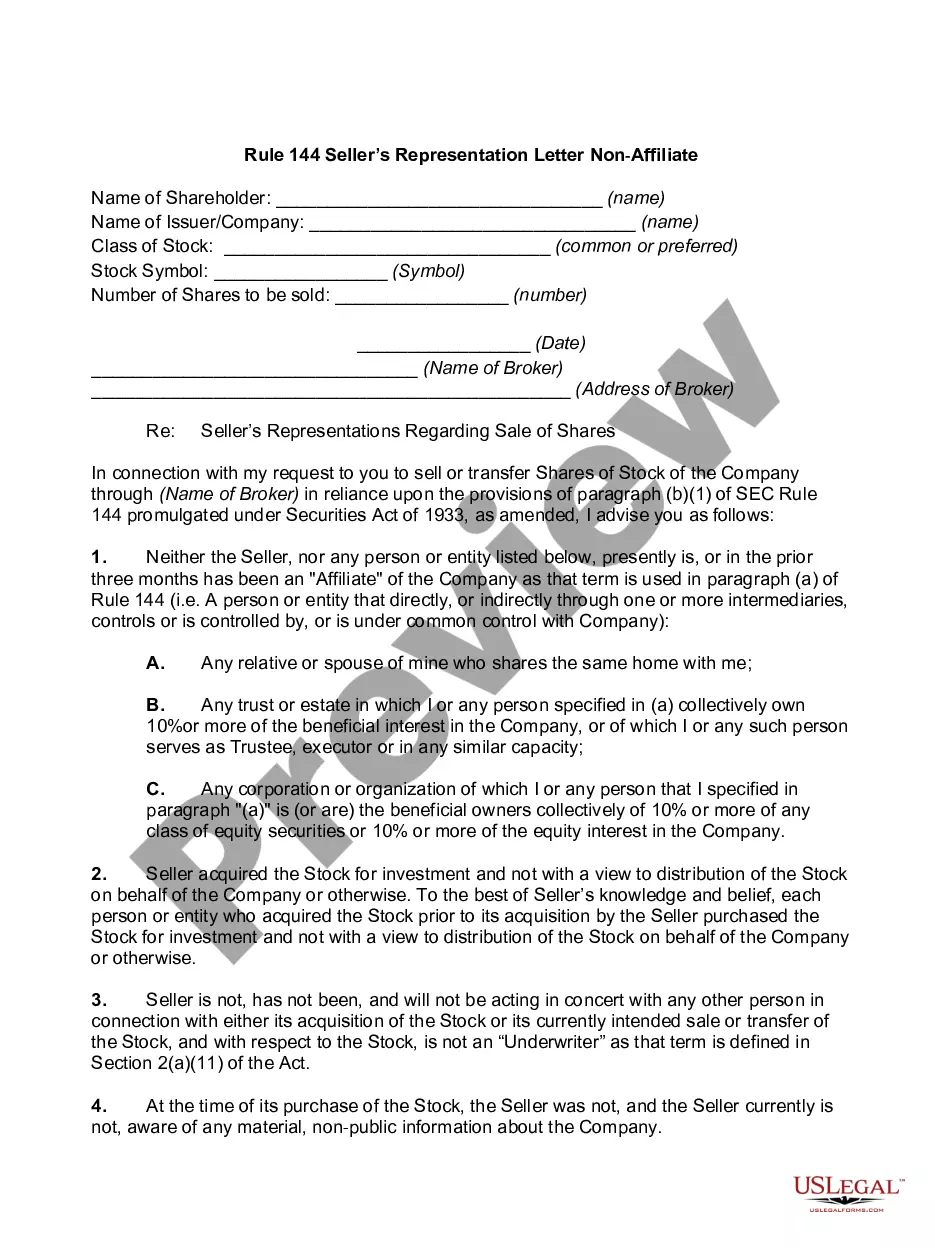

Utilize the US Legal Forms website. This service offers a vast array of templates, including the New Hampshire Aging Accounts Payable, which can be utilized for both business and personal purposes.

If the form does not meet your expectations, use the Search field to find the correct form. Once you are confident that the form is suitable, click the Get now button to acquire it. Select the payment plan you want and enter the necessary information. Create your account and complete the transaction using your PayPal account or Visa or Mastercard. Choose the file format and download the official document template to your device. Complete, edit, print, and sign the received New Hampshire Aging Accounts Payable. US Legal Forms is the largest library of legal forms where you can find numerous document templates. Leverage this service to download professionally crafted documents that comply with state regulations.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the New Hampshire Aging Accounts Payable.

- Use your account to search for the legal forms you have previously obtained.

- Visit the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

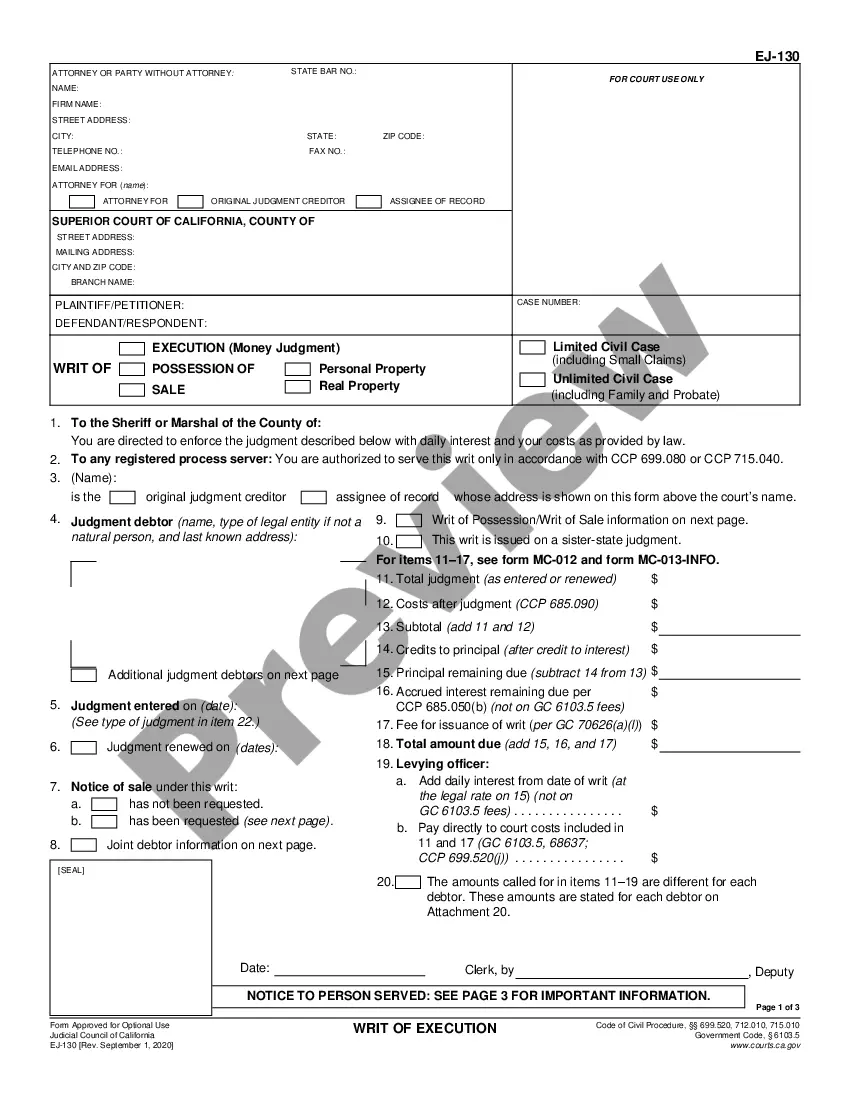

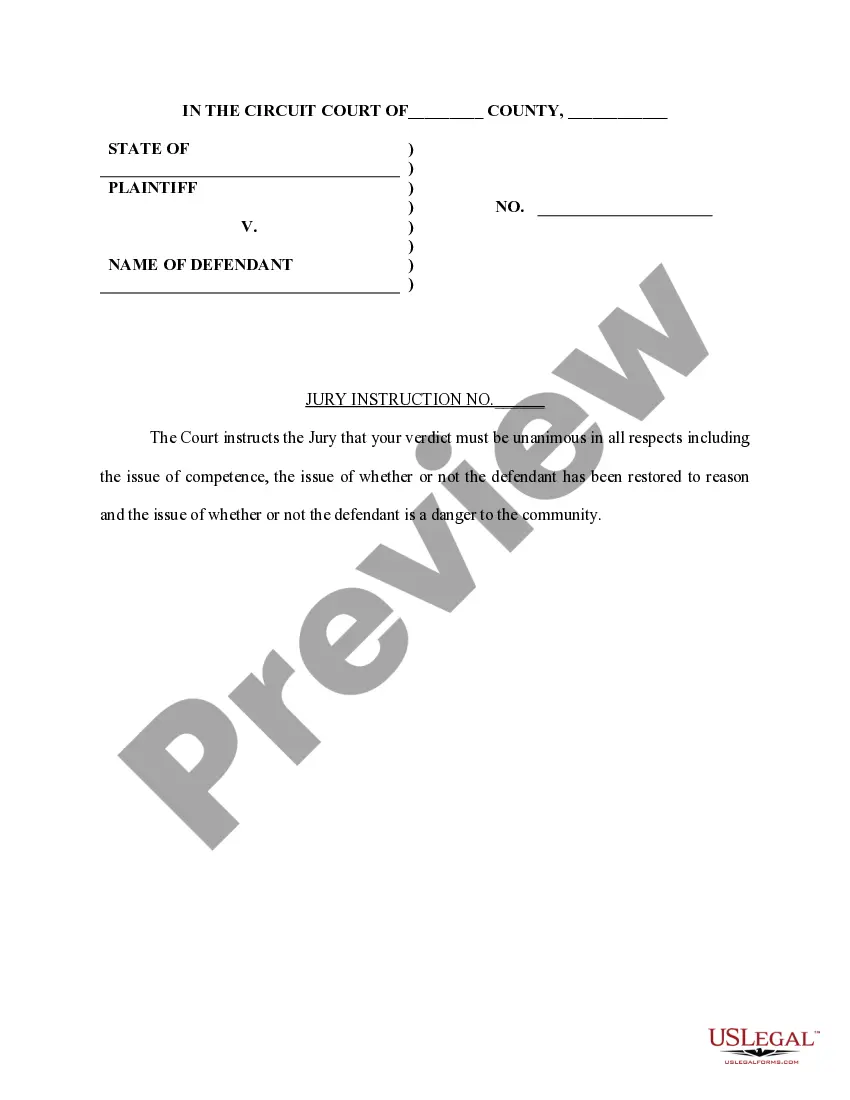

- First, make sure you have selected the correct form for your city/region. You can review the form using the Preview button and examine the form description to confirm it is the right one for you.

Form popularity

FAQ

To file a Benefit of Incorporation (BOI) in New Hampshire, you must complete the necessary paperwork and submit it to the Secretary of State. It's essential to provide accurate information regarding your business operations. Additionally, you might want to utilize resources like US Legal Forms to streamline your filing process, particularly if you're managing New Hampshire aging accounts payable.