New Hampshire Letter of Notice to Borrower of Assignment of Mortgage

Description

How to fill out Letter Of Notice To Borrower Of Assignment Of Mortgage?

Choosing the right legitimate file format can be a have a problem. Of course, there are a lot of web templates available online, but how will you obtain the legitimate develop you need? Utilize the US Legal Forms internet site. The service provides a large number of web templates, for example the New Hampshire Letter of Notice to Borrower of Assignment of Mortgage, which you can use for business and private requires. Every one of the forms are inspected by professionals and meet federal and state requirements.

In case you are previously registered, log in for your bank account and click the Obtain key to obtain the New Hampshire Letter of Notice to Borrower of Assignment of Mortgage. Make use of your bank account to look through the legitimate forms you may have ordered previously. Visit the My Forms tab of the bank account and obtain one more backup of the file you need.

In case you are a fresh user of US Legal Forms, listed here are simple instructions that you can comply with:

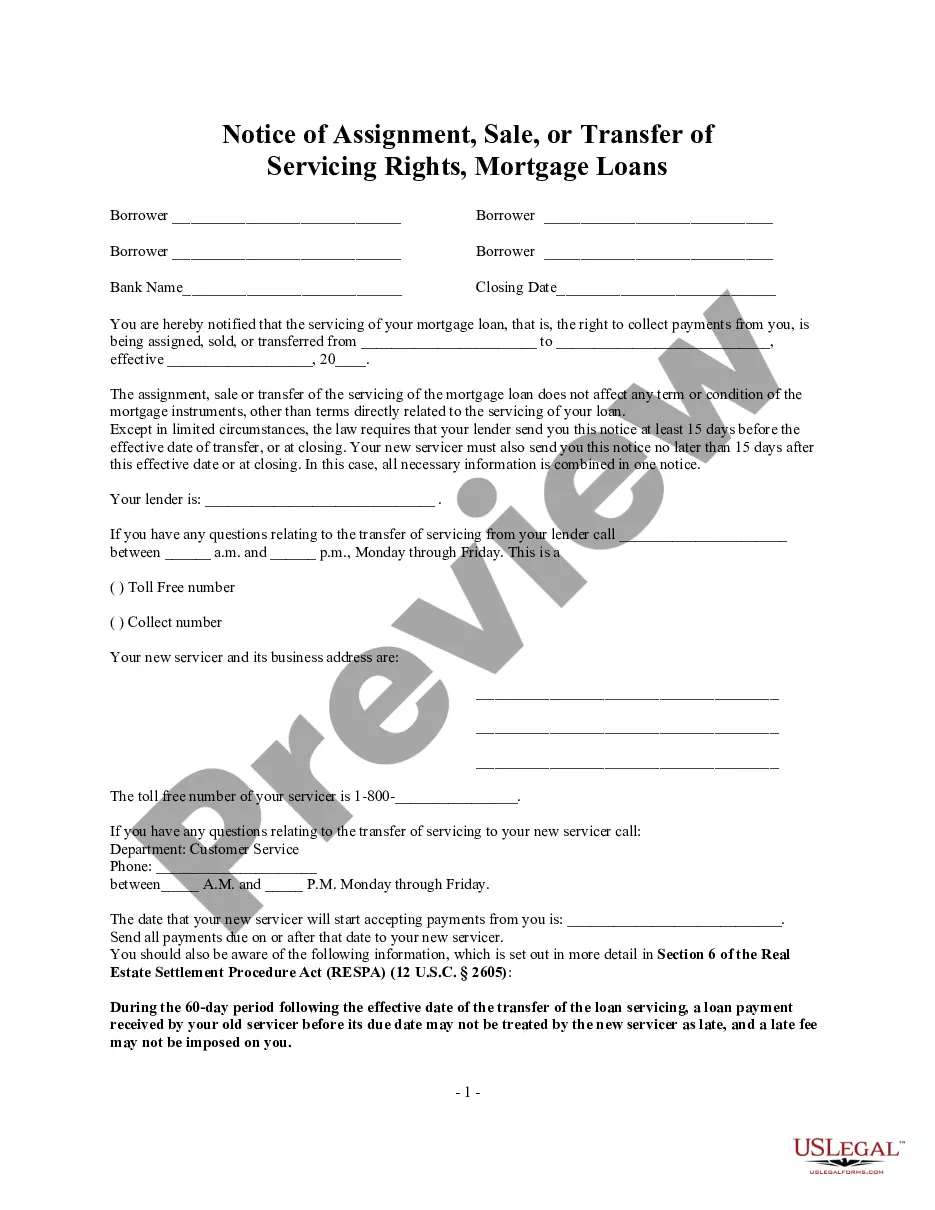

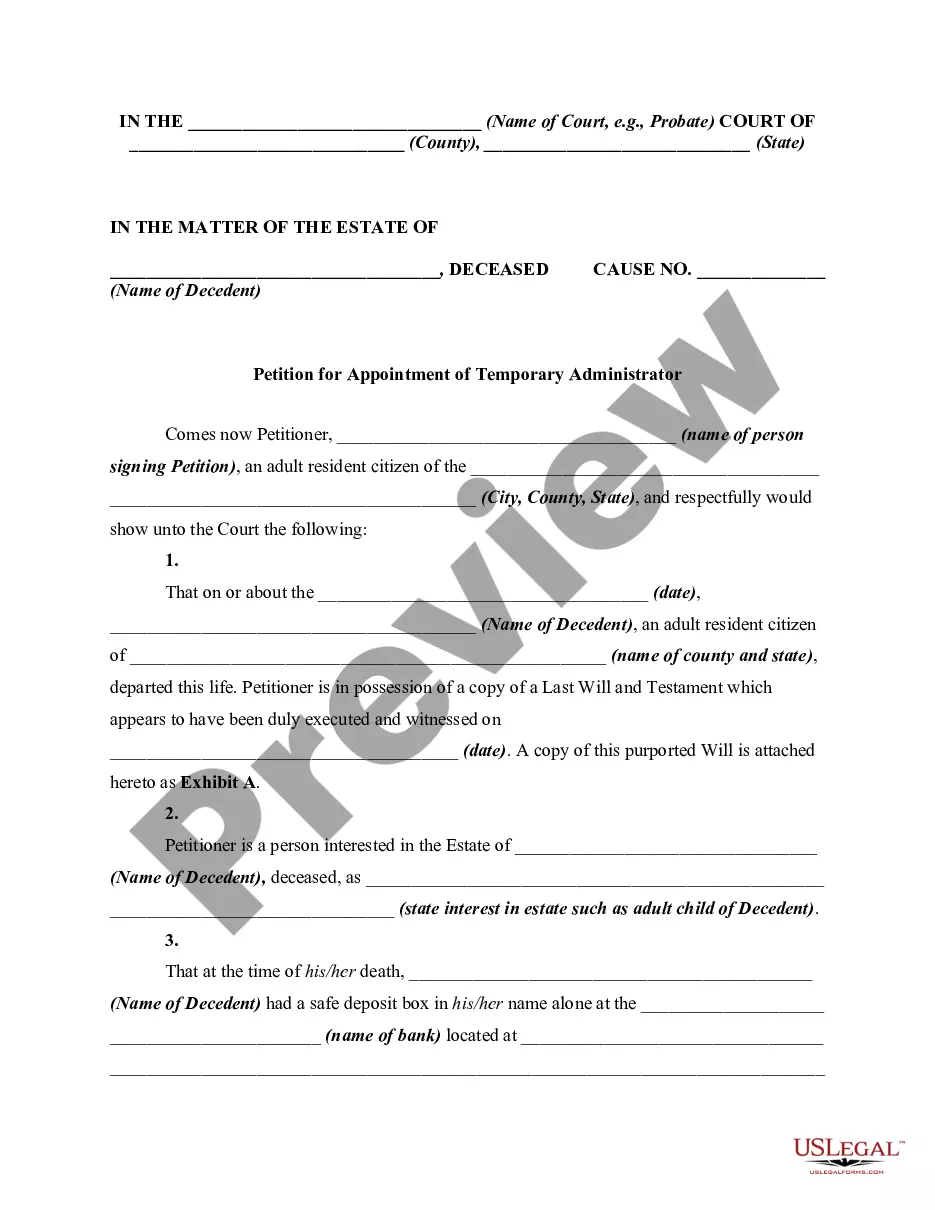

- Initially, be sure you have chosen the correct develop to your area/county. You can check out the shape utilizing the Preview key and study the shape description to make sure it is the right one for you.

- In the event the develop fails to meet your preferences, utilize the Seach discipline to get the correct develop.

- When you are sure that the shape is proper, click on the Purchase now key to obtain the develop.

- Select the rates prepare you want and type in the needed info. Create your bank account and pay money for the transaction utilizing your PayPal bank account or Visa or Mastercard.

- Select the document file format and download the legitimate file format for your device.

- Complete, revise and produce and indicator the attained New Hampshire Letter of Notice to Borrower of Assignment of Mortgage.

US Legal Forms is the most significant library of legitimate forms that you will find various file web templates. Utilize the company to download skillfully-created files that comply with condition requirements.

Form popularity

FAQ

Civil Code section 2932.5, which mandates that an assignee of a mortgagee must record the assignment before exercising a power to sell the real property, only applies to mortgages and does not apply to deeds of trust. (Haynes v. EMC Mortgage Corporation (? Cal.

If an assignment is made with the fraudulent intent to delay, hinder, and defraud creditors, then it is void as fraudulent in fact.

That a mortgage is not recorded does not prohibit the commencement of a mortgage foreclosure action. The mortgage contract between the borrower and the lender is no more binding when it is recorded and so legal action can be taken.

Mortgages are interests in property, and so can and should be recorded as soon as possible after the closing. Most states have recording statutes that impose restrictions on when and how a document conveying property rights can be legally created. Recording statutes are important for several purposes.

Format it as you would a business letter, address it to your lender and plug in the address of the property it's regarding in the subject line. Keep it brief, providing only what the lender requests. It needs to be no more than a single paragraph describing that you'll use the property as your primary home.

If it does not have an assignment or failed to record it as required by state law, this may result in the dismissal of the foreclosure action. Recording rules may require that the foreclosing party record the assignment before starting the foreclosure.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

A recorded mortgage must be discharged by a certificate signed by the mortgagee, his personal representatives or assigns, acknowledged or proved and certified as prescribed by the chapter on ?recording transfers,? stating that the mortgage has been paid, satisfied, or discharged.