New Hampshire Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance A nonqualified retirement plan is an arrangement made between an employer and an employee that provides additional benefits upon retirement, beyond those offered by traditional qualified retirement plans such as a 401(k). In New Hampshire, nonqualified retirement plans may be funded with life insurance policies, which can offer both financial security and tax advantages to employees. The New Hampshire Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance is a legally binding contract that outlines the terms and conditions of the arrangement between the employer and the employee regarding this specific type of retirement plan. With this agreement, both parties can ensure a clear understanding of their roles, responsibilities, and entitlements throughout the course of the employment and retirement. In general, a nonqualified retirement plan funded with life insurance involves the employer purchasing a life insurance policy on the employee's life and making the employee the named beneficiary. The employer is responsible for paying the premiums, while the employee may have the opportunity to contribute to the policy as well. Upon the employee's retirement, the life insurance policy can provide a tax-efficient source of income. The policy's cash value grows tax-deferred, and the employee can access it through withdrawals or policy loans. The death benefit can also be used to provide financial support to the employee's beneficiaries in the event of their passing. While the New Hampshire Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance does not specify different types of plans, there can be variations depending on the specific terms negotiated between the employer and the employee. Some key factors that might vary in different agreements include: 1. Contribution levels: The employer may decide to contribute a fixed dollar amount or a percentage of the employee's salary to the life insurance policy, while the employee's contributions may or may not be mandatory. 2. Vesting schedule: The agreement may outline a vesting schedule, which determines the percentage of the employer's contributions that the employee is entitled to upon retirement. For example, an employee may become vested in 20% of the employer's contributions after five years of service and gradually become fully vested over a certain period. 3. Plan termination: The agreement should address the circumstances under which the plan can be terminated and how the accumulated cash value and death benefit would be distributed to the employee or their beneficiaries. 4. Change in employment: The agreement may specify the implications of a change in the employee's employment status, such as retirement, disability, or termination, on the benefits provided by the nonqualified retirement plan funded with life insurance. Overall, the New Hampshire Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance serves as a comprehensive document that ensures both parties are aware of their respective rights and obligations regarding this specific retirement arrangement. It offers flexibility in tailoring the terms to fit the needs of the employer and the employee while providing additional financial security for retirement through a life insurance policy.

New Hampshire Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

How to fill out New Hampshire Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

Have you been inside a position that you require paperwork for both company or specific purposes just about every day? There are tons of legal record templates available on the Internet, but getting types you can rely is not straightforward. US Legal Forms offers 1000s of kind templates, such as the New Hampshire Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance, that are written to fulfill federal and state requirements.

In case you are already knowledgeable about US Legal Forms site and possess an account, basically log in. After that, it is possible to download the New Hampshire Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance design.

Should you not offer an accounts and would like to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is to the proper city/area.

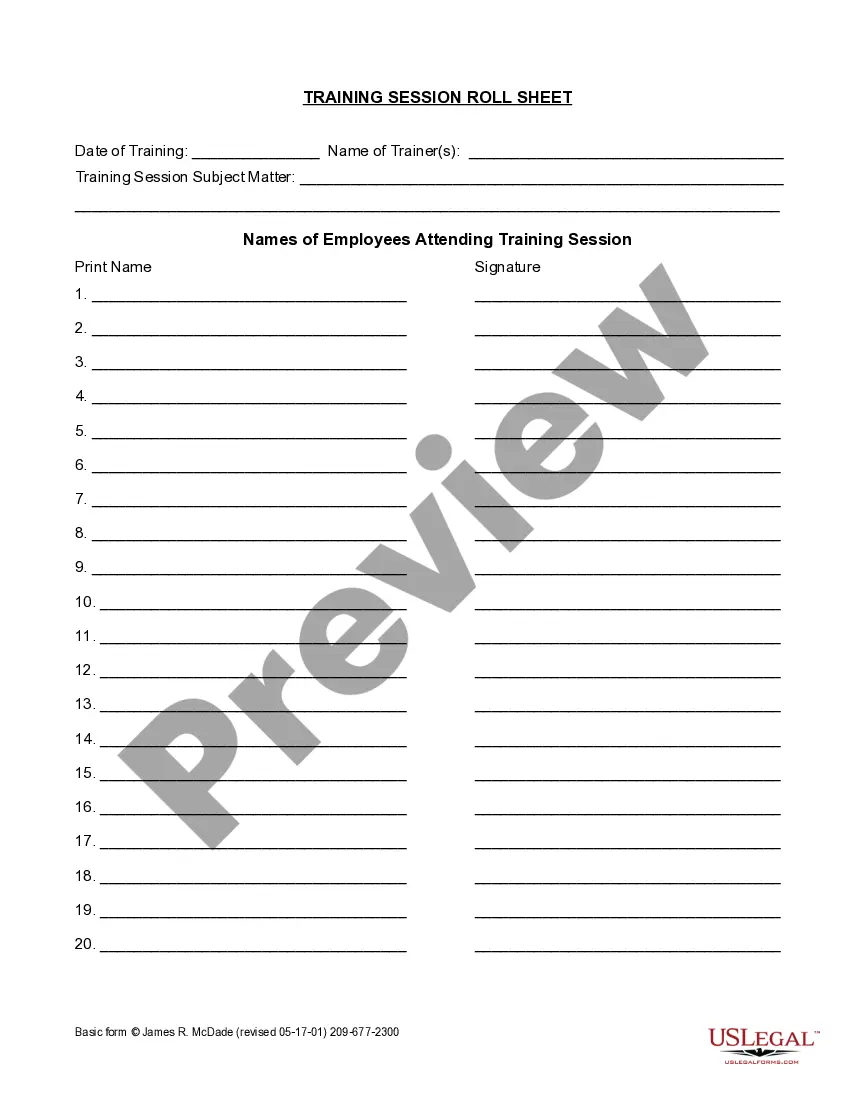

- Make use of the Review key to examine the form.

- Read the information to ensure that you have selected the correct kind.

- If the kind is not what you`re looking for, make use of the Search industry to discover the kind that meets your requirements and requirements.

- Once you obtain the proper kind, just click Purchase now.

- Choose the prices plan you want, fill out the required details to make your money, and pay for your order making use of your PayPal or bank card.

- Decide on a hassle-free data file format and download your version.

Get every one of the record templates you may have bought in the My Forms menu. You can get a extra version of New Hampshire Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance whenever, if required. Just go through the essential kind to download or produce the record design.

Use US Legal Forms, probably the most extensive collection of legal kinds, to save lots of efforts and prevent blunders. The service offers skillfully produced legal record templates that can be used for a range of purposes. Generate an account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.

A NQDC plan is unfunded if either assets have not been set aside by your employer to pay plan benefits (that is, your employer pays benefits from its general assets on a "pay as you go" basis), or assets have been set aside but those assets remain subject to the claims of your employer's creditors (often referred to as

Although the Internal Revenue Code itself does not expressly state that a plan must be permanent to be qualified under Code Section 401(a), the applicable Treasury regulations state that the term plan implies a permanent, as distinct from a temporary, program.

A qualified retirement plan is a retirement plan recognized by the IRS where investment income accumulates tax-deferred. Common examples include individual retirement accounts (IRAs), pension plans and Keogh plans. Most retirement plans offered through your job are qualified plans.

Examples of nonqualified plans are deferred compensation plans, supplemental executive retirement plans, split-dollar arrangements and other similar arrangements. Contributions to a deferred compensation plan will reduce an employee's gross income, but there's no rollover option upon termination of employment.

A qualified benefit plan also: Qualifies for certain tax benefits and government protection, including tax breaks for employers and tax credits for businesses with these plans in place.

Whenever life insurance is included in a qualified retirement plan, the insured is receiving an immediate benefit in the form of the life insurance protection. The value of this benefit is reported and added to the insured's taxable income each year.

qualified deferred compensation plan is a binding contract between an employer and an employee where the employer agrees to pay the employee at a later time. Specifically, the employer makes an unsecured promise to pay an employee's future benefits, subject to the specific terms of the contract.

Qualified plans have tax-deferred contributions from the employee, and employers may deduct amounts they contribute to the plan. Nonqualified plans use after-tax dollars to fund them, and in most cases employers cannot claim their contributions as a tax deduction.

Using life insurance in a qualified plan does offer several advantages, including: The ability to use pre-tax dollars to pay premiums that would otherwise not be tax-deductible. Fully funding the retirement benefit at the premature death of the plan participant.