A New Hampshire Trust Agreement for Pension Plan with Corporate Trustee is a legally binding document that outlines the terms and conditions related to managing a pension plan in the state of New Hampshire. This agreement is designed to protect the interests of both the pension plan beneficiaries and the corporation responsible for administering the plan. In this agreement, a corporate trustee is appointed to manage the pension plan according to the rules and regulations set forth by the state and federal laws governing pensions. The trustee acts as a fiduciary, meaning they are obligated to act in the best interests of the plan beneficiaries and to administer the plan prudently. The New Hampshire Trust Agreement for Pension Plan with Corporate Trustee typically includes several important sections. These include: 1. Purpose: This section outlines the overall objective and purpose of the pension plan, which is to provide retirement benefits to eligible employees. It may also highlight any specific goals or objectives unique to the plan. 2. Definitions: Here, the agreement defines key terms and concepts used throughout the document, such as "beneficiary," "trust assets," "trustee," and other relevant terminology. 3. Appointment of the Trustee: This section specifies the appointment and acceptance of the corporate trustee responsible for administering the plan. The agreement will outline the trustee's powers, responsibilities, and limitations within the scope of managing the pension plan. 4. Contributions and Funding: This section details the rules and guidelines for making contributions to the pension plan, including both the employer's and employee's responsibilities. It may also specify the frequency and methods for funding the plan. 5. Vesting and Eligibility: This section explains the eligibility criteria for employees to participate in the pension plan and become vested in their benefits. It may outline the service requirements and conditions necessary for employees to become eligible for plan benefits. 6. Investment Powers: This section outlines the trustee's authority to invest the plan assets prudently, in accordance with applicable laws and regulations. It may specify the types of investments allowed, any restrictions or limitations, and the management of investment returns. 7. Distribution and Payments: Here, the agreement describes how and when pension plan benefits will be distributed to the participants, including retirement, disability, death, and other applicable events. It may also address any payment options available to the beneficiaries. 8. Amendment and Termination: This section defines the process and requirements for amending or terminating the trust agreement and the pension plan itself. It may specify the conditions under which amendments can be made and who has the authority to initiate termination. Types of New Hampshire Trust Agreement for Pension Plan with Corporate Trustee: 1. Defined Benefit Trust Agreement: This type of agreement establishes a pension plan that promises a specific benefit amount to participants based on a formula incorporating factors such as salary, years of service, and age. 2. Defined Contribution Trust Agreement: This type of agreement establishes a pension plan where the contributions made are specified, but the eventual benefits depend on the investment performance of those contributions. This is commonly known as a 401(k) or 403(b) plan. In conclusion, a New Hampshire Trust Agreement for Pension Plan with Corporate Trustee is a comprehensive legal document that outlines the terms and conditions for managing a pension plan in accordance with state and federal regulations. By establishing clear guidelines, this agreement aims to safeguard the interests of both the plan beneficiaries and the corporation administering the plan.

New Hampshire Trust Agreement for Pension Plan with Corporate Trustee

Description

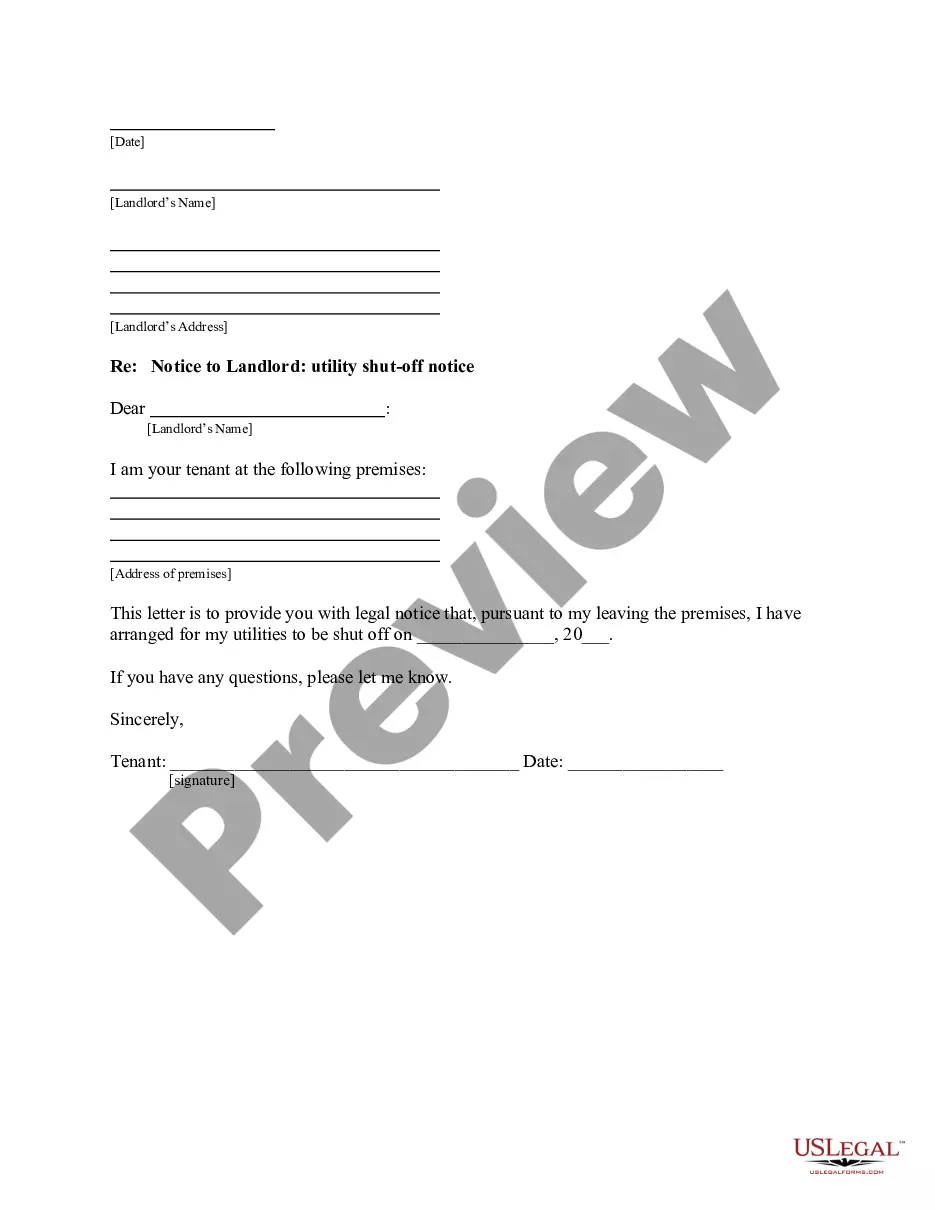

How to fill out Trust Agreement For Pension Plan With Corporate Trustee?

You can devote several hours on the Internet attempting to find the legitimate document design that suits the state and federal requirements you require. US Legal Forms gives thousands of legitimate forms which are evaluated by specialists. It is possible to down load or print the New Hampshire Trust Agreement for Pension Plan with Corporate Trustee from my services.

If you already have a US Legal Forms accounts, you may log in and click the Download switch. Following that, you may complete, modify, print, or indication the New Hampshire Trust Agreement for Pension Plan with Corporate Trustee. Each and every legitimate document design you purchase is the one you have forever. To have another backup of any acquired form, visit the My Forms tab and click the related switch.

Should you use the US Legal Forms website initially, stick to the basic instructions beneath:

- Very first, ensure that you have chosen the proper document design to the region/metropolis of your choice. Browse the form explanation to make sure you have chosen the appropriate form. If accessible, utilize the Review switch to look with the document design at the same time.

- If you wish to get another model in the form, utilize the Look for industry to discover the design that meets your needs and requirements.

- When you have located the design you need, simply click Buy now to carry on.

- Choose the costs program you need, type your accreditations, and register for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your Visa or Mastercard or PayPal accounts to fund the legitimate form.

- Choose the format in the document and down load it to your device.

- Make adjustments to your document if required. You can complete, modify and indication and print New Hampshire Trust Agreement for Pension Plan with Corporate Trustee.

Download and print thousands of document web templates making use of the US Legal Forms Internet site, that provides the biggest collection of legitimate forms. Use specialist and state-certain web templates to tackle your business or personal demands.

Form popularity

FAQ

A trustee is the person or entity entrusted to make investment decisions in the best interests of plan participants. A trustee is assigned by another fiduciary, such as the employer who sponsors the qualified retirement plan, and should be named in the plan documents. Additional restrictions apply for a trustee.

A trustee is responsible for managing and maintaining trust property while the custodian is only the entity that holds the assets. When you open a trust, you must appoint a trustee to oversee the trust's activities, which includes managing, selling, and distributing trust property to beneficiaries.

New Hampshire is consistently rated as a best place to retire year after year, and for good reason. Financial stability, safety, along with health & wellbeing are all factors one must consider when deciding where to retire.

NHRS is a public employee defined benefit plan providing retirement, disability, and death benefits to eligible members and their beneficiaries. Eligible members can receive a lifetime pension at retirement. The benefit is calculated based on service time and average salary using formulas outlined in state law.

What Is a 401(k) Trustee? The trustee (or trustees) of a plan is the individual that has the primary fiduciary responsibility to ensure the plan assets are being managed in the best interest of the participants and in line with the plan document. The trustee can be held personally liable for the misuse of plan asset.

The trustee's role is to administer and distribute the assets in the trust according to your wishes, as expressed in the trust document. Trustees have the fiduciary duty, legal authority, and responsibility to manage your assets held in trust and handle day-to-day financial matters on your behalf.

A pension trustee is someone who technically holds an occupational pension scheme's assets for the beneficiaries. They act separately from the employer for the benefit of scheme members and their powers are written in the trust deed and the scheme's rules.

The person (or group of persons) the individual appoints to control and manage the assets in the trust is known as the trustee(s). Sometimes the settlor will also be a trustee. Finally, there's the person, or group of persons, who will benefit from the assets owned by the trust. They are known as the beneficiaries.

Service retirement pension benefits are calculated based on three factors: (1) years of creditable service; (2) Average Final Compensation (AFC) which is the average of a member's three or five highest-paid years (depending on vested status as of January 1, 2012) and; (3) a benefit factor that is different for

What does it mean to be vested? A member who is vested has earned the right to a future service retirement benefit.