Title: New Hampshire Investment Management Agreement for Separate Account Clients: A Comprehensive Overview Introduction: The New Hampshire Investment Management Agreement for Separate Account Clients is a legally binding contract that governs the relationship between an investment management firm and its separate account clients. This agreement outlines the terms and conditions under which the investment manager provides professional services to manage and invest the client's assets. Tailored to meet the unique needs and goals of individual clients, this agreement ensures transparency, accountability, and collaboration throughout the investment process. Key Features: 1. Defining Separate Account Clients: The New Hampshire Investment Management Agreement caters specifically to separate account clients. Separate accounts are personalized investment portfolios managed for individual clients, consisting of various securities and assets such as stocks, bonds, cash, and other investment instruments. These accounts are distinct from pooled investment vehicles like mutual funds. 2. Scope of Services: The agreement outlines the investment manager's responsibilities, which can include portfolio design, asset allocation, investment selection, risk management, and ongoing monitoring. It also specifies the limitations of services, if any, by highlighting any specific investment strategies or asset classes that are excluded. 3. Investment Guidelines and Objectives: The agreement establishes clear investment objectives based on the client's risk tolerance, financial goals, and time horizon. It specifies investment guidelines, criteria, and any restrictions that the investment manager must adhere to, such as ethical considerations or client-specific requirements. 4. Fee Structure: The agreement details the fee structure for the investment management services, such as an annual asset-based fee or a performance-based fee. This section may also outline any additional charges, such as custodial fees or transaction costs, ensuring transparency in fee disclosure. 5. Reporting and Performance Evaluation: Clients will receive periodic reports detailing the performance of their separate accounts. These reports may include investment returns, portfolio composition, sector allocation, benchmark comparisons, and any relevant commentary or analysis. Performance evaluation metrics are typically defined in the agreement, providing a basis for assessing the investment manager's performance. Types of New Hampshire Investment Management Agreement for Separate Account Clients: 1. Individual Investors: This agreement is designed for individual investors seeking customized investment management services tailored to their specific financial circumstances, goals, and risk tolerance. 2. Institutional Clients: The New Hampshire Investment Management Agreement caters to institutional clients such as pension funds, insurance companies, endowments, and foundations. Institutional clients often require more complex investment strategies, diverse asset classes, and customized reporting aligning with their unique objectives. 3. High Net Worth Individuals: This specialized agreement is tailored for high net worth individuals who typically have larger investment portfolios and may require additional services like tax planning, estate planning, or philanthropic strategies. Conclusion: The New Hampshire Investment Management Agreement for Separate Account Clients is a crucial document that establishes the terms for the professional relationship between the investment manager and separate account clients. By clearly defining roles, responsibilities, and investment objectives, the agreement ensures transparency, legality, and effective wealth management.

New Hampshire Investment Management Agreement for Separate Account Clients

Description

How to fill out New Hampshire Investment Management Agreement For Separate Account Clients?

Are you presently in a placement the place you will need papers for either enterprise or personal uses almost every time? There are a lot of legal papers layouts accessible on the Internet, but getting versions you can rely is not easy. US Legal Forms provides 1000s of type layouts, just like the New Hampshire Investment Management Agreement for Separate Account Clients, which are written in order to meet federal and state demands.

If you are currently acquainted with US Legal Forms site and possess an account, basically log in. Next, it is possible to down load the New Hampshire Investment Management Agreement for Separate Account Clients design.

If you do not offer an profile and wish to begin using US Legal Forms, abide by these steps:

- Find the type you need and make sure it is for that correct area/state.

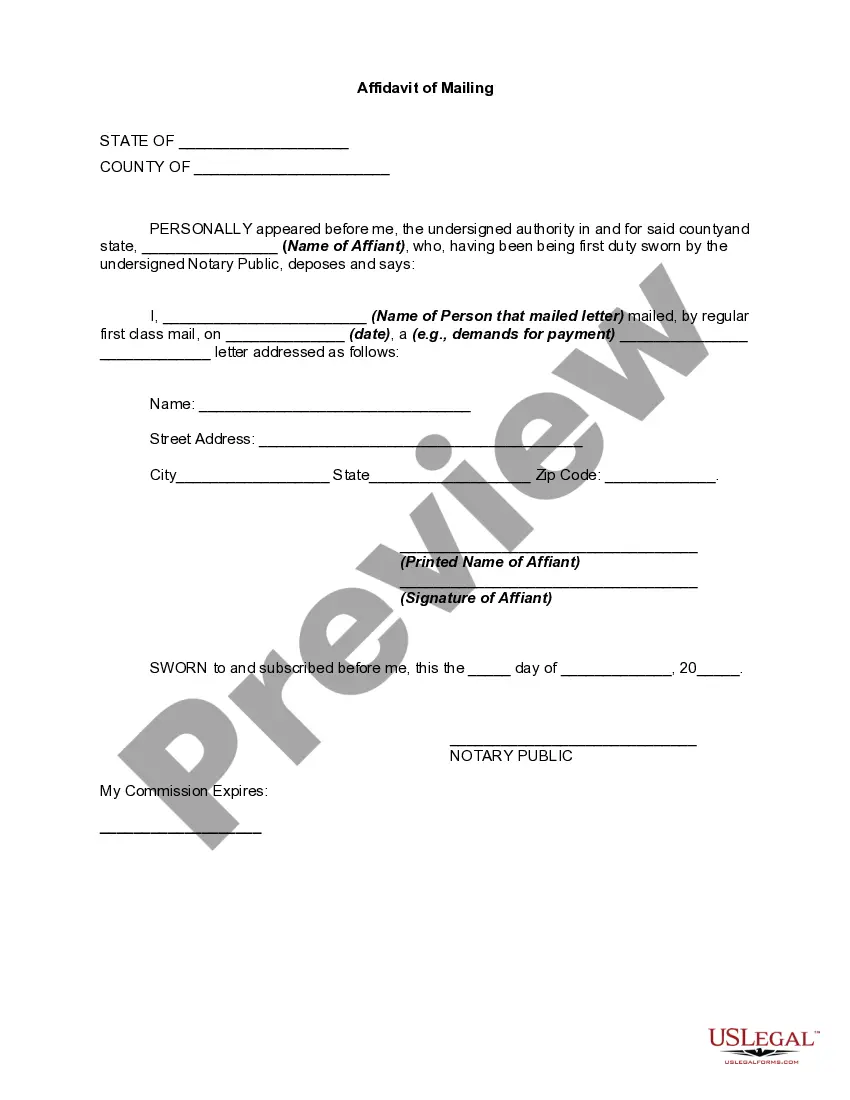

- Utilize the Review option to check the shape.

- See the information to ensure that you have chosen the proper type.

- In case the type is not what you are looking for, use the Search field to discover the type that meets your needs and demands.

- Whenever you obtain the correct type, simply click Purchase now.

- Select the prices prepare you want, submit the required information to produce your account, and purchase your order utilizing your PayPal or bank card.

- Select a hassle-free paper format and down load your duplicate.

Discover all the papers layouts you possess bought in the My Forms food list. You may get a additional duplicate of New Hampshire Investment Management Agreement for Separate Account Clients any time, if required. Just click on the required type to down load or printing the papers design.

Use US Legal Forms, probably the most substantial selection of legal kinds, to conserve time and avoid blunders. The services provides professionally created legal papers layouts that you can use for a range of uses. Make an account on US Legal Forms and initiate generating your lifestyle a little easier.