Title: Exploring the New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment Keywords: New Hampshire, Agreement to Dissolve, Wind up Partnership, Settlement, Lump-sum Payment, Types Introduction: The New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment is a legal document that outlines the process by which a partnership comes to an end in New Hampshire. This comprehensive agreement addresses various aspects related to dissolving, winding up the partnership's affairs, and settling any outstanding obligations. Let's delve into the details of this agreement and explore any potential types that may exist. 1. Purpose of the Agreement: The primary objective of the New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment is to ensure an orderly and fair dissolution process while protecting the rights and interests of the partners involved. 2. Dissolution Process: This agreement lays out the steps involved in dissolving a partnership, including the initial decision to dissolve, notification of all relevant parties, and the timeline for winding up the partnership's affairs. 3. Winding Up: The agreement guides the partners on how to settle any pending obligations, including the sale or transfer of partnership assets, payment of remaining debts and liabilities, and distribution of remaining assets among the partners. 4. Settlement Terms: Partnerships may vary in structure, so settlement terms can differ depending on the specific circumstances of each case. These terms may cover aspects such as the allocation of profits, losses, and distribution of partnership assets. Parties may negotiate specific settlement terms based on their individual requirements. 5. Lump-sum Payment: The New Hampshire Agreement to Dissolve and Wind up Partnership often includes a lump-sum payment provision. This provision specifies the agreed-upon amount to be paid by the partnership to each partner upon dissolution and settlement. The lump-sum payment serves as a final settlement and releases any further claims among the partners. Types of New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment: While there may not be explicitly defined types of agreements of this nature, some variations can arise based on the circumstances of the partnership's dissolution. Here are two potential examples: 1. Amicable Dissolution Agreement: This type of agreement is appropriate when partners agree to dissolve the partnership on amicable terms, without any major disputes or conflicts. It outlines the agreed-upon terms for winding up the partnership and distribution of assets, offering a smooth dissolution process. 2. Contested Dissolution Agreement: In cases of disagreement or disputes, a contested dissolution agreement may be necessary. This agreement addresses the contested issues, such as settlement terms, asset distribution, or payment disputes, providing a legal framework to resolve disagreements and proceed with dissolution while protecting the interests of all parties involved. Conclusion: The New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment is an essential legal document for partners looking to end their partnership in a structured and fair manner. Its comprehensive framework ensures that all obligations are met, and settlement terms are agreed upon, providing a clear path for dissolution. While there may not be specific types of this agreement, variations can arise based on the context and circumstances of the dissolution.

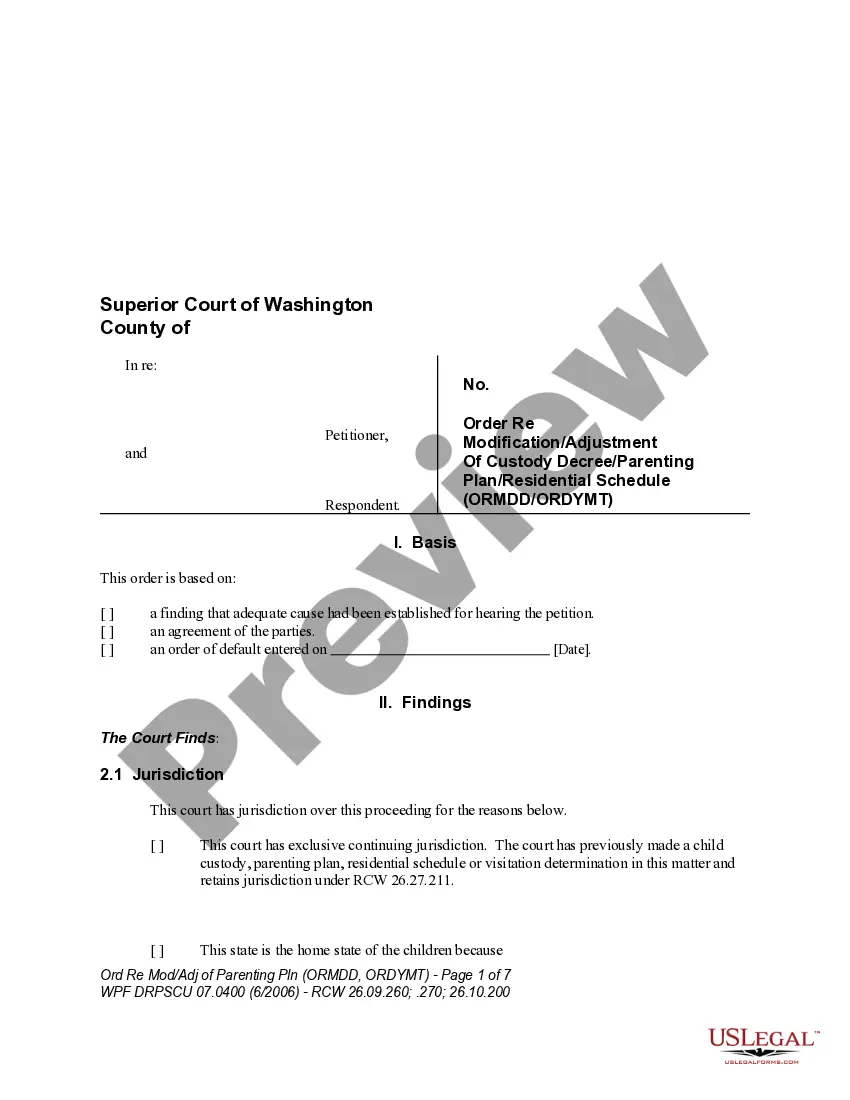

New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

How to fill out New Hampshire Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

If you need to full, download, or produce lawful papers web templates, use US Legal Forms, the largest selection of lawful forms, which can be found on-line. Make use of the site`s basic and handy search to find the files you need. A variety of web templates for company and specific uses are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to find the New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment within a number of clicks.

When you are presently a US Legal Forms customer, log in in your profile and click on the Download key to find the New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment. You can also gain access to forms you in the past delivered electronically from the My Forms tab of your own profile.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the form to the proper area/country.

- Step 2. Take advantage of the Preview method to look over the form`s content. Never neglect to learn the explanation.

- Step 3. When you are not satisfied with all the form, make use of the Research area near the top of the display screen to find other models from the lawful form template.

- Step 4. Once you have identified the form you need, click on the Buy now key. Choose the costs plan you choose and add your credentials to register for an profile.

- Step 5. Process the transaction. You can use your charge card or PayPal profile to perform the transaction.

- Step 6. Select the format from the lawful form and download it on the device.

- Step 7. Full, edit and produce or indication the New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

Each lawful papers template you buy is yours for a long time. You might have acces to every form you delivered electronically inside your acccount. Go through the My Forms area and choose a form to produce or download once more.

Compete and download, and produce the New Hampshire Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment with US Legal Forms. There are many specialist and condition-particular forms you can use to your company or specific requirements.

Form popularity

FAQ

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

In the dissolution process, any partner may dissolve the partnership at any time by providing a notice of dissolution. The partnership is then required to wind up its business activities and distribute its assets.

Dissolution of a limited partnership is the first step toward termination (but termination does not necessarily follow dissolution). The limited partners have no power to dissolve the firm except on court order, and the death or bankruptcy of a limited partner does not dissolve the firm.

When a partnership dissolves, the individuals involved are no longer partners in a legal sense, but the partnership continues until the business's debts are settled, the legal existence of the business is terminated and the remaining assets of the company have been distributed.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

The liabilities of the partnership shall rank in order of payment, as follows:Those owing to creditors other than partners,Those owing to partners other than for capital and profits,Those owing to partners in respect of capital,Those owing to partners in respect of profits.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

Winding up ends all outstanding legal and financial obligations of the partnership so that the business can be terminated. Winding up is a process and will be conducted according to the partnership agreement and according to applicable state laws. Once winding up is complete, the partnership is terminated.

The proceeds from the sale of assets along with the contribution of the partners at the time of dissolution of the firm are first used up to pay off the external liabilities, i.e., the creditors, bank loans, bank overdrafts, bills payable etc.