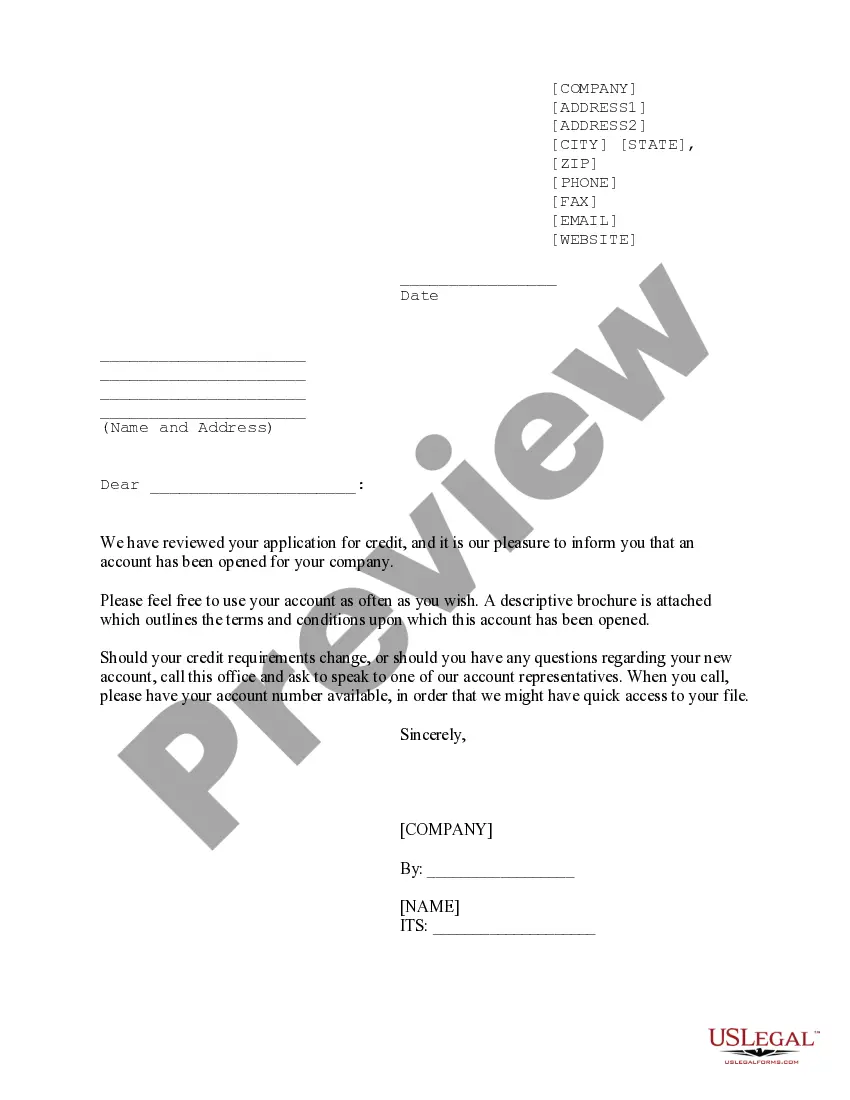

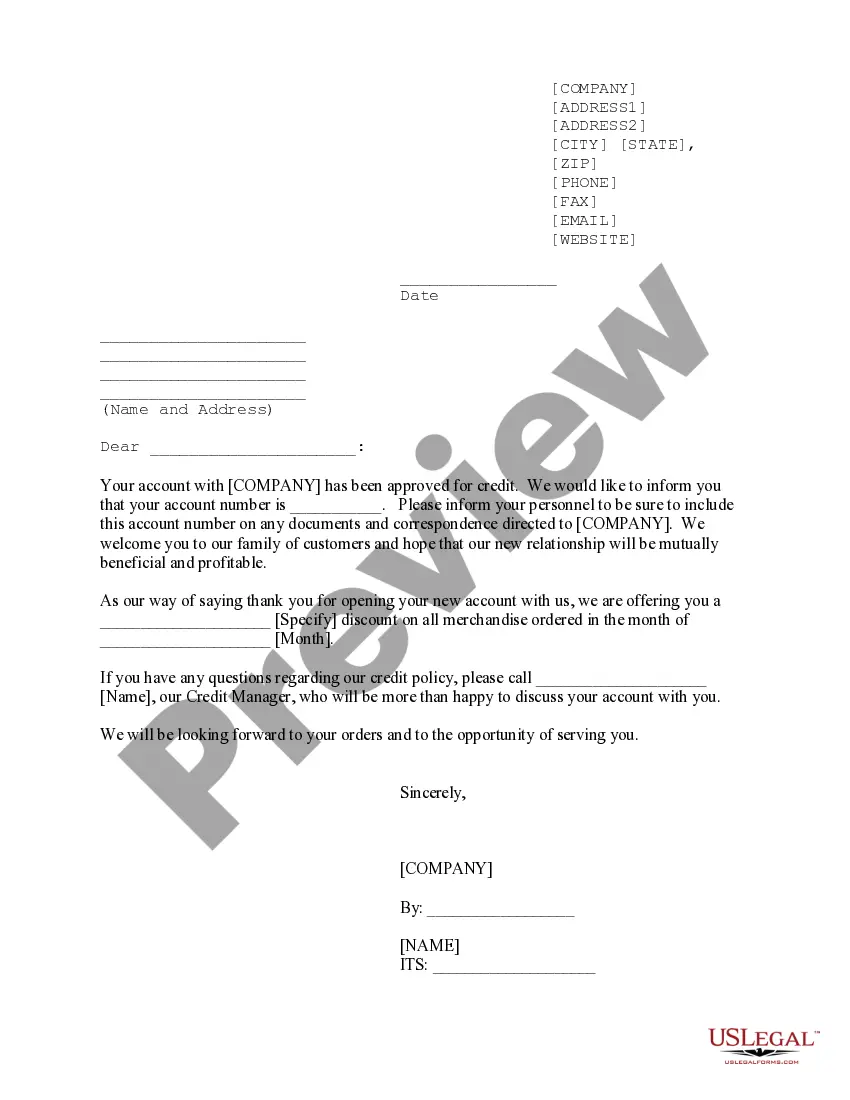

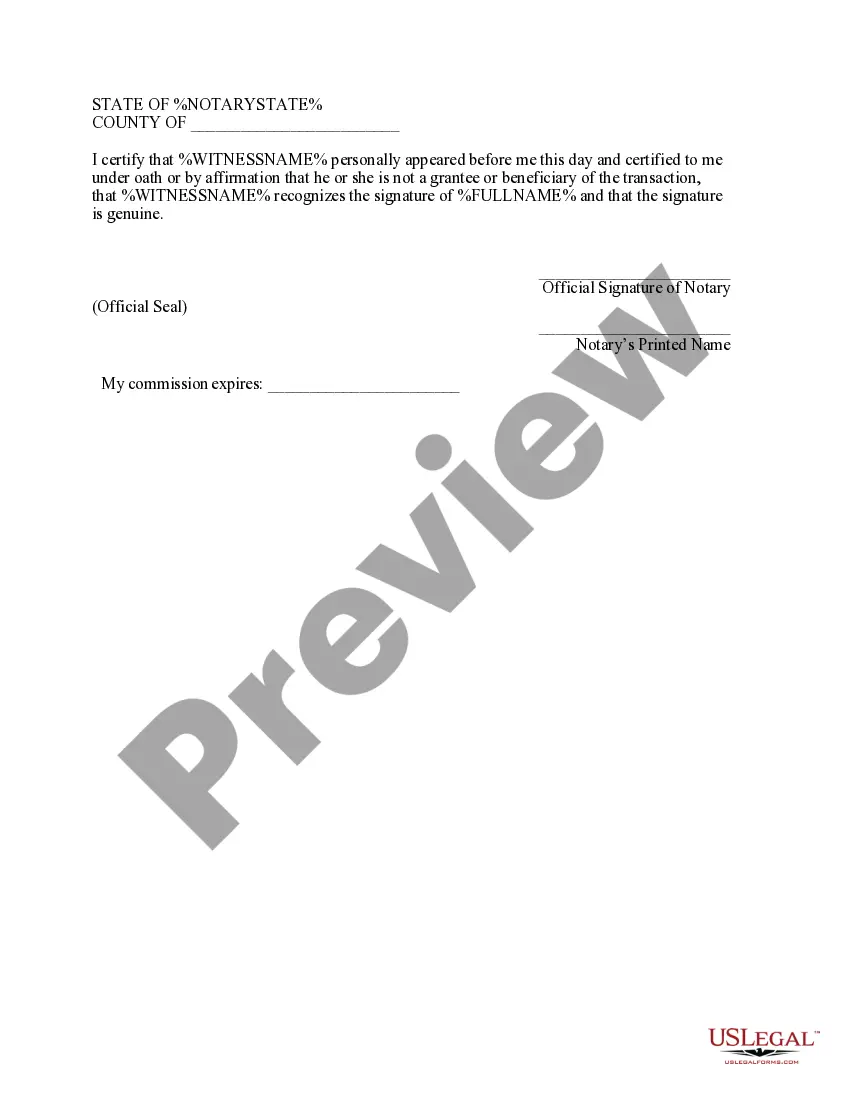

New Hampshire Credit Approval Form

Description

How to fill out Credit Approval Form?

If you intend to finalize, acquire, or create legitimate document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Employ the site’s simple and convenient search to find the forms you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Choose your preferred pricing plan and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of your legal document and download it to your device. Step 7. Complete, edit, and print or sign the New Hampshire Credit Approval Form.

- Utilize US Legal Forms to obtain the New Hampshire Credit Approval Form in just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and click on the Download button to get the New Hampshire Credit Approval Form.

- You can also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you have selected the form for your specific city/state.

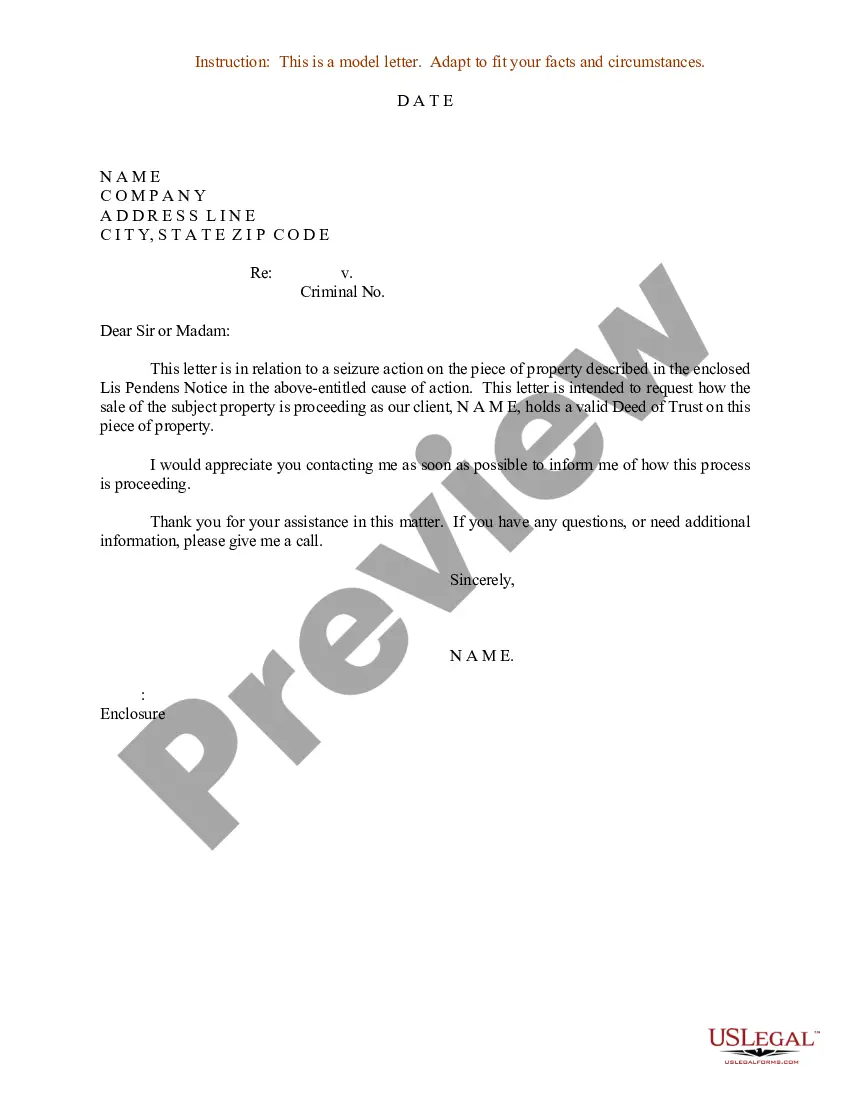

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the page to find other versions of the legal form template.

Form popularity

FAQ

Generally, applicants aiming to transfer to the University of New Hampshire should have a minimum GPA of 2.5. However, a higher GPA will strengthen your application, showcasing your academic readiness. Completing your New Hampshire Credit Approval Form helps clarify how your current GPA aligns with UNH expectations. Thus, preparing your application effectively can significantly enhance your chances of admission.