New Hampshire Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory

Description

How to fill out Sales Consultant Agreement With Consultant Operating As Independent Contractor In A Defined Territory?

US Legal Forms - one of the greatest libraries of legal types in the United States - offers a wide array of legal papers themes you are able to download or print. While using website, you may get 1000s of types for company and individual purposes, sorted by categories, says, or search phrases.You will find the most recent models of types just like the New Hampshire Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory within minutes.

If you already possess a membership, log in and download New Hampshire Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory in the US Legal Forms collection. The Obtain switch will appear on every single kind you view. You gain access to all earlier delivered electronically types in the My Forms tab of your respective account.

If you want to use US Legal Forms the first time, listed below are simple directions to help you get started:

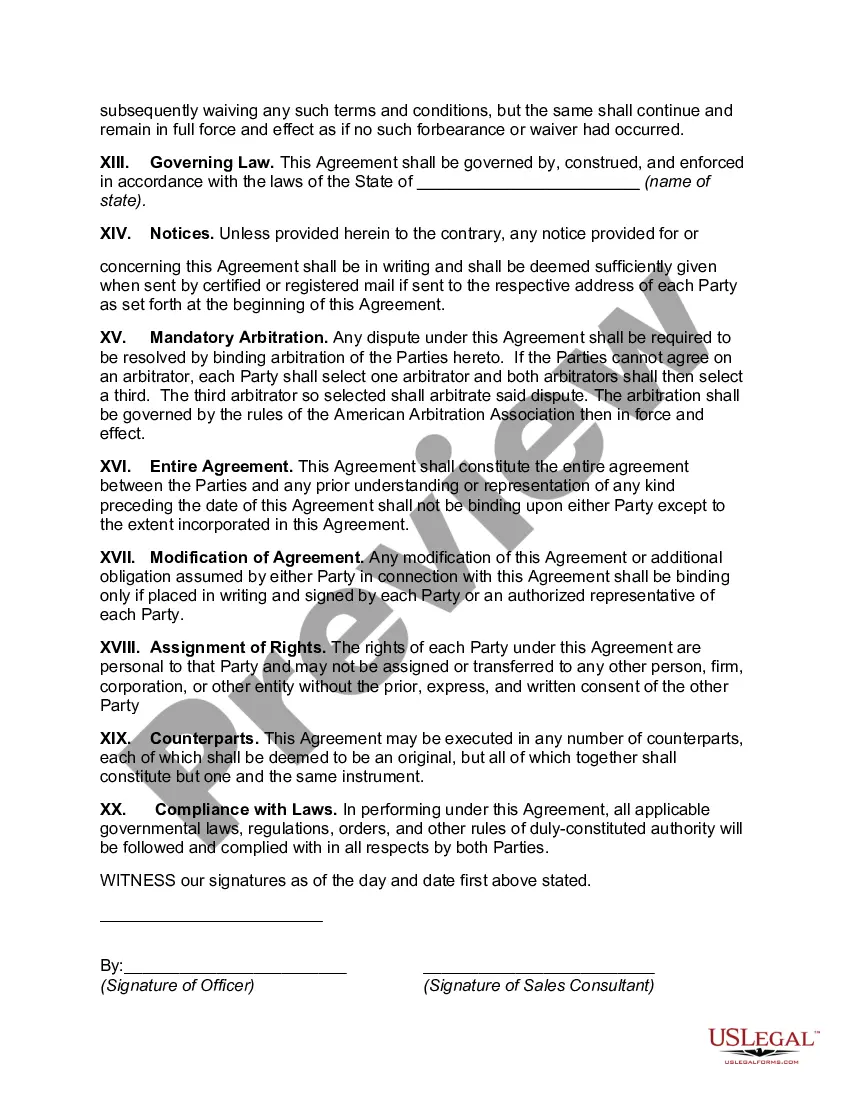

- Ensure you have picked out the proper kind to your metropolis/county. Click on the Review switch to analyze the form`s articles. See the kind description to actually have selected the correct kind.

- If the kind does not suit your requirements, take advantage of the Research industry near the top of the display screen to find the the one that does.

- If you are satisfied with the form, confirm your option by visiting the Get now switch. Then, pick the rates prepare you favor and offer your qualifications to register for an account.

- Procedure the purchase. Use your bank card or PayPal account to perform the purchase.

- Select the structure and download the form in your gadget.

- Make changes. Fill up, change and print and indication the delivered electronically New Hampshire Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory.

Every format you included with your account lacks an expiration time and is also your own forever. So, in order to download or print one more backup, just visit the My Forms segment and then click in the kind you need.

Gain access to the New Hampshire Sales Consultant Agreement with Consultant Operating as Independent Contractor in a Defined Territory with US Legal Forms, one of the most considerable collection of legal papers themes. Use 1000s of professional and state-specific themes that meet up with your business or individual requirements and requirements.

Form popularity

FAQ

Contracts play an essential role in the relationships that consultants have their clients. These legally binding documents tell a client what work you will perform, how long you expect the project to take, what compensation you expect, and more.

Contractors, freelancers, and consultants are self-employed individuals who work alone or as part of other businesses. These terms cause a great deal of confusion because they are often used interchangeably when discussing self-employment.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

Here's a short list of what should be included in every consulting contract:Full names and titles of the people with whom you're doing business. Be sure they're all spelled correctly.Project objectives.Detailed description of the project.List of responsibilities.Fees.Timeline.Page numbers.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

When you do consulting work in the U.S., you can be paid two different ways: as an employee on a W-2 tax basis, or on a 1099 tax basis as an independent contractor. As a consultant, being paid on a 1099 tax basis is a huge plus for two key reasons: You save more for retirement.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Generally, a Consultant is a self-employed independent businessperson who has a special field of expertise or skill.