Title: Exploring the New Hampshire Partnership Agreement with One Full-Time Partner and One Part-Time Partner Introduction: A New Hampshire Partnership Agreement with one partner working full-time and the other working part-time is a legally binding document that outlines the terms and conditions under which a partnership operates in the state of New Hampshire. This agreement ensures that both partners are aware of their rights, responsibilities, and contributions to the partnership, while also establishing mechanisms for decision-making, profit-sharing, and dispute resolution. Let's dive deeper into this unique partnership arrangement and explore its potential types. Types of New Hampshire Partnership Agreements with One Full-Time and One Part-Time Partner: 1. Equal Share Partnership: In this type of agreement, both partners have equal ownership rights and share profits and losses equally. Although one partner works full-time, while the other only part-time, the distribution of profits is divided equally, reflecting the equal partnership status. 2. Different Profit-Sharing Ratio: Here, the partners agree to an unequal distribution of profits based on their level of contribution and commitment to the partnership. The full-time partner may receive a higher percentage of profits compared to the part-time partner, reflecting the disparity in their time, effort, and resources devoted to the partnership. 3. Fixed Salary Partnership: In some cases, the full-time partner receives a fixed salary, ensuring a steady income for their commitment to the partnership. The part-time partner may or may not receive a salary, depending on the arrangement specified in the agreement. Profit-sharing remains separate from the fixed salary for the full-time partner. Key Elements of a New Hampshire Partnership Agreement: 1. Partnership Structure and Duration: Clearly define the name, purpose, and duration of the partnership. Outline the roles and responsibilities of each partner — designating one as the full-time partner and the other as the part-time partner. 2. Capital Contributions: Specify the initial capital contributions made by each partner, whether in cash, property, or services. This ensures clarity regarding the respective investments made by both partners. 3. Profit-Sharing and Losses: Define how profits and losses will be distributed, whether equally or based on a predetermined ratio. Outline how funds are distributed, ensuring transparency for both partners. 4. Decision-Making Authority: Clearly state the decision-making process, whether it requires unanimous agreement or a majority vote. This helps avoid conflicts and establishes a framework for resolving disputes in consensus-based decision-making. 5. Partnership Dissolution: Establish provisions for the orderly dissolution of the partnership, including procedures for asset distribution, outstanding liabilities, and the possibility of buyouts. Conclusion: A New Hampshire Partnership Agreement between a full-time partner and a part-time partner is a flexible option for individuals seeking to collaborate on a business venture while accommodating different levels of involvement. The agreement allows for customization to meet the specific needs of partners, considering their respective roles, investments, profit-sharing preferences, and long-term objectives. Properly executed, this agreement serves as a crucial foundation for managing the partnership effectively and resolving potential conflicts in a fair and structured manner.

New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time

Description

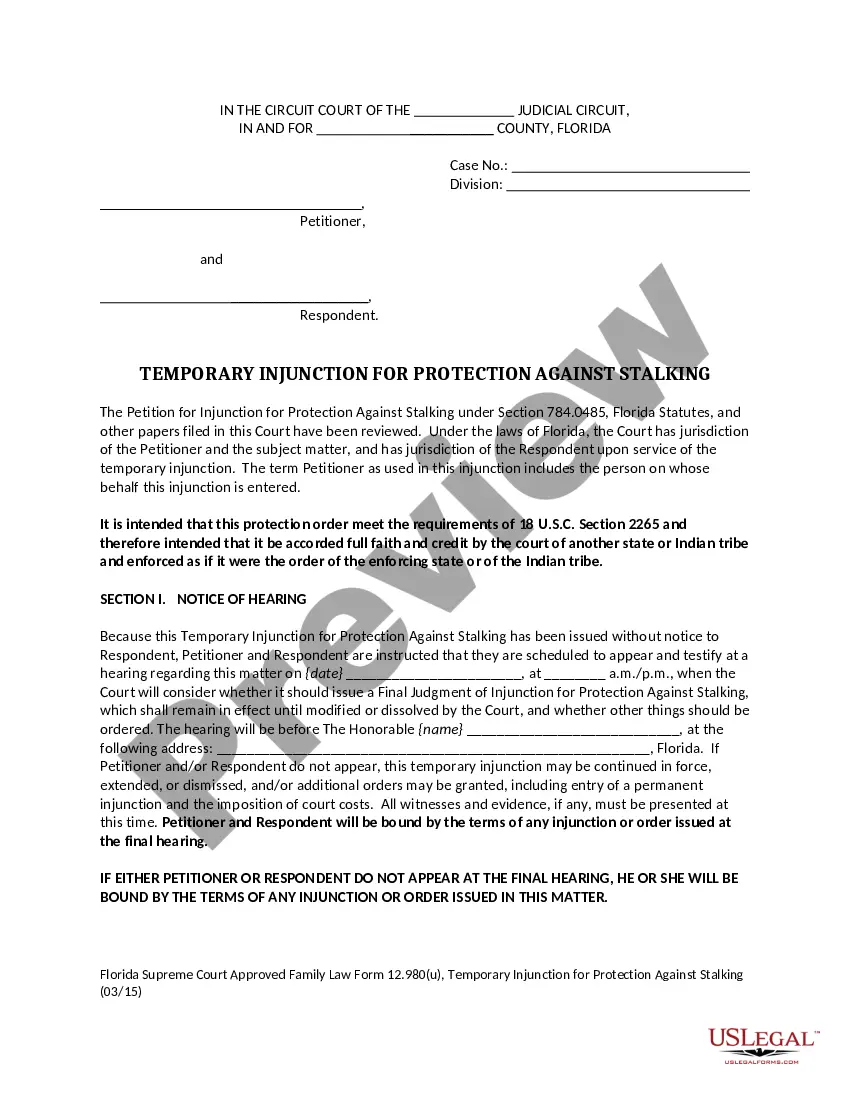

How to fill out New Hampshire Partnership Agreement With One Partner To Work Full Time For Partnership And Other Partner To Work Part Time?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates that can be downloaded or printed.

By utilizing the site, you can locate countless documents for business and personal purposes, categorized by type, state, or keywords. You can find the most current versions of documents such as the New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time in no time.

If you already have an account, Log In and download the New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time from the US Legal Forms repository. The Download button will be available on each document you view. You can access all previously downloaded documents in the My documents section of your account.

Next, select the payment plan you prefer and provide your details to sign up for an account.

Complete the transaction. Use your credit card or PayPal account to process the payment. Choose the format and download the document to your device. Make modifications. Fill in, edit, print, and sign the downloaded New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time. Every template you save in your account has no expiration date and is yours permanently. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the document you need. Access the New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time through US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professionally tailored and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the appropriate form for the region/state.

- Click the Review button to examine the document's content.

- Check the document description to confirm that you've chosen the correct form.

- If the document does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Get Now button.

Form popularity

FAQ

Partnerships typically dissolve if one partner leaves unless otherwise stipulated in the partnership agreement. You can structure your New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time to include provisions that allow continuity under specific circumstances, facilitating smoother transitions.

Most states do not directly tax partnerships as entities; instead, they tax the income earned by individuals within the partnership. However, some states have specific partnership-level taxes or fees. If your business operates under a New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, you should research your obligations not just in New Hampshire but in any states where you operate.

In general, a partnership requires at least two partners; however, certain business structures like a single-member limited liability company (LLC) can provide similar benefits. If you're considering a New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, understanding this distinction can help in structuring your business effectively.

New Hampshire does not tax partnership income directly at the state level, but partners must report their share of the partnership income on their personal tax returns. If you are part of a New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, it is vital to ensure proper tax reporting to avoid any penalties.

Yes, partnership income is generally taxable, but it often does not get taxed at the entity level. Instead, profits and losses pass through to the partners, who report them on their personal tax returns. In the context of a New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, accurately reporting this income is crucial for compliance.

New Hampshire has a unique tax structure, with no sales tax or income tax on wages. However, other taxes such as the Interest and Dividends Tax do exist. If you create a New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, knowing these exemptions may help optimize your overall tax burden.

Yes, New Hampshire does tax interest income, although it only applies to certain types of interest. This is relevant for individuals involved in a New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time. Understanding these tax obligations can help you properly manage your partnership's finances and plan accordingly.

The minimum number of partners required to form a partnership is two. This requirement is essential for the legal recognition of the partnership entity. If you are in a unique situation where one partner works full-time and another part-time, it's wise to draft a New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time. This document can help clarify roles and responsibilities while ensuring that your partnership complies with legal standards.

No, a formal partnership requires at least two individuals to operate legally as a partnership. If you find yourself with only one active partner, the partnership structure may need to change. Utilizing a New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time will help you navigate these structural shifts, ensuring you maintain legal compliance while defining each partner's role effectively.

Yes, by definition, a partnership consists of two or more partners. This is a crucial characteristic that differentiates it from other business entities like sole proprietorships. In crafting your New Hampshire Partnership Agreement with One Partner to Work Full Time for Partnership and Other Partner to Work Part Time, it is vital to acknowledge this requirement and understand the implications of having only one active partner.