Title: New Hampshire Agreement for Withdrawal of Partner from Active Management: A Comprehensive Overview Introduction: The New Hampshire Agreement for Withdrawal of Partner from Active Management is a legal document that outlines the terms and conditions regarding the departure of an existing partner from active management within a business partnership or company in the state of New Hampshire. This agreement is designed to ensure a smooth transition, protect the rights of partners, and provide clarity on the departing partner's obligations and liabilities. In New Hampshire, there are various types of agreements available for withdrawing partners, including the Voluntary Withdrawal Agreement, Involuntary Withdrawal Agreement, and Retirement Withdrawal Agreement. 1. Voluntary Withdrawal Agreement: The Voluntary Withdrawal Agreement under the New Hampshire Agreement for Withdrawal of Partner from Active Management allows a partner to voluntarily exit the partnership or company. This type of withdrawal typically occurs due to personal reasons, career changes, or the pursuit of other opportunities. The voluntary agreement sets forth the terms, such as the partner's notification period, compensation, profit sharing, and the extent of the partner's ongoing obligations after withdrawal. 2. Involuntary Withdrawal Agreement: The Involuntary Withdrawal Agreement addresses situations where a partner is compelled to withdraw from active management against their will. This may arise due to a breach of the partnership agreement, violation of fiduciary duties, or other actions that jeopardize the partnership's interests or its reputation. The agreement outlines the conditions under which the withdrawal occurs, potential financial compensation, and the distribution of the departing partner's interest in the partnership. 3. Retirement Withdrawal Agreement: The Retirement Withdrawal Agreement is specifically designed for partners who have reached the end of their active involvement in the partnership but wish to maintain their financial interest or receive retirement benefits. This agreement clarifies the terms and conditions governing the retirement process, including the determination of retirement benefits, profit-sharing arrangements, buyout procedures, and any ongoing obligations or restrictions on the retired partner. Key Elements of the New Hampshire Agreement for Withdrawal of Partner from Active Management: a) Notification Period: Specifies the duration of advance notice required from the withdrawing partner before their departure becomes effective. b) Compensation and Profit-Sharing: Outlines how the withdrawing partner will be compensated for their share of profits during their active management and upon withdrawal. c) Distribution of Assets and Liabilities: Defines the process by which the withdrawing partner's share of assets and liabilities is divided among the remaining partners. d) Non-Compete and Non-Disclosure Clauses: Determines any restrictions on the withdrawing partner's ability to compete with the partnership or disclose confidential information. e) Termination of Authority: States the exact date when the withdrawing partner loses their authority to act on behalf of the partnership or company. f) Dispute Resolution: Specifies the method for resolving any disputes that may arise during or after the withdrawal process, such as mediation, arbitration, or litigation. Conclusion: The New Hampshire Agreement for Withdrawal of Partner from Active Management provides a legal framework for the departure of partners from a partnership or company. It ensures a clear understanding of the rights, responsibilities, and obligations of all parties involved, safeguarding the business's ongoing operations and promoting a smooth transition for all partners. Whether it's a voluntary, involuntary, or retirement withdrawal, these agreements help maintain transparency, protect interests, and foster a positive working environment within the partnership or company.

New Hampshire Agreement for Withdrawal of Partner from Active Management

Description

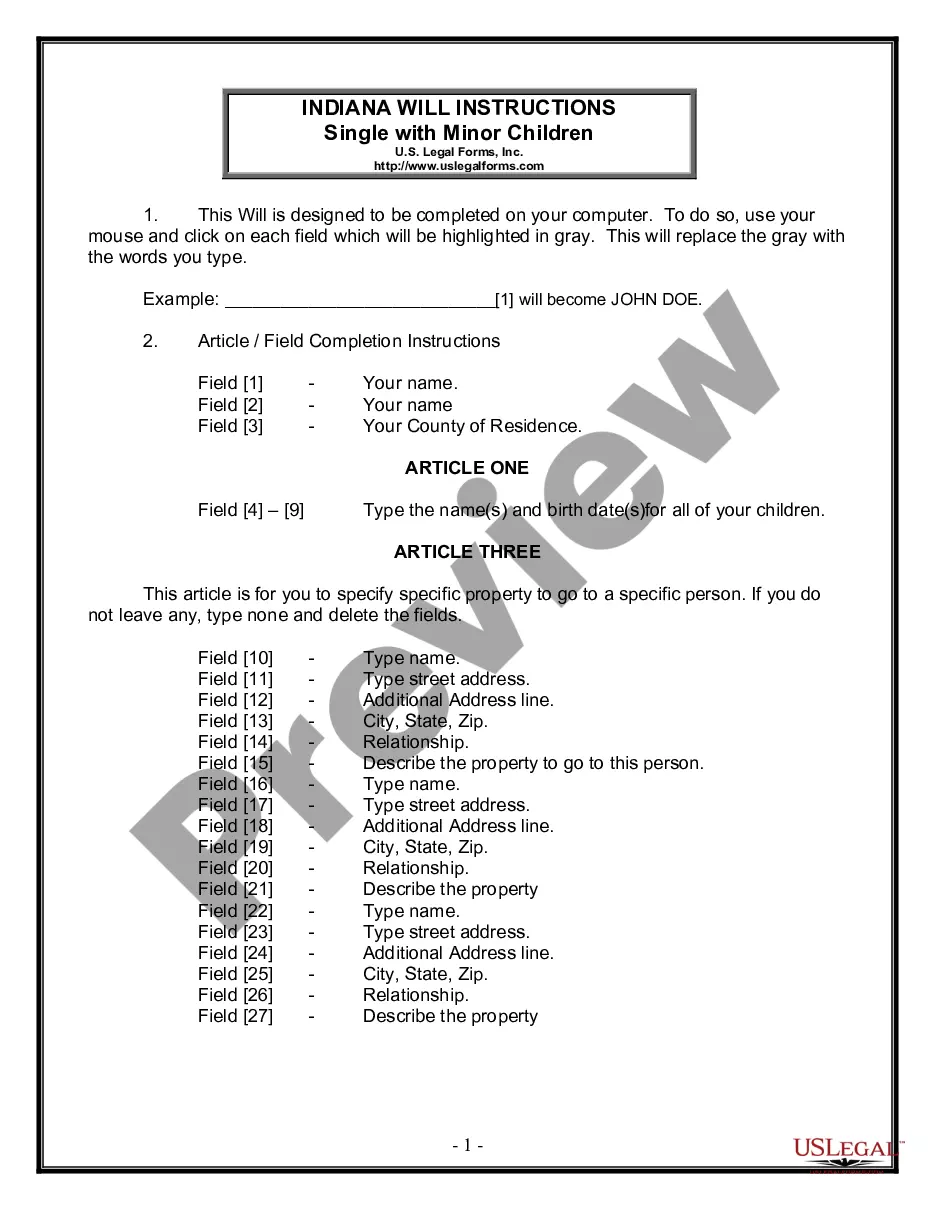

How to fill out New Hampshire Agreement For Withdrawal Of Partner From Active Management?

US Legal Forms - among the largest collections of legal documents in the United States - offers a selection of legal document templates you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by type, state, or keywords. You can find the latest editions of forms such as the New Hampshire Agreement for Withdrawal of Partner from Active Management in minutes.

If you hold a membership, Log In and download the New Hampshire Agreement for Withdrawal of Partner from Active Management from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Utilize your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your system. Make edits. Fill out, modify, print, and sign the downloaded New Hampshire Agreement for Withdrawal of Partner from Active Management. Every template added to your account does not have an expiration date and is yours indefinitely. So, if you want to download or print another copy, simply visit the My documents section and click on the form you need. Access the New Hampshire Agreement for Withdrawal of Partner from Active Management with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that suit your business or personal needs and requirements.

- Ensure you have chosen the correct form for your specific area/region.

- Click the Preview button to inspect the form’s content.

- Review the form description to make certain you have selected the appropriate form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Yes, a partner can withdraw from a partnership, but the process must be handled carefully. It is essential to consult the partnership agreement for any specific provisions regarding withdrawal. Creating a New Hampshire Agreement for Withdrawal of Partner from Active Management allows for a clear and legal withdrawal process. This written document can help to ensure that all partners are on the same page, minimizing the risk of misunderstandings.

To terminate a partner from a partnership, first, confirm the grounds for termination as defined in your partnership agreement. Following this, draft a New Hampshire Agreement for Withdrawal of Partner from Active Management, which should document the terms of the termination clearly. This agreement can specify what happens to the partner's stake, as well as any financial obligations to be settled. Seeking legal advice is also advisable to navigate any complexities that may arise.

Removing a partner from a partnership firm often involves a significant legal process. Start by consulting your partnership agreement for specific provisions regarding removal. Additionally, utilizing a New Hampshire Agreement for Withdrawal of Partner from Active Management can facilitate the process, clarifying the rights and obligations of the remaining partners. This detailed agreement helps avoid potential disputes and ensures a smooth transition.

Withdrawing a partner from a partnership firm requires a clear and structured approach. First, review your partnership agreement to understand the withdrawal process outlined. Next, you may need to create a New Hampshire Agreement for Withdrawal of Partner from Active Management, which outlines the terms of the withdrawal. This agreement ensures that all parties agree on the distribution of assets and responsibilities.

Dealing with a withdrawing partner can involve sensitive discussions regarding their contributions, responsibilities, and interests in the partnership. Open communication is crucial for a smooth transition, and the details should be documented carefully. A New Hampshire Agreement for Withdrawal of Partner from Active Management can provide a clear framework for addressing these important matters.

Changing partners in a partnership firm typically requires an agreement from all existing partners. The process may involve negotiations and possibly re-evaluating roles and responsibilities. A New Hampshire Agreement for Withdrawal of Partner from Active Management can formalize this change and ensure compliance with legal requirements.

Withdrawing a partner's interest can lead to changes in the current profit-sharing and management structure. The remaining partners need to address this matter promptly to ensure the partnership's continuity. A New Hampshire Agreement for Withdrawal of Partner from Active Management can effectively document this change and protect everyone's interests.

When a partner withdraws, it often impacts various aspects of the partnership's operations. The remaining partners must evaluate the business’s direction and the departing partner's contributions. Creating a New Hampshire Agreement for Withdrawal of Partner from Active Management can clarify the withdrawal's terms and minimize disputes.

When a partner leaves, the remaining partners face decisions regarding the business's future and structure. Responsibilities may shift, and the ownership arrangement could change. Utilizing a New Hampshire Agreement for Withdrawal of Partner from Active Management can help manage these changes effectively and maintain stability.

If a partner expresses a desire to leave the partnership, it is vital to have a clear strategy in place. The partnership should initiate discussions about the leaving partner's interests and responsibilities. A New Hampshire Agreement for Withdrawal of Partner from Active Management can streamline this process and set forth the terms for the exit.

Interesting Questions

More info

Org) Real Estate Agent Business Name Real Estate Brokerage LLC (RBI.