New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance

Description

How to fill out Employment Agreement Between General Agent As Employer And Salesperson - Sale Of Insurance?

If you want to retrieve, download, or print authorized document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Capitalize on the site’s user-friendly and efficient search function to locate the documents you require.

A selection of templates for business and personal use are categorized by types, states, or keywords.

Step 4. When you find the form you need, click on the Buy now button. Choose your preferred pricing plan and provide your details to create an account.

Step 6. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase. Step 7. Select the format of your legal form and download it to your device. Step 8. Complete, modify, and print or sign the New Hampshire Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance.

Every legal document template you purchase becomes your property for an extended period. You have access to all forms you have saved in your account. Click on the My documents section and choose a form to print or download again.

Be proactive and download and print the New Hampshire Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- Employ US Legal Forms to access the New Hampshire Employment Agreement between General Agent as Employer and Salesperson – Sale of Insurance with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then select the Download option to retrieve the New Hampshire Employment Agreement.

- You can also retrieve forms you have saved previously in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the guidelines below.

- Step 1. Confirm you have chosen the correct form for the appropriate city/state.

- Step 2. Use the Review feature to preview the form’s content. Be sure to read the details.

- Step 3. If you are dissatisfied with the form, employ the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

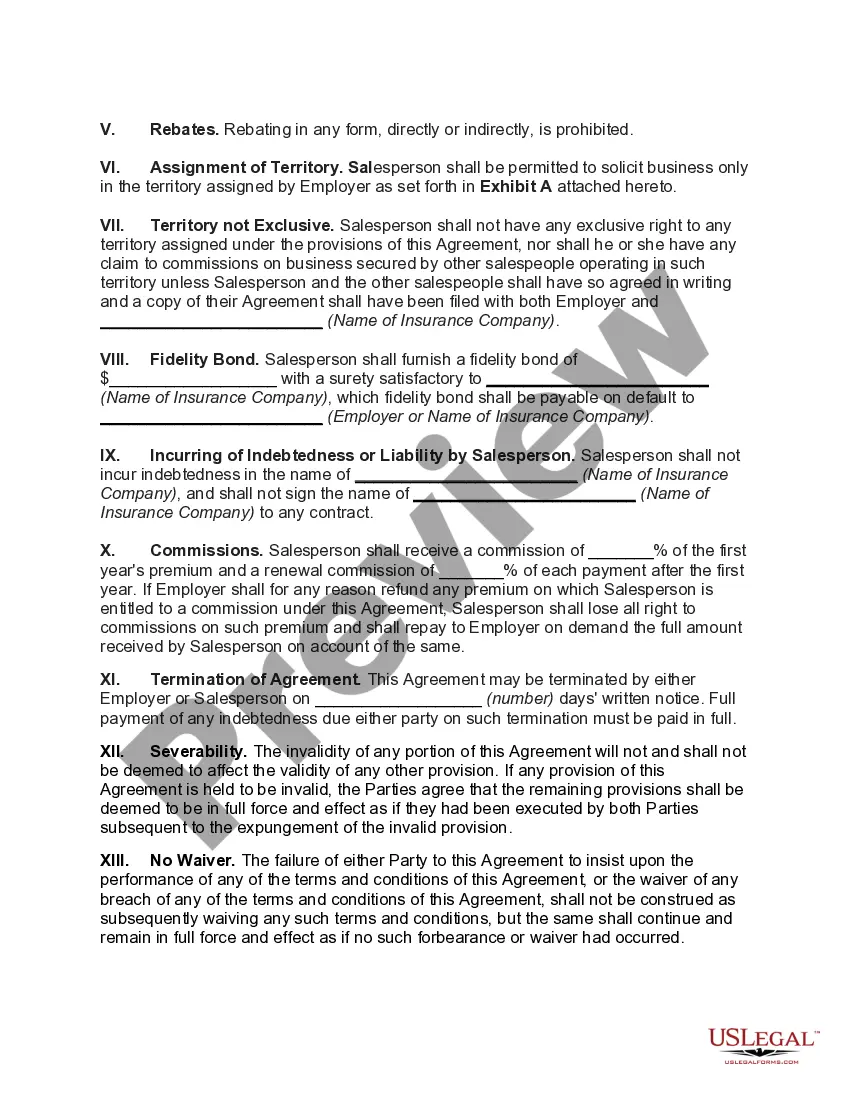

An agreement between an employer and employee details the job requirements, responsibilities, and benefits associated with the position. In a New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, this includes sales targets, expected behavior, and compensation plans. This type of agreement serves to align expectations and foster a positive work environment. Utilizing platforms like uslegalforms can simplify the creation of such agreements, ensuring they meet legal standards and address both parties' needs.

The contract of a salesperson outlines the relationship between the salesperson and the employer. In the context of a New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, this contract specifies duties, commission structures, and expectations. Such agreements help establish clarity regarding compensation and job responsibilities. By having a solid contract, both parties can avoid misunderstandings and ensure a smooth working relationship.

Yes, you can assign a contract to another party if the contract allows for such an assignment. With a New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, it's crucial to confirm the terms of assignment stated in the agreement. If the contract does not address assignments, seeking legal guidance through platforms like uslegalforms can help you navigate the process effectively.

Sharing an employment contract is generally legal, but it depends on the information included within the document. If a New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance contains confidential or sensitive details, sharing it without permission can lead to legal issues. It's best to consult a legal expert to understand the implications of sharing such agreements.

Certain contracts may contain clauses that expressly prohibit assignment. For instance, personal service contracts or agreements requiring specific skills typically cannot be assigned. In the case of a New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, any restrictions on assignment will be detailed within the contract itself. Always clarify these points before proceeding.

Yes, employment agreements can often be assigned to another party, provided the original agreement permits such action. When dealing with a New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, it is essential to verify if the contract specifies any restrictions or requirements for assignment. This precaution will help protect all parties involved.

Generally, you can assign an employment agreement, but it depends on the specific terms outlined within the contract. In the context of a New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance, it may contain clauses regarding assignment. Thus, it's crucial to review the agreement carefully or consult a legal professional to ensure compliance and avoid potential issues.

When a company is sold, existing employment contracts typically remain in effect unless they are explicitly terminated or modified. This means that the New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance generally continues to govern the relationship unless agreed otherwise. The new owner may choose to maintain these agreements, thereby ensuring stability for employees during the transition. Understanding these complexities is essential for both agents and salespersons alike.

Contract law in New Hampshire governs the legal principles that apply to agreements made between parties. This includes contracts like the New Hampshire Employment Agreement between General Agent as Employer and Salesperson - Sale of Insurance. Understanding this law is crucial for both employers and employees, as it dictates enforceability and remedies in case of a breach. Adhering to contract law helps protect both parties and promotes fair dealings.

The employment agreement in New Hampshire serves as a binding contract that outlines the terms agreed upon by the General Agent as Employer and the Salesperson in the Sale of Insurance. This agreement should include details on wages, benefits, and termination rights. Its purpose is to create a clear understanding between the two parties regarding their expectations. Such clarity helps maintain a positive working relationship and ensures compliance with state regulations.