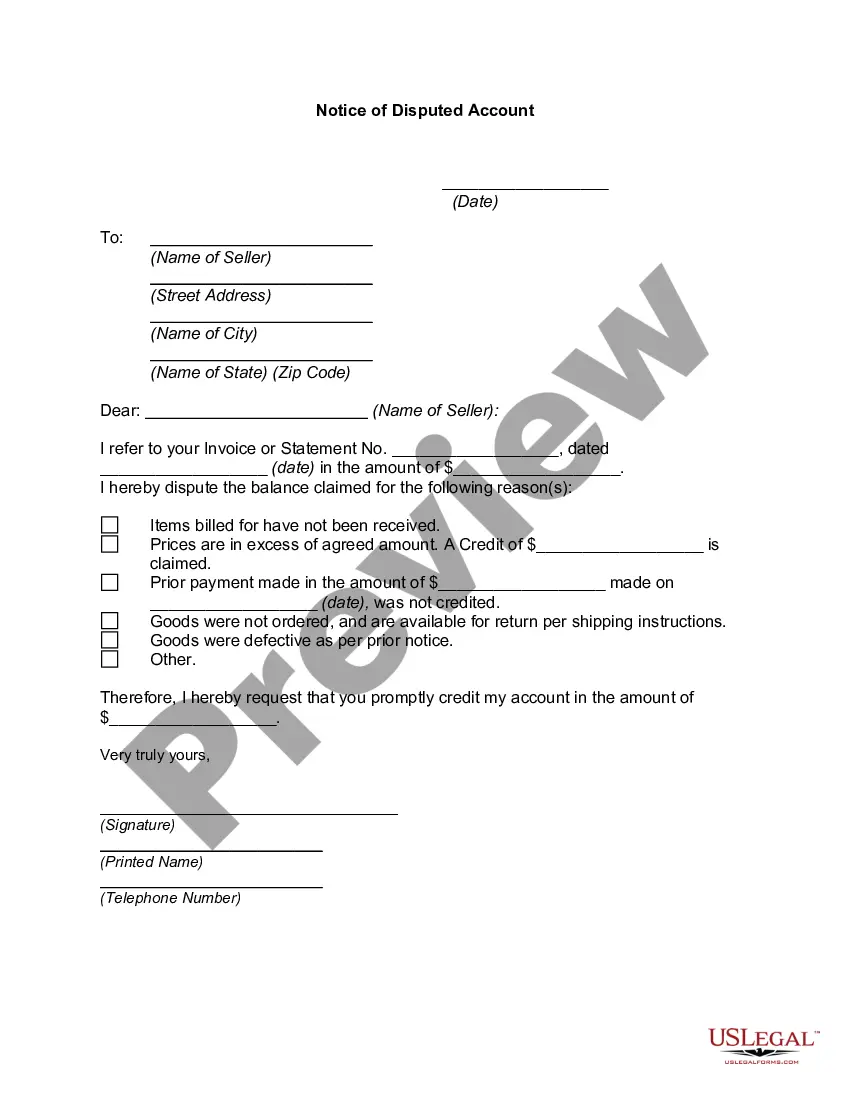

A New Hampshire Notice of Disputed Account is an official document that allows a consumer to challenge and dispute the accuracy of information reported by a creditor or debt collector. This notice is governed by the laws and regulations set forth by the Fair Debt Collection Practices Act (FD CPA) and the Fair Credit Reporting Act (FCRA). When a consumer encounters an item on their credit report that they believe is inaccurate or incomplete, they can send a New Hampshire Notice of Disputed Account to the appropriate party, such as the credit reporting agency (CRA) or the creditor. This notice informs them about the disputed information and requests an investigation into the matter. Key details to include in a New Hampshire Notice of Disputed Account are: 1. Consumer Information: The notice should contain the consumer's full name, current address, and contact details. Including their Social Security number and date of birth can help in accurately identifying the individual. 2. Account Information: The notice should specify which account(s) are being disputed. This includes the account name, number, and any relevant dates associated with the account. 3. Basis for Dispute: The consumer must clearly explain the reason(s) for disputing the account. Whether it is an incorrect balance, an inaccurate payment history, or unauthorized charges, the notice should highlight the specific issues observed by the consumer. 4. Supporting Documents: If available, the consumer should attach any relevant documents or evidence supporting their dispute. This may include payment receipts, credit statements, or correspondence with the creditor or collection agency. 5. Desired Action: The notice should state the desired outcome or action sought by the consumer. This could be updating or correcting the information, conducting an investigation, or removing the disputed item from their credit report. 6. Legal References: It can be beneficial to include citations to relevant laws and regulations, such as the FD CPA and FCRA, to assert the consumer's rights and ensure compliance by the recipient. While there may not be different types of New Hampshire Notice of Disputed Account, variations may arise depending on the intended recipient. For instance, if the notice is being sent to a credit reporting agency, it might follow specific guidelines provided by that agency. However, the core elements of the notice, as mentioned above, should remain consistent. In conclusion, a New Hampshire Notice of Disputed Account is a powerful tool that empowers consumers to challenge inaccuracies on their credit reports. This formal document helps ensure fair and accurate reporting while maintaining the consumer's rights under state and federal laws.

New Hampshire Notice of Disputed Account

Description

How to fill out New Hampshire Notice Of Disputed Account?

If you need extensive, obtain, or producing legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Utilize the site's straightforward and efficient search function to find the documents you need.

Numerous templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to access the New Hampshire Notice of Disputed Account with just a few clicks.

Every legal document template you purchase is yours indefinitely.

You will have access to every form you downloaded through your account. Navigate to the My documents section and select a form to print or download again.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to get the New Hampshire Notice of Disputed Account.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to explore other formats within the legal document category.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the New Hampshire Notice of Disputed Account.

Form popularity

FAQ

The four main types of alternative dispute resolution are mediation, arbitration, conciliation, and negotiation. Mediation involves a neutral mediator guiding the parties to find common ground, while arbitration entails a third party making a binding decision. These methods can be particularly beneficial for disputes involving a New Hampshire Notice of Disputed Account, as they allow for collaborative problem-solving and often lead to better relationships between the parties.

In New Hampshire, alternative dispute resolution includes several methods to settle disputes outside of the courtroom, such as mediation and arbitration. The state encourages these approaches to help reduce the burden on courts and provide a faster resolution for issues like a New Hampshire Notice of Disputed Account. By utilizing these methods, parties can address their disagreements constructively and reach satisfactory outcomes.

Alternative dispute resolution, or ADR, refers to methods used to resolve disputes without going to court. In simple terms, it provides options for parties to settle conflicts more amicably and efficiently. In situations involving a New Hampshire Notice of Disputed Account, ADR can facilitate a smoother resolution process, allowing both parties to express their concerns and reach an agreement without the stress of litigation.

To access your court records in New Hampshire, visit the official state court website or contact the local courthouse directly. You may need to provide details such as case numbers or personal information to facilitate your request. Many records are available online for convenience, while some may require in-person visits. If your records relate to disputes, like the New Hampshire Notice of Disputed Account, USLegalForms can streamline your process.

Filling out an affidavit example involves using a template that closely resembles your specific situation. Carefully follow the structure, filling in your details where needed while ensuring clarity and accuracy. Remember to adhere to any local laws regarding signatures and notarization. For establishing effective legal documents, including those related to the New Hampshire Notice of Disputed Account, USLegalForms serves as a helpful tool.

When completing an affidavit of financial information, first obtain the correct form from your legal advisor or an official website. Fill in details such as income, assets, and debts accurately to reflect your financial status. Ensure all necessary sections are completed and obtain a witness or notary signature if required. If you face complexities, especially with the New Hampshire Notice of Disputed Account, USLegalForms can provide valuable support.

To correctly fill out an affidavit of claim, begin by gathering all pertinent information related to the claim. Clearly outline your reasons for the claim and provide supporting evidence, such as contracts or receipts. Remember to sign, date, and notarize the document as required. For broader legal issues, including the New Hampshire Notice of Disputed Account, explore the assistance offered by USLegalForms.

Contesting a will in New Hampshire involves filing a complaint with the probate court. You must demonstrate valid grounds, such as lack of capacity or undue influence, when submitting your contest. Always follow the specific timelines and procedures set by the court. If you require help with documentation related to the New Hampshire Notice of Disputed Account, consider utilizing resources from USLegalForms.

To fill out an affidavit of financial support, start by downloading the appropriate form from a reliable source. Clearly state your financial details, including income sources and amounts, as well as any expenses. Make sure to include all necessary signatures and dates to ensure the document is valid. For assistance with related documents, such as the New Hampshire Notice of Disputed Account, you can use platforms like USLegalForms.

Filing a Motion for Reconsideration in NH involves identifying the legal grounds for your request. After drafting a clear motion, you must file it with the court, referencing your New Hampshire Notice of Disputed Account appropriately. Don't forget to include the required documentation and follow the court's filing procedures. Additionally, consider using platforms like USLegalForms to simplify the preparation process and ensure accuracy.