Title: Unleashing Generosity: New Hampshire Unrestricted Charitable Contribution of Cash Introduction: New Hampshire Unrestricted Charitable Contribution of Cash is a unique initiative that enables individuals and organizations to make meaningful financial donations to various charitable causes within the state. This program serves as a catalyst for philanthropy, fostering a culture of giving while promoting social welfare and enhancing the overall well-being of New Hampshire communities. In this article, we will explore the significance of unrestricted charitable contributions in New Hampshire, its impact, and the different types of programs available. Keywords: New Hampshire, unrestricted charitable contribution, cash, philanthropy, social welfare, community, donations, impact. 1. Importance of Unrestricted Charitable Contribution in New Hampshire: New Hampshire recognizes the critical role unrestricted charitable contributions play in supporting nonprofits and charitable organizations across the state. Unrestricted donations provide organizations with the flexibility to allocate funds where they are most needed, ensuring effective service delivery, sustainable operations, and the ability to respond to evolving community needs. Keywords: New Hampshire, unrestricted charitable contribution, nonprofits, organizations, flexibility, funds allocation, service delivery, community needs. 2. Positive Impact of Cash Contributions: The New Hampshire Unrestricted Charitable Contribution of Cash allows donors to provide financial support directly to nonprofits, foundations, community development programs, and other charitable initiatives. This unrestricted funding empowers organizations to carry out their missions efficiently, ensuring long-term sustainability and enabling them to amplify their impact throughout the community. Keywords: Cash contributions, financial support, nonprofits, foundations, community development, sustainability, impact, missions. 3. Different Types of New Hampshire Unrestricted Charitable Contribution of Cash: a. General Unrestricted Contributions: General unrestricted contributions refer to monetary donations made without any specific purpose or designation. Donors entrust organizations to utilize the funds according to their discretion, allowing them to allocate resources towards urgent needs, operational expenses, community programs, or strategic initiatives. Keywords: General unrestricted contributions, monetary donations, specific purpose, discretion, resources allocation, operational expenses, strategic initiatives. b. Annual Unrestricted Campaigns: Annual unrestricted campaigns are time-bound fundraising efforts wherein individuals, corporations, and foundations are encouraged to make cash contributions within a predetermined timeframe. Such campaigns often focus on raising unrestricted funds to fill gaps in essential services, drive innovation, and create sustainable solutions for pressing community issues. Keywords: Annual unrestricted campaigns, fundraising efforts, individuals, corporations, foundations, cash contributions, predetermined timeframe, essential services, innovation, sustainable solutions, community issues. c. Endowment Funds: Endowment funds are long-term investment vehicles where cash contributions are held in perpetuity. These funds generate income through investments, which is then used to support charitable activities on a regular basis. Donors can create endowment funds to establish a lasting impact and ensure the sustained growth and stability of nonprofits and organizations. Keywords: Endowment funds, long-term investments, cash contributions, perpetual holding, income generation, charitable activities, lasting impact, sustained growth, stability. Conclusion: The New Hampshire Unrestricted Charitable Contribution of Cash program is a vital mechanism for driving social change and empowering nonprofits in the state. By offering various options such as general unrestricted contributions, annual campaigns, and endowment funds, the program ensures that financial support reaches where it is most needed, enabling organizations to make a lasting difference in the lives of individuals and communities. Keywords: New Hampshire, unrestricted charitable contribution, cash program, social change, nonprofits, financial support, general unrestricted contributions, annual campaigns, endowment funds, lasting difference.

New Hampshire Unrestricted Charitable Contribution of Cash

Description

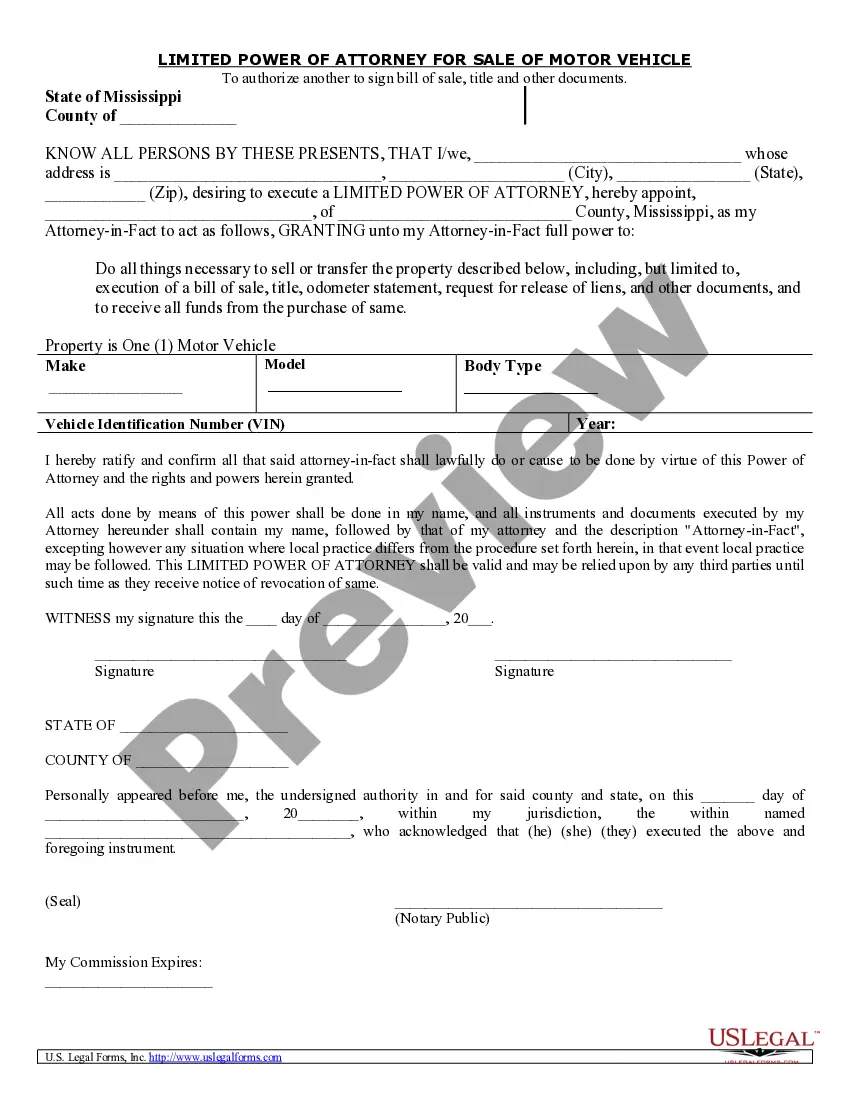

How to fill out New Hampshire Unrestricted Charitable Contribution Of Cash?

If you need to comprehensive, download, or printing authorized papers templates, use US Legal Forms, the largest variety of authorized varieties, that can be found on-line. Take advantage of the site`s simple and hassle-free lookup to obtain the files you need. Numerous templates for enterprise and individual functions are categorized by types and says, or key phrases. Use US Legal Forms to obtain the New Hampshire Unrestricted Charitable Contribution of Cash within a number of mouse clicks.

If you are presently a US Legal Forms consumer, log in for your profile and click the Obtain key to find the New Hampshire Unrestricted Charitable Contribution of Cash. You can even access varieties you earlier delivered electronically in the My Forms tab of the profile.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for the appropriate area/country.

- Step 2. Use the Review option to look over the form`s content material. Do not neglect to learn the information.

- Step 3. If you are unsatisfied with all the form, take advantage of the Lookup discipline towards the top of the display to discover other variations in the authorized form web template.

- Step 4. Once you have identified the form you need, go through the Acquire now key. Choose the rates plan you prefer and put your credentials to register for an profile.

- Step 5. Process the deal. You can utilize your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Choose the format in the authorized form and download it in your device.

- Step 7. Complete, revise and printing or signal the New Hampshire Unrestricted Charitable Contribution of Cash.

Every authorized papers web template you buy is the one you have forever. You have acces to every single form you delivered electronically within your acccount. Go through the My Forms section and decide on a form to printing or download yet again.

Be competitive and download, and printing the New Hampshire Unrestricted Charitable Contribution of Cash with US Legal Forms. There are thousands of expert and express-particular varieties you can use for your personal enterprise or individual requires.

Form popularity

FAQ

Any donations worth $250 or more must be recognized with a receipt. The charity receiving this donation must automatically provide the donor with a receipt. As a general rule a nonprofit organization should NOT place a value on what is donated (that is the responsibility of the donor).

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity. It must include the amount of cash you donated, whether you received anything from the charity in exchange for your donation, and an estimate of the value of those goods and services.

A charitable contribution is a donation or gift to, or for the use of, a qualified organization. It is voluntary and is made without getting, or ex- pecting to get, anything of equal value. Qualified organizations.

Cash or property donations worth more than $250: The IRS requires you to get a written letter of acknowledgment from the charity. It must include the amount of cash you donated, whether you received anything from the charity in exchange for your donation, and an estimate of the value of those goods and services.

Overview. Donations to 501(c)(3) nonprofits are tax-deductible. This means that when you make a contribution to an organization that has been designated as a 501(c)(3) by the IRS and you have not received anything in return for your gift, you are eligible for a deduction when you file your taxes.

For any contribution of $250 or more (including contributions of cash or property), you must obtain and keep in your records a contemporaneous written acknowledgment from the qualified organization indicating the amount of the cash and a description of any property contributed.

For the 2021 tax year, single nonitemizers can again deduct up to $300 in cash donations to qualifying charities. The 2021 deduction for married couples who take the standard deduction has increased; they can deduct up to $600 of cash contributions.

Rules Around Donation Tax Receipts The IRS considers each donation separately. It doesn't matter whether the donation to one organization reaches the $250 limit.

Yes, you may still qualify for the charitable donations deduction without a donation receipt. However, there are certain specifications around the donation, including cash limits and type of donation.