New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation

Description

How to fill out Conflict Of Interest Disclosure For Member Of Board Of Directors Of Corporation?

Are you presently in a circumstance where you frequently require documents for both business or personal reasons.

There are numerous authentic template documents available online, but finding dependable ones is not straightforward.

US Legal Forms provides thousands of document templates, such as the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation, designed to comply with federal and state regulations.

Select the pricing plan you want, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient file format and download your version.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for your specific city/state.

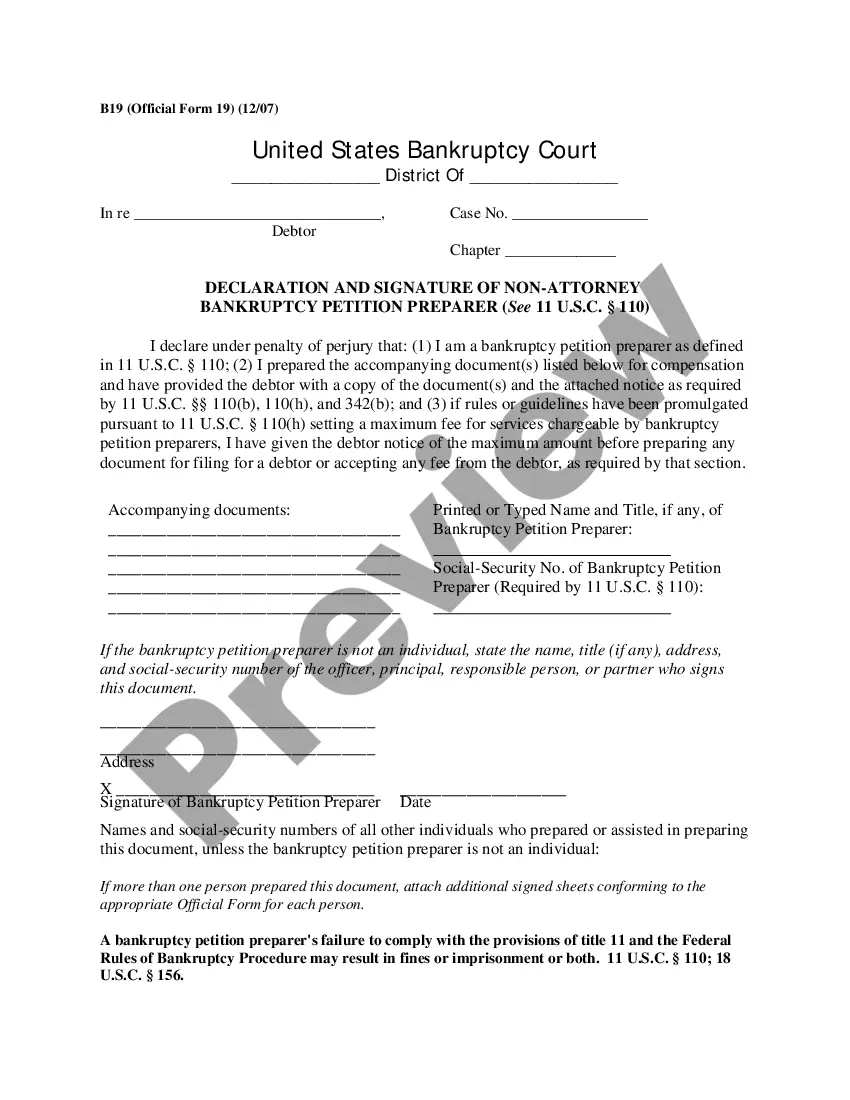

- Use the Review button to examine the form.

- Read the description to ensure you have selected the correct document.

- If the document is not what you're looking for, use the Lookup field to find the template that suits your needs and requirements.

- When you find the correct template, click Buy now.

Form popularity

FAQ

The four types of conflict of interest include personal conflict, financial conflict, professional conflict, and contractual conflict. Each type can impact a board member's decision-making and the corporation's operations. Understanding these conflicts is essential for ensuring compliance with the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation. By recognizing and addressing these issues, boards can create a fair and unbiased environment for all stakeholders.

If a conflict of interest arises, the affected board member must immediately disclose the situation to the board. The New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation outlines that the board should evaluate the claim and take appropriate action. This may involve abstaining from discussions or decisions related to the issue. By addressing conflicts promptly and openly, the board can uphold ethical standards and protect the corporation's integrity.

The board policy on conflict of interest aims to ensure transparency and integrity within the organization. Under the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation, directors must disclose any personal interests that could affect their decisions. This policy helps maintain trust among members and safeguards the corporation's interests. It is crucial for each board member to understand and adhere to these guidelines to prevent potential conflicts.

A Form 990 conflict of interest refers to the section within the Form 990 tax return where organizations disclose any conflicts involving board members. This is crucial for compliance with regulations and is part of the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation. By accurately reporting these conflicts, organizations demonstrate transparency and responsibility to donors and stakeholders. US Legal Forms can assist you in correctly assessing and documenting this information.

A board member conflict of interest form is a document that members must fill out to disclose any conflicts they may have. This form is integral to the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation, ensuring that potential conflicts are identified and managed. This proactive approach helps uphold ethical governance standards within the organization. To simplify this process, you can find customizable forms on the US Legal Forms platform.

If a board member has a conflict of interest, the first step is to ensure they disclose the matter according to the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation. The board should then discuss the conflict openly, allowing the member to recuse themselves from related decisions. It is crucial to document these actions to promote transparency and trust among the board and stakeholders alike. Utilizing the resources provided by US Legal Forms can help guide this process.

A board declaration of conflict of interest is a formal statement that board members must complete to disclose any personal interests that might influence their decisions. This declaration is an essential component of the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation. It helps maintain ethical standards within the board, protecting both the organization's integrity and its members. US Legal Forms offers templates to simplify this declaration process for boards.

Dealing with conflict of interest on a board requires a clear understanding of the policies and procedures in place. Members should disclose any potential conflicts as per the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation. Open discussions can help address concerns, and keeping transparent records ensures accountability. Utilizing resources like US Legal Forms can provide the necessary forms and guidelines to navigate these situations effectively.

The form for board members' conflict of interest typically includes sections for personal information, a description of the potential conflict, and signatures. It is essential to ensure that this form is completed accurately and submitted on time. Utilizing resources like the US Legal Forms platform can streamline the process for the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation.

To write a declaration of conflict of interest, start by clearly stating your name and board position. Follow with a detailed account of any personal, financial, or professional ties that could compromise your decisions. This declaration should align with the New Hampshire Conflict of Interest Disclosure for Member of Board of Directors of Corporation requirements.