New Hampshire Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits: In New Hampshire, employment opportunities for executives come with attractive compensation packages, including a combination of salary, stock dividends, and retirement benefits. Executives in this state can enjoy a variety of perks, ensuring both financial security and long-term growth. Salary: As part of their overall compensation, executives in New Hampshire receive a competitive salary commensurate with their experience, expertise, and the responsibilities they undertake. These salaries are typically higher than those of non-executive employees and are reflective of their leadership roles within the organization. Cash Equivalent to Stock Dividends: Executives in New Hampshire often receive compensation in the form of stock dividends. This means that in addition to their regular salary, they are entitled to a portion of the profits generated by the company. These dividends are paid out in cash equivalents, further bolstering their overall income and incentivizing long-term commitment to the organization's growth and success. Retirement Benefits: New Hampshire companies recognize the value of providing secure retirement benefits to their executives. These benefits ensure that executives can retire with financial stability and peace of mind. Retirement benefits often include contribution plans such as 401(k) or pension plans, where the company contributes a portion of the executive's salary towards their retirement fund. This investment helps executives build a sizeable nest egg for when they decide to retire, laying the foundation for a comfortable and fulfilling post-employment life. Types of New Hampshire Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits: 1. CEO (Chief Executive Officer): Chief Executive Officers hold the highest-ranking executive role in an organization and are responsible for making major strategic decisions. They receive a competitive salary, along with stock dividends and robust retirement benefits. Their compensation packages are designed to attract top talent and reward their leadership in driving the company's success. 2. CFO (Chief Financial Officer): Chief Financial Officers oversee a company's financial operations, including financial planning, budgeting, and reporting. They are compensated with a salary that reflects their expertise in managing the organization's finances. Additionally, they may receive stock dividends and retirement benefits that align with their contributions to financial growth and stability. 3. CIO (Chief Information Officer): Chief Information Officers are responsible for overseeing a company's technology and information systems. Their compensation typically includes a substantial salary, stock dividends, and retirement benefits. Their vital role in ensuring the efficient functioning of a company's IT infrastructure warrants a comprehensive compensation package. 4. Vice Presidents and Directors: Vice Presidents and Directors hold critical leadership positions within various departments, such as marketing, operations, or human resources. They receive a combination of salary, stock dividends, and retirement benefits that reflect their responsibilities and contributions to the company's success. In summary, New Hampshire offers a range of executive employment opportunities with enticing compensation packages, including salary, stock dividends, and retirement benefits. Executives play vital roles in driving organizational growth, and these rewarding packages are designed to attract top talent and provide financial security for their future.

New Hampshire Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits

Description

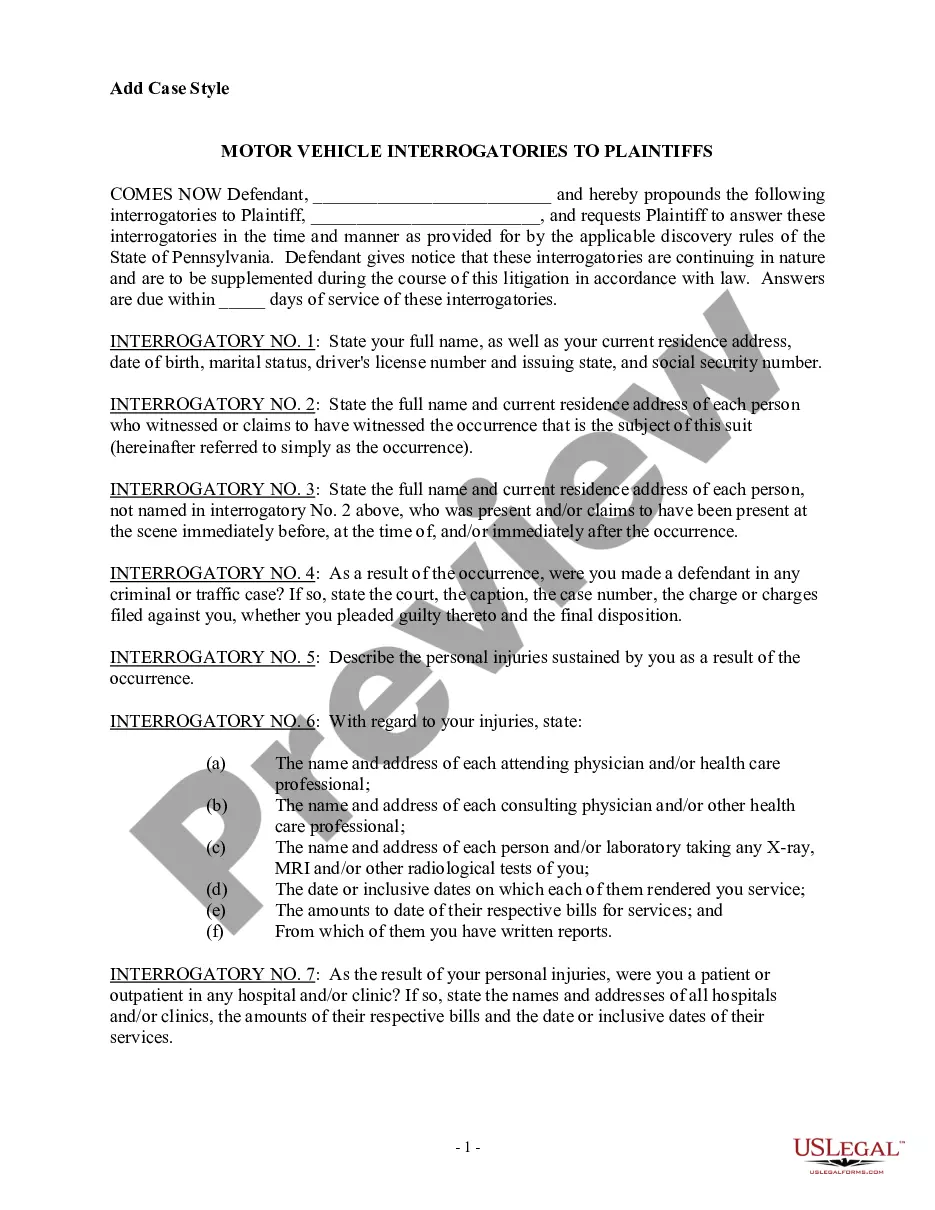

How to fill out New Hampshire Employment Of Executive With Salary Plus Cash Equivalent To Stock Dividends And Retirement Benefits?

Choosing the right lawful file format can be a have a problem. Naturally, there are a variety of themes available on the Internet, but how will you discover the lawful kind you want? Take advantage of the US Legal Forms web site. The support gives a large number of themes, such as the New Hampshire Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits, which you can use for company and personal requirements. All of the forms are checked out by experts and satisfy federal and state needs.

In case you are presently listed, log in for your profile and click the Acquire key to find the New Hampshire Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits. Make use of your profile to appear with the lawful forms you might have bought earlier. Check out the My Forms tab of your profile and acquire an additional copy of the file you want.

In case you are a fresh user of US Legal Forms, here are straightforward guidelines for you to comply with:

- Initially, make certain you have selected the proper kind to your area/area. You can look over the form making use of the Review key and look at the form description to guarantee it is the right one for you.

- In the event the kind is not going to satisfy your preferences, use the Seach discipline to obtain the right kind.

- When you are certain that the form is proper, click on the Buy now key to find the kind.

- Choose the costs program you need and enter the needed info. Design your profile and pay for the transaction utilizing your PayPal profile or bank card.

- Select the data file format and obtain the lawful file format for your gadget.

- Complete, revise and produce and sign the acquired New Hampshire Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits.

US Legal Forms is definitely the largest catalogue of lawful forms where you can discover numerous file themes. Take advantage of the service to obtain skillfully-produced documents that comply with express needs.

Form popularity

FAQ

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax. Homeowners in New Hampshire pay some of the highest average effective property tax rates in the country.

In New Hampshire, the new employer SUI (state unemployment insurance) rate is 2.3% on the first $14,000 of wages for each employee. Employers are also charged a surcharge tax called the Administrative Contribution (AC) rate, which is 0.4% for a total contribution of 2.7%.

For retirement accounts, stock dividends are not taxed. In a non-retirement account, qualified dividends are taxed at long-term capital gains rates depending on your tax bracket (federal rates are 0%, 15%, or 20%), while non-qualified dividends are taxed at ordinary income rates just like regular income.

A. The New Hampshire new employer tax rate is 2.7% (UI Rate: 2.3% / AC Rate: 0.4%).

Taxable income is the portion of your gross income that the IRS deems subject to taxes. It consists of both earned and unearned income. Taxable income is generally less than adjusted gross income because of deductions that reduce it.

The New Hampshire new employer tax rate is 2.7% (UI Rate: 2.3% / AC Rate: 0.4%).

Moreover, New Hampshire also has separate, state-based payroll taxes of 1.7%. Unemployment insurance (1.5%) and administrative contribution (0.2%, also known as the AC rate) comprise this New Hampshire payroll tax.

Income Tax Range: New Hampshire doesn't have an income tax. However, currently there's a 5% tax on dividends and interest in excess of $2,400 for individuals ($4,800 for joint filers). The tax on dividends and interest is being phased out. The rate will be 4% for 2023, 3% for 2024, 2% for 2025, and 1% for 2026.

The minimum earnings required for eligibility are $2800 ($1400 each in 2 separate quarters), which would result in a $32 weekly benefit amount. The more earnings in your base period, the higher your weekly benefit amount, to a maximum of $427 for $41,500 or more in earnings.

NH employees do not pay any taxes for the unemployment program.