New Hampshire Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status

Description

How to fill out Charitable Trust With Creation Contingent Upon Qualification For Tax Exempt Status?

You might spend multiple hours online searching for the legitimate document template that complies with the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that have been vetted by professionals.

You can easily download or print the New Hampshire Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status from the service.

First, ensure that you have selected the correct document template for your chosen region/city. Review the form description to confirm you have the right one. If available, use the Preview button to view the document template as well.

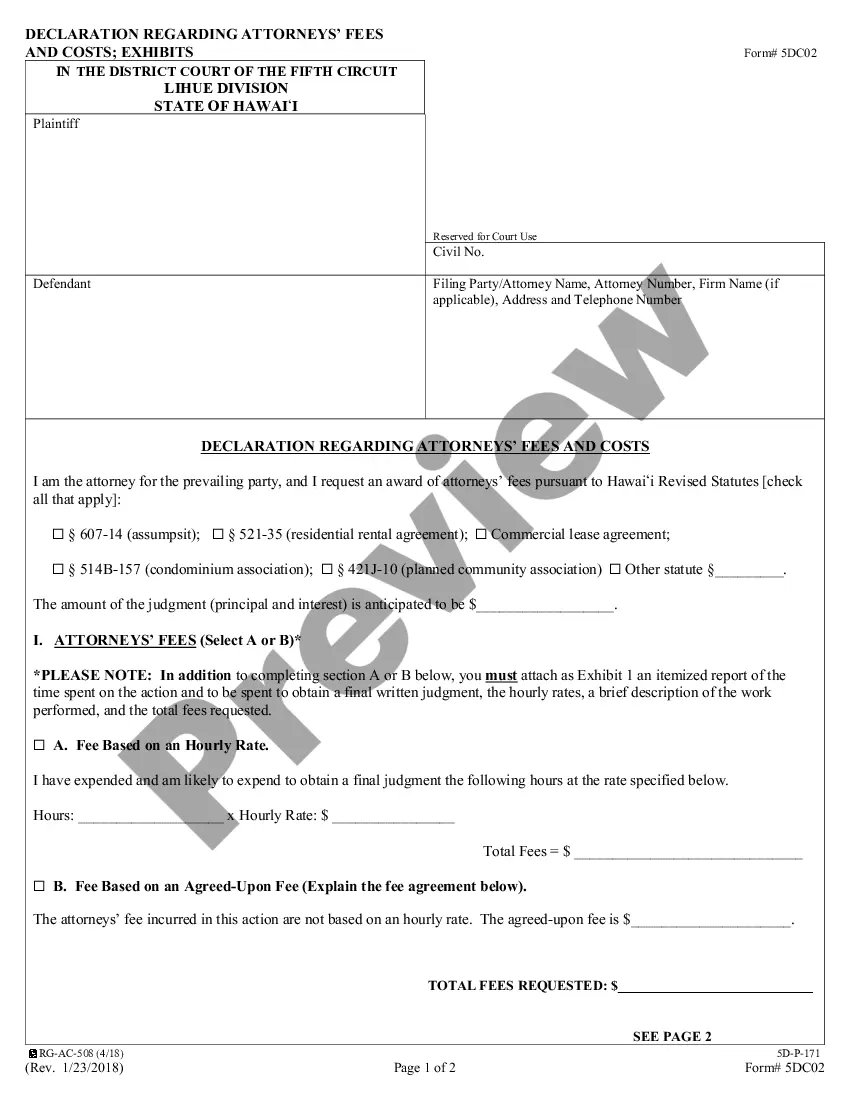

- If you already have a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can complete, modify, print, or sign the New Hampshire Charitable Trust with Creation Contingent upon Qualification for Tax Exempt Status.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

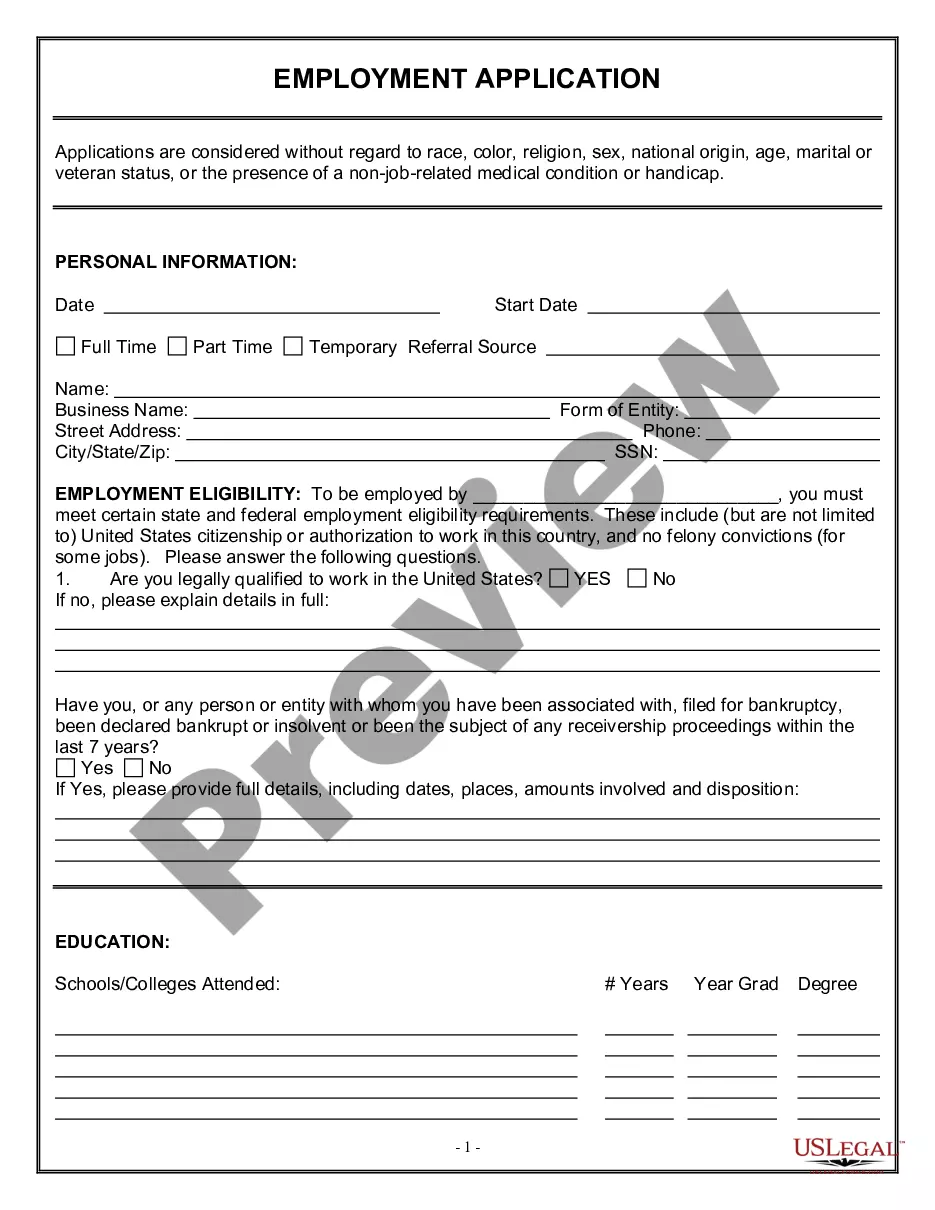

How to Start a Nonprofit in New HampshireName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

Tax information for charitable, religious, scientific, literary, and other organizations exempt under Internal Revenue Code ("IRC") section 501(c)(3). Information, explanations, guides, forms, and publications available on irs.gov for tax-exempt social welfare organizations.

Organizations organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, educational, or other specified purposes and that meet certain other requirements are tax exempt under Internal Revenue Code Section 501(c)(3).

Exemption Requirements - 501(c)(3) Organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

IRS 557 provides details on the different categories of nonprofit organizations. Public charities, foundations, social advocacy groups, and trade organizations are common types of nonprofit organization. Any profits generated by these organizations is not distributed to shareholders or owners.

The IRS groups the 501(c)(9), 501(c)(4), and 501(c)(17) together when the latter two are employees' associations.

For the purposes of PSLF, eligible not-for-profit organizations include a organizations that are tax exempt under section 501(c)(3) of the Internal Revenue Code (IRC), or other not-for-profit organizations that provide a qualifying service.

There are two broad categories of nonprofit organizations: charitable nonprofits, as described under Section 501(c)(3) of the Internal Revenue Code, and service or membership organizations formed under other subparagraphs of Section 501(c).

Exempt Organization TypesCharitable Organizations.Churches and Religious Organizations.Private Foundations.Political Organizations.Other Nonprofits.

A charitable trust is a trust which you establish to distribute assets to a charity. A charitable remainder trust distributes assets to named beneficiaries first, then distributes any remaining assets to charity.