New Hampshire Equipment Lease with Lessor to Purchase Equipment Specified by Lessee is a contract agreement that allows individuals or businesses in New Hampshire to acquire necessary equipment for their operations without the immediate financial burden of purchasing the equipment outright. This type of lease provides lessees with the option to eventually purchase the leased equipment for a predetermined price, usually at the end of the lease term or through a buyout option. Keywords: New Hampshire, Equipment Lease, Lessor, Purchase Equipment, Lessee. Different types of New Hampshire Equipment Lease with Lessor to Purchase Equipment Specified by Lessee may include: 1. Commercial Equipment Lease: This type of lease is commonly used by businesses to lease various types of equipment required for their day-to-day operations. It can include equipment like construction machinery, office equipment, medical devices, or vehicles. 2. Industrial Equipment Lease: This lease is designed specifically for lessees who require industrial-grade equipment for manufacturing, production, or heavy-duty purposes. It may involve leasing machinery, specialized tools, or large-scale equipment used in industries like manufacturing, agriculture, or energy. 3. Technology Equipment Lease: This type of lease is focused on providing lessees with up-to-date technology and computer equipment necessary for their business operations. It can include leases for laptops, servers, software, or telecommunications equipment. 4. Medical Equipment Lease: Healthcare providers often require advanced medical equipment but may face budget constraints. This lease enables them to acquire medical devices, imaging systems, diagnostic tools, or other equipment needed for patient care. 5. Construction Equipment Lease: Leasing construction equipment is common for contractors, builders, or construction companies. This type of lease allows lessees to acquire heavy machinery, excavation tools, cranes, or other equipment required for construction projects. Whether you are a small startup, a growing business, or an established corporation, a New Hampshire Equipment Lease with Lessor to Purchase Equipment Specified by Lessee offers a flexible and cost-effective way to obtain necessary equipment without a significant upfront investment. It allows lessees to conserve capital, benefit from the latest technology, and explore ownership options in the future, all tailored to their specific business needs in New Hampshire.

New Hampshire Equipment Lease with Lessor to Purchase Equipment Specified by Lessee

Description

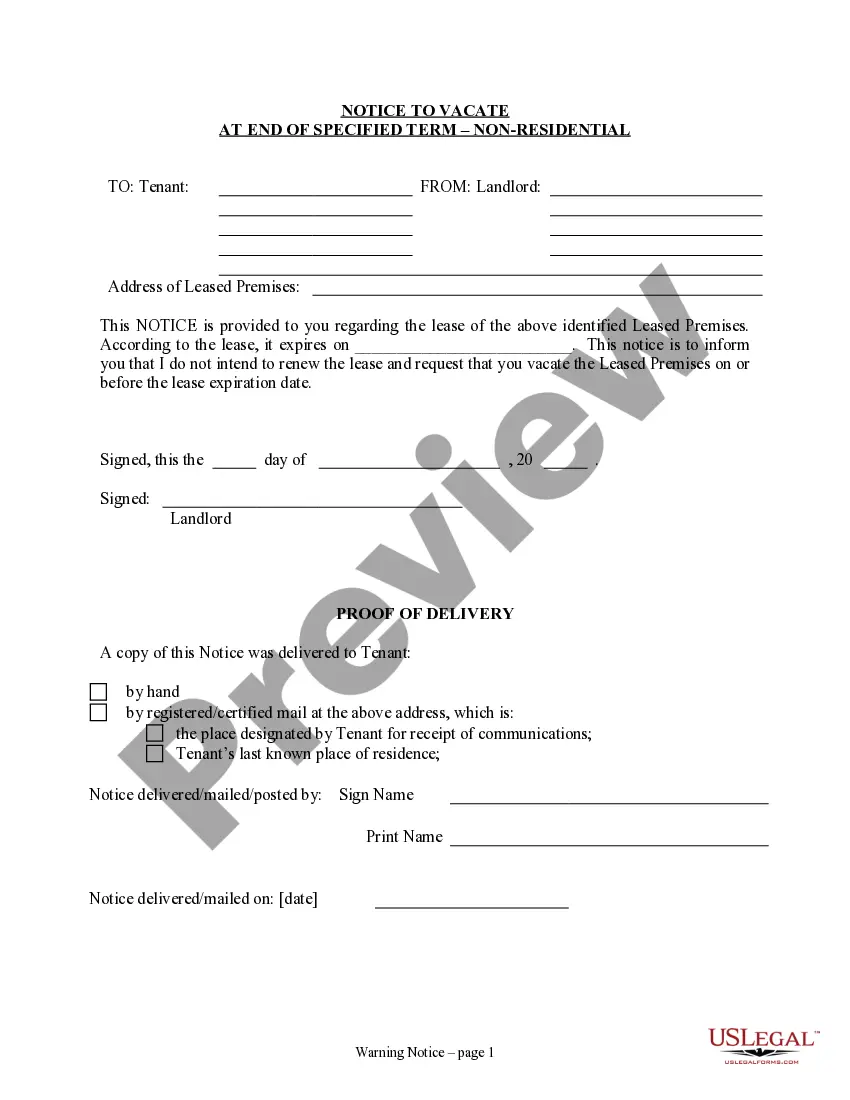

How to fill out New Hampshire Equipment Lease With Lessor To Purchase Equipment Specified By Lessee?

Finding the right legitimate record design can be a struggle. Naturally, there are plenty of layouts available online, but how would you get the legitimate kind you need? Make use of the US Legal Forms site. The service offers thousands of layouts, for example the New Hampshire Equipment Lease with Lessor to Purchase Equipment Specified by Lessee, which you can use for organization and personal requirements. Every one of the kinds are examined by pros and meet up with federal and state requirements.

When you are previously authorized, log in to the account and click on the Down load switch to have the New Hampshire Equipment Lease with Lessor to Purchase Equipment Specified by Lessee. Utilize your account to look through the legitimate kinds you possess purchased earlier. Check out the My Forms tab of your account and acquire an additional version in the record you need.

When you are a brand new customer of US Legal Forms, here are simple instructions so that you can comply with:

- Initial, be sure you have selected the proper kind for your personal metropolis/region. It is possible to check out the shape using the Preview switch and look at the shape information to make sure it is the best for you.

- In the event the kind is not going to meet up with your expectations, take advantage of the Seach field to discover the proper kind.

- When you are certain the shape is proper, click the Purchase now switch to have the kind.

- Pick the rates plan you would like and enter in the essential info. Create your account and pay for your order using your PayPal account or bank card.

- Choose the document file format and download the legitimate record design to the product.

- Complete, change and print out and sign the received New Hampshire Equipment Lease with Lessor to Purchase Equipment Specified by Lessee.

US Legal Forms is definitely the most significant catalogue of legitimate kinds where you can find a variety of record layouts. Make use of the service to download appropriately-made papers that comply with state requirements.

Form popularity

FAQ

The three most common types of leases are gross leases, net leases, and modified gross leases.The Gross Lease. The gross lease tends to favor the tenant.The Net Lease. The net lease, however, tends to favor the landlord.The Modified Gross Lease.

Various Types of Lease: Finance, Operating, Direct, LeveragedVarious Types of Lease.(1) Finance lease :(2) Operating lease :(3) Sale and lease back :(4) Direct lease :(5) Single investor lease :(6) Leveraged lease :(7) Domestic Lease :More items...

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Key TakeawaysCapital leases transfer ownership to the lessee while operating leases usually keep ownership with the lessor. For accounting purposes, short-term leases under 12 months in length are treated as expenses and longer-term leases are capitalized as assets.

The three main types of leasing are finance leasing, operating leasing and contract hire.

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

Step 1: The lessee selects an asset that they require for a business. Step 2: The lessor, usually a finance company, purchases the asset. Step 3: The lessor and lessee enter into a legal contract in which the lessee will have use of the asset during the agreed upon lease.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

Almost Any Type Of Equipment Can Be LeasedManufacturing and Production Equipment.Construction Equipment (cranes, tractors, forklifts, machine tools)Energy Equipment, HVAC, and Lighting.Heavy Machinery.Transportation Equipment (trailers, delivery vehicles)Refuse Trucks and Equipment.More items...

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...