The New Hampshire Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a type of trust designed to provide financial security for a surviving spouse while allowing the trust or to maintain control over the distribution of assets upon their death. In this trust arrangement, a single individual, known as the trust or, creates a trust and names their spouse as the beneficiary. The trust or also designates a trustee to manage the trust's assets and oversee its administration. The primary purpose of this trust is to take advantage of the marital deduction, which allows assets to be transferred between spouses without incurring any immediate federal estate tax liability. By utilizing this deduction, the trust or can ensure that their estate is not subject to unnecessary taxation upon their passing. Furthermore, the trust provides the surviving spouse with income for the rest of their life. The trust or can specify the terms and conditions under which income is distributed, such as regular monthly or annual payments. This provision ensures that the surviving spouse has a stable source of funds to support their lifestyle even after the trust or's death. A crucial feature of this trust is the power of appointment granted to the beneficiary spouse. This power allows the surviving spouse to determine how the remaining trust assets will be distributed upon their death. They have the freedom to allocate the assets to their own heirs or beneficiaries according to their wishes, ensuring that the trust or's intended legacy is carried out. Different variations of the New Hampshire Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse may include specific provisions for: 1. Charitable Remainder Trust: This type of trust enables the beneficiary spouse to designate a charity or charitable organization as the recipient of the trust's remaining assets upon their death, furthering philanthropic efforts in alignment with the trust or's values. 2. Testamentary Trust: In this case, the trust is created and funded through the trust or's will upon their death. It allows the trust or to have control over the distribution of assets after their passing while providing adequate financial support to the beneficiary spouse during their lifetime. 3. Dynasty Trust: A dynasty trust is designed to continue in perpetuity, benefiting multiple generations of the trust or's family. The trust or can include provisions that limit the beneficiary spouse's power of appointment, ensuring that the trust assets remain within the family bloodline while providing lifetime income to the surviving spouse. Overall, the New Hampshire Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse offers individuals a comprehensive estate planning solution, combining tax-efficient wealth transfer with ongoing financial support for their spouse. The trust or has the flexibility to tailor the trust's provisions to meet their specific goals and needs, ensuring the protection and preservation of their assets for generations to come.

New Hampshire Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out New Hampshire Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

US Legal Forms - one of several most significant libraries of lawful kinds in the States - provides a variety of lawful document web templates you can download or print. Utilizing the internet site, you can find a huge number of kinds for enterprise and individual purposes, sorted by categories, suggests, or search phrases.You will find the newest versions of kinds just like the New Hampshire Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse within minutes.

If you already have a registration, log in and download New Hampshire Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse from the US Legal Forms collection. The Acquire option will appear on every single kind you perspective. You have access to all previously saved kinds inside the My Forms tab of the account.

If you want to use US Legal Forms the first time, listed below are easy guidelines to get you started off:

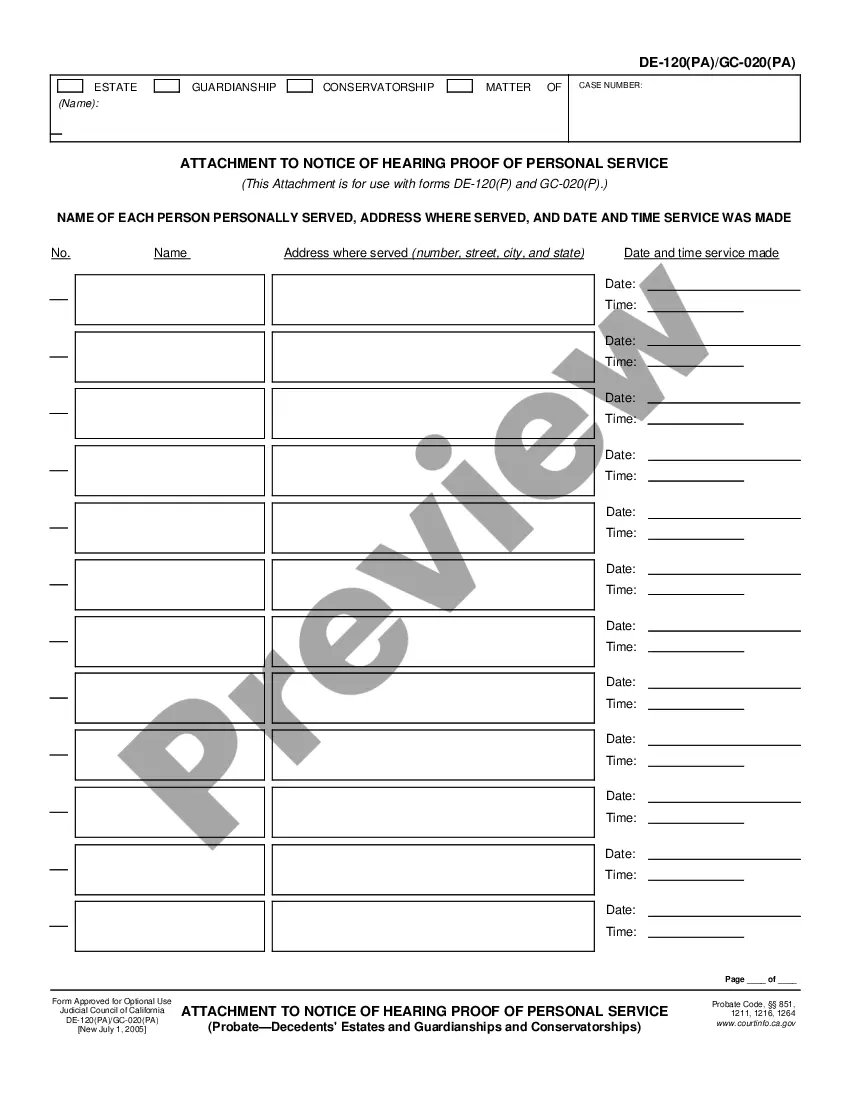

- Be sure to have chosen the proper kind for your personal city/area. Select the Preview option to analyze the form`s content material. Read the kind description to actually have selected the right kind.

- When the kind doesn`t suit your specifications, take advantage of the Research industry on top of the display screen to obtain the one which does.

- When you are content with the form, confirm your decision by visiting the Buy now option. Then, opt for the prices plan you prefer and provide your references to sign up on an account.

- Procedure the financial transaction. Make use of bank card or PayPal account to finish the financial transaction.

- Pick the formatting and download the form on your gadget.

- Make adjustments. Load, modify and print and sign the saved New Hampshire Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Every format you included with your bank account does not have an expiration day and is yours eternally. So, if you wish to download or print another backup, just go to the My Forms portion and click about the kind you require.

Get access to the New Hampshire Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse with US Legal Forms, probably the most considerable collection of lawful document web templates. Use a huge number of skilled and condition-certain web templates that meet your organization or individual needs and specifications.

Form popularity

FAQ

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.

A Marital Trust is an irrevocable trust that allows for estate tax deferral and possibly elimination. On the other hand, a family trust is generally revocable and will not achieve the same estate tax benefits.

The first trust (the ?marital? trust) is for the surviving spouse, and the second trust (the ?bypass? or ?residual? trust) is typically for the couple's heirs. The surviving spouse can access the residual trust or receive income from it during their lifetime, but it does not belong to them.

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

A QTIP trust offers more control to the grantor but less control to the surviving spouse compared to marital trust. The surviving spouse cannot choose final beneficiaries and has limited control over the assets, receiving only trust income in ance with the IRS laws.

A marital deduction trust is a trust where transfers of property between married partners are free of federal transfer tax. A marital deduction trust can take one of two forms: A life estate coupled with a general power of appointment given to the spouse, or. A Qualified Terminable Interest Property (QTIP) trust.

Primary tabs A residuary beneficiary is a person who receives any property from a will or trust that is not specifically left to another designated beneficiary.