New Hampshire Revocable Letter of Credit

Description

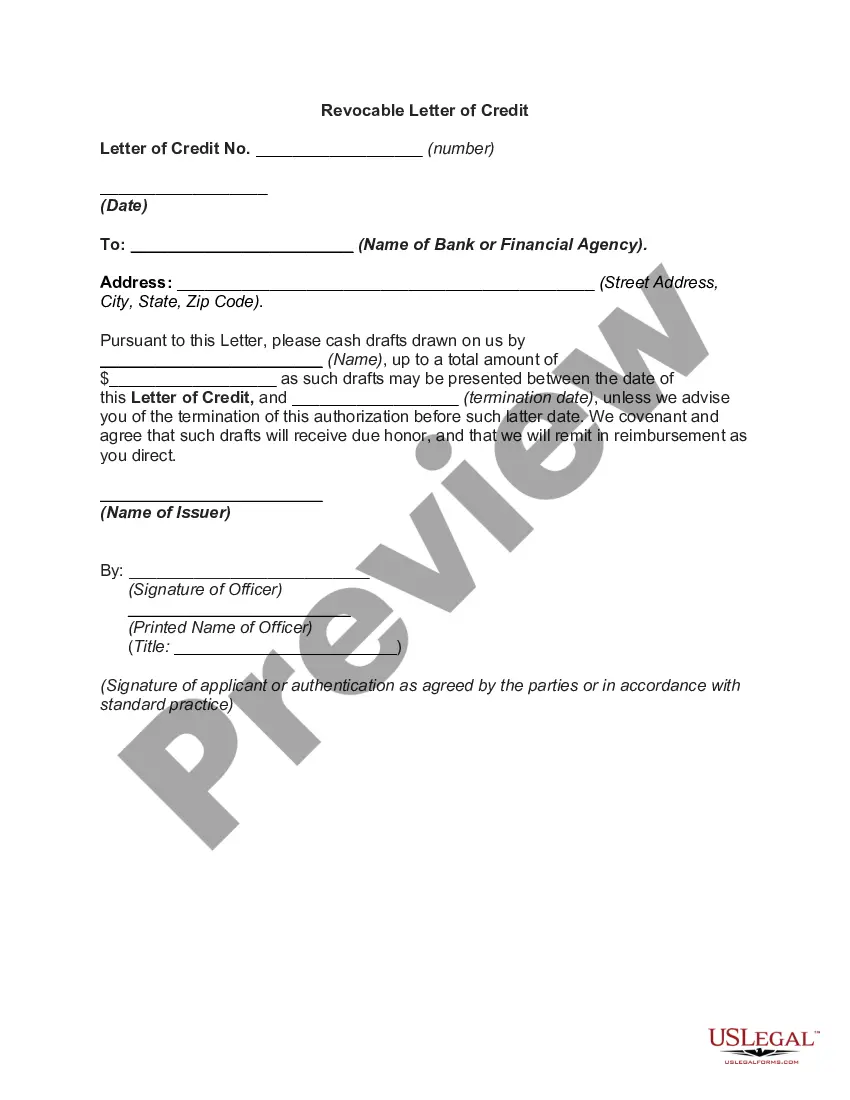

How to fill out Revocable Letter Of Credit?

US Legal Forms - one of the biggest libraries of authorized varieties in the States - delivers a wide range of authorized record templates you can acquire or print. While using site, you may get thousands of varieties for organization and person reasons, categorized by groups, states, or keywords and phrases.You will discover the latest models of varieties just like the New Hampshire Revocable Letter of Credit in seconds.

If you already possess a subscription, log in and acquire New Hampshire Revocable Letter of Credit from your US Legal Forms library. The Acquire switch will show up on each develop you view. You have accessibility to all in the past acquired varieties from the My Forms tab of your own profile.

If you would like use US Legal Forms the first time, listed here are basic guidelines to get you started:

- Be sure you have picked the best develop for the city/region. Click the Preview switch to analyze the form`s articles. Read the develop description to ensure that you have chosen the proper develop.

- In case the develop doesn`t fit your specifications, use the Look for industry at the top of the display screen to discover the one that does.

- Should you be content with the form, verify your choice by simply clicking the Buy now switch. Then, select the rates prepare you want and supply your credentials to sign up for the profile.

- Process the financial transaction. Make use of your Visa or Mastercard or PayPal profile to complete the financial transaction.

- Find the structure and acquire the form on your own gadget.

- Make modifications. Fill up, edit and print and sign the acquired New Hampshire Revocable Letter of Credit.

Every single format you added to your money lacks an expiration time and is yours forever. So, in order to acquire or print one more duplicate, just visit the My Forms area and click on on the develop you will need.

Obtain access to the New Hampshire Revocable Letter of Credit with US Legal Forms, probably the most comprehensive library of authorized record templates. Use thousands of professional and express-particular templates that meet up with your small business or person requirements and specifications.

Form popularity

FAQ

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

A revocable LC is a credit, the terms and conditions of which can be amended/ cancelled by the Issuing Bank. This cancellation can be done without prior notice to the beneficiaries. An irrevocable credit is a credit, the terms and conditions of which can neither be amended nor cancelled.

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees.

A revocable letter of credit is a financial instrument that can be amended or cancelled by the issuing bank without the approval and consent of the beneficiary or trading parties. This LC does not provide any security and could be terminated at any time, resulting in financial loss for the seller.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

A revocable letter of credit is a financial instrument that can be amended or cancelled by the issuing bank without the approval and consent of the beneficiary or trading parties. This LC does not provide any security and could be terminated at any time, resulting in financial loss for the seller.

A revocable letter of credit is one which can be cancelled or amended by the issuing bank at any time and without prior notice to or consent of the beneficiary. From the exporter's point of view such LCs are not safe.

For example, under a revocable letter of credit, if the seller was unable to ship within the stipulated time period, he could simply amend the shipment date to whenever suits him. That may not suit the buyer, but he would be powerless.