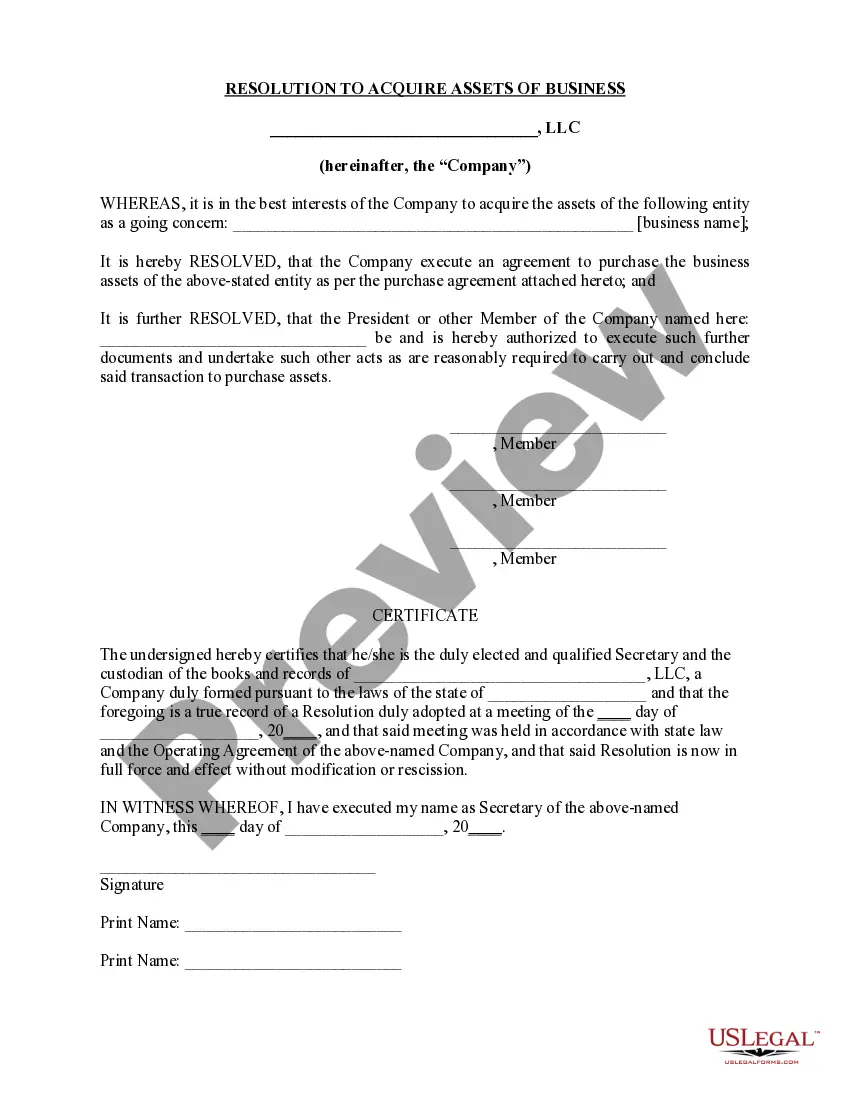

Title: New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business: A Comprehensive Guide Description: A New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business is a formal document prepared by members of a limited liability company (LLC) in New Hampshire. This resolution serves as an official record of a meeting where the LLC members discuss and approve the acquisition of assets belonging to another business. This description aims to provide a detailed overview of this resolution, its purpose, importance, and any potential variations. Keywords: — New Hampshire Resolution of Meeting of LLC Members — Acquiring Assets of Businesses— - LLC Members Meeting Resolution — Asset AcquisitioProcesses— - New Hampshire LLC Acquisition Resolution — Business AssetTransferfe— - Resolutions for Acquiring Business Assets — Importance of LLC MemberMeetingin— - Legal Resolution of Asset Acquisition — New Hampshire Business Law Types of New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business: 1. General Resolution: A general resolution covers the acquisition of assets of businesses in New Hampshire. It outlines the purpose of the acquisition, the specific assets to be acquired, and the terms of the agreement. This resolution ensures all members are informed and in agreement before proceeding with the acquisition. 2. Specific Asset Acquisition Resolution: This type of resolution focuses on a particular asset or group of assets that the LLC aims to acquire from another business. It provides detailed information about the asset(s) and includes specific terms and conditions for the acquisition. The members discuss and document their approval for acquiring these assets during the meeting. 3. Multiple Assets Acquisition Resolution: In cases where an LLC intends to acquire multiple assets from different businesses within a single transaction, this resolution is used. It allows the LLC members to discuss and authorize the acquisition of several assets simultaneously. The resolution outlines the assets, their individual terms, and any additional conditions necessary for the successful completion of the acquisition process. 4. Amended Resolution: In certain instances, an amendment to the original resolution may be required due to changes in the acquisition terms or unforeseen circumstances. The amended resolution is prepared to seek approval from the members for these modifications, ensuring transparency and compliance with New Hampshire business laws. Conclusion: A New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business is a crucial document that formalizes the process of asset acquisition within an LLC. By ensuring transparency, unanimity, and compliance with legal requirements, this detailed resolution becomes the foundation of a successful business asset acquisition in New Hampshire. Understanding the different types of resolutions helps ensure the appropriate documentation is prepared for specific acquisition situations.

New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business

Description

How to fill out New Hampshire Resolution Of Meeting Of LLC Members To Acquire Assets Of A Business?

US Legal Forms - among the greatest libraries of authorized varieties in the United States - gives a wide range of authorized record themes you may acquire or printing. Using the site, you may get thousands of varieties for company and person reasons, categorized by groups, states, or keywords and phrases.You will discover the most recent variations of varieties such as the New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business in seconds.

If you already have a subscription, log in and acquire New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business from the US Legal Forms local library. The Acquire option will appear on each kind you look at. You have access to all previously saved varieties inside the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, here are straightforward directions to help you get started off:

- Ensure you have picked the right kind for your town/state. Select the Review option to analyze the form`s content. Look at the kind description to ensure that you have chosen the right kind.

- In the event the kind doesn`t match your requirements, make use of the Research area on top of the display to get the one that does.

- In case you are content with the form, affirm your option by visiting the Get now option. Then, pick the pricing prepare you want and supply your references to sign up for the bank account.

- Approach the deal. Make use of your Visa or Mastercard or PayPal bank account to accomplish the deal.

- Find the format and acquire the form on your system.

- Make alterations. Load, modify and printing and signal the saved New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business.

Every single template you included with your account does not have an expiration date and is your own forever. So, if you would like acquire or printing an additional version, just check out the My Forms segment and click on in the kind you need.

Get access to the New Hampshire Resolution of Meeting of LLC Members to Acquire Assets of a Business with US Legal Forms, probably the most comprehensive local library of authorized record themes. Use thousands of skilled and status-specific themes that meet up with your business or person needs and requirements.

Form popularity

FAQ

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners).

Law ? 203(d), 202. Since an LLC is a legal person, the property it owns is the property of the LLC, not of the members.

LLCs have no limit on the number of members and the ownership of each member can be entirely different from another member. For example, one member might have 5% ownership in the LLC, whereas another member could have 45% ownership in the LLC.

Differences in ownership and formalities LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners).

New Hampshire currently is one of just five states that does not charge sales tax. Consequently, unlike LLCs that sell goods in most other states, if your LLC sells goods in New Hampshire you don't need to worry about paying sales tax to the state.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

The Business Profits Tax ("BPT") was enacted in 1970. The tax is assessed on income from conducting business activity within the state at the rate of 7.7% for taxable periods ending on or after December 31, 2019. For taxable periods ending on or after December 31, 2022, the BPT rate is reduced to 7.6%.

Member LLC is abbreviated MMLLC and is the term used for an LLC that has 2 or more Members (owners). There are no limits to the number of Members a MultiMember LLC can have and the LLC Members can be individual people, or they can be companies (like another Corporation or LLC).

How Many Members Can There Be? A standard LLC has no upper limit when it comes to the number of members the business can have. The only exception is for those LLCs that choose to be taxed as S corporations. This designation carries a 100 member limit.

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesn't pay taxes on business income. The members of the LLC pay taxes on their share of the LLC's profits.