A New Hampshire Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a legally binding document that outlines the decision and agreement reached by the members of a Limited Liability Company (LLC) in the state of New Hampshire to borrow capital from a designated bank. This resolution is a crucial step in obtaining financing for the LLC's operations, expansion, or other specific purposes. The resolution document typically includes several key elements and important information to ensure transparency and compliance. Keywords to consider when discussing this topic may include: 1. New Hampshire LLC: This term refers to a specific type of business entity registered and operating within the state of New Hampshire, providing limited liability protection to its members. 2. Resolution: The resolution is a formal decision or action taken by the members of an LLC during a meeting to authorize the borrowing of capital from a designated bank. It serves as evidence of the LLC's intent and agreement to take on a loan. 3. Meeting: The meeting comprises the gathering of LLC members for the purpose of discussing and making decisions regarding the borrowing of capital. Such meetings can be conducted in person, via teleconference, or through written consent. 4. LLC Members: These are the individuals or entities who own and hold membership interests in the LLC. Members may include co-founders, investors, or any other stakeholders who have a financial interest in the company. 5. Borrow Capital: This refers to the LLC's intention to obtain funds or capital from a designated bank for various operational needs, business investments, expansion plans, or other agreed-upon purposes. 6. Designated Bank: The designated bank is the specific financial institution chosen by the LLC members to provide the capital funds. The resolution may include details regarding the name, address, and other relevant information about the bank. Different Types of New Hampshire Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank: 1. Single Borrowing Resolution: This type of resolution authorizes a one-time borrowing of capital from a designated bank and specifies the loan amount, terms, and any necessary collateral. 2. Blanket Borrowing Resolution: A blanket resolution gives the LLC members the authority to borrow capital multiple times from the designated bank without the need for a separate resolution for each borrowing. However, it may contain specific limitations or guidelines set by the members. 3. Emergency Borrowing Resolution: This resolution allows the LLC to quickly obtain capital in urgent situations where immediate financing is necessary, providing flexibility to respond to unexpected business needs or opportunities. 4. Revolving Credit Resolution: In this type of resolution, the LLC establishes a revolving credit facility with a designated bank. It enables the company to borrow and repay funds multiple times up to a predetermined credit limit over a specified time period. 5. Acquisition Financing Resolution: This resolution focuses on borrowing capital specifically for acquiring or merging with another business entity. It outlines the LLC's intent, borrowing limits, and the purpose of the funds within the context of the acquisition. Remember, this content should be tailored to the specific needs and requirements of an LLC registered in New Hampshire. It's recommended to consult legal professionals or advisors to ensure compliance and accuracy when drafting or reviewing a resolution document.

New Hampshire Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

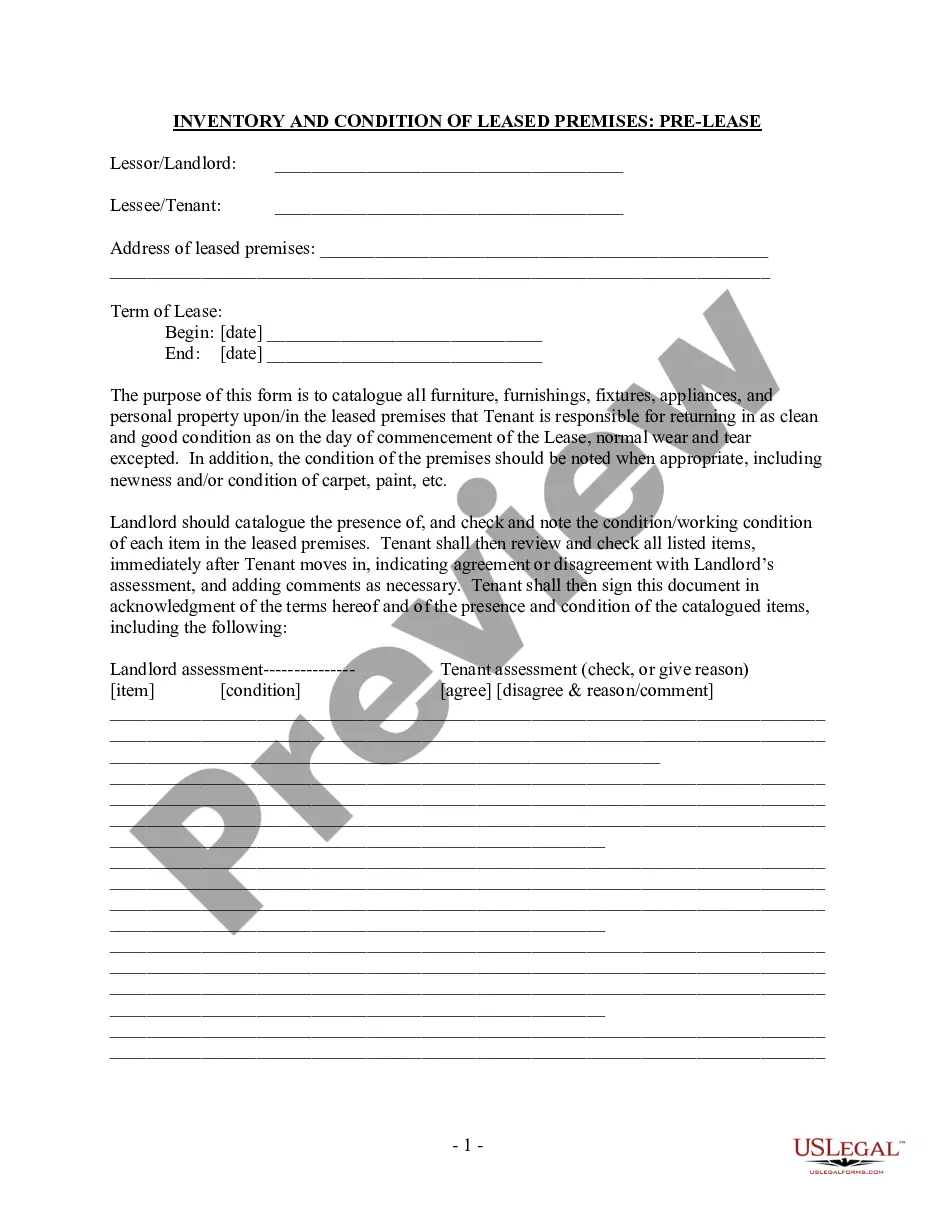

How to fill out New Hampshire Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

If you want to total, down load, or print out legal file web templates, use US Legal Forms, the greatest collection of legal types, which can be found online. Use the site`s simple and practical lookup to discover the files you need. Different web templates for enterprise and personal functions are sorted by groups and suggests, or key phrases. Use US Legal Forms to discover the New Hampshire Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank in just a few click throughs.

Should you be already a US Legal Forms buyer, log in to your account and click the Obtain key to obtain the New Hampshire Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank. Also you can entry types you in the past saved in the My Forms tab of your respective account.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the appropriate city/nation.

- Step 2. Use the Review option to look through the form`s content. Do not overlook to learn the information.

- Step 3. Should you be not happy with the form, utilize the Search industry on top of the monitor to locate other types of your legal form web template.

- Step 4. When you have found the shape you need, click the Purchase now key. Select the prices program you choose and add your accreditations to sign up for the account.

- Step 5. Method the financial transaction. You can use your Мisa or Ьastercard or PayPal account to accomplish the financial transaction.

- Step 6. Select the formatting of your legal form and down load it on the system.

- Step 7. Comprehensive, change and print out or signal the New Hampshire Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

Every single legal file web template you get is your own eternally. You might have acces to each form you saved with your acccount. Click the My Forms portion and pick a form to print out or down load once again.

Be competitive and down load, and print out the New Hampshire Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank with US Legal Forms. There are millions of specialist and condition-specific types you can use for your personal enterprise or personal needs.

Form popularity

FAQ

A banking resolution is the simplest way to authorize someone to open a bank account and provide signature for the business. This document is created by the owners for a limited liability company (LLC) or the board of directors for a corporation.

A resolution is a document stands as a record if compliance comes in to question. A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity. The length of the resolution isn't important.

Who Needs an LLC Banking Resolution. You may need an LLC Banking Resolution to open a business banking account. This document defines the relationship with the banking institution and persons within the company who can access the account.

Key Takeaways. A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

An LLC resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of a limited liability company.

An LLC Banking Resolution is a formal document needed for an LLC to establish a bank relationship. It defines the representatives who are authorized to manage the company's bank account, including their roles and privileges.

What is a resolution to open a bank account? A banking resolution allows a business to document the authorization by its members/board of directors to open a bank account. This document is required by the bank as proof that the person who will apply for a bank account on behalf of the business is authorized to do so.

How to write Corporate/board Resolution to Open Bank Account?corporate name and address.the title i.e CORPORATE/BOARD RESOLUTION TO OPEN BANK ACCOUNT.the date which the resolution passed.the purpose of opening a bank account.the Bank name and address where the account will be opened,More items...

A banking resolution is the simplest way to authorize someone to open a bank account and provide signature for the business. This document is created by the owners for a limited liability company (LLC) or the board of directors for a corporation.