New Hampshire Resolution of Meeting of LLC Members to Sell Assets is a legal document that outlines the procedure and decision-making process for selling assets owned by limited liability companies (LCS) registered in the state of New Hampshire. This resolution is crucial for ensuring transparency, accountability, and compliance with the laws governing LCS. The LLC members, also known as the owners or shareholders, must meet and collectively agree upon the sale of specific assets of the company. This resolution serves as a formal record of their decision and provides clear guidelines for executing the sale. Keywords: New Hampshire, Resolution of Meeting, LLC Members, Sell Assets, limited liability companies, procedure, decision-making process, transparency, accountability, compliance, owners, shareholders, formal record, guidelines, executing sale. Different types of New Hampshire Resolution of Meeting of LLC Members to Sell Assets can vary depending on the circumstances and the type of assets being sold. Some common variations include: 1. Resolution for the Sale of Real Estate Assets: This type of resolution is specific to the sale of real property owned by the LLC, such as land, buildings, or rental properties. It may involve additional legal requirements, such as property inspections or title transfers. 2. Resolution for the Sale of Intellectual Property Assets: If an LLC owns intellectual property assets, such as patents, trademarks, copyrights, or trade secrets, a specific resolution would be required to ensure the legal transfer of these intangible assets. This type of resolution might involve provisions for due diligence and negotiations with potential buyers. 3. Resolution for the Sale of Business Assets: In instances where an LLC intends to sell its entire business, including assets like inventory, equipment, contracts, and customer lists, a comprehensive resolution is necessary. This document will outline the terms and conditions of the sale, including any liabilities to be assumed by the buyer. 4. Resolution for the Sale of Financial Assets: If an LLC holds financial assets, such as stocks, bonds, or investment portfolios, a resolution would be required for their sale. This type of resolution might involve consultation with financial advisors, compliance with securities regulations, and approval from governing bodies if applicable. It is essential to consult with legal professionals experienced in New Hampshire LLC regulations to ensure the appropriate type of resolution is adopted and to comply with all legal requirements throughout the asset sale process.

New Hampshire Resolution of Meeting of LLC Members to Sell Assets

Description

How to fill out New Hampshire Resolution Of Meeting Of LLC Members To Sell Assets?

Are you presently inside a situation in which you need files for sometimes business or personal uses nearly every time? There are a variety of lawful file templates available on the net, but locating types you can trust isn`t effortless. US Legal Forms offers thousands of develop templates, like the New Hampshire Resolution of Meeting of LLC Members to Sell Assets, that are published to satisfy federal and state demands.

When you are presently acquainted with US Legal Forms site and get your account, simply log in. Afterward, it is possible to obtain the New Hampshire Resolution of Meeting of LLC Members to Sell Assets design.

If you do not come with an profile and need to begin using US Legal Forms, abide by these steps:

- Get the develop you require and make sure it is for the correct area/county.

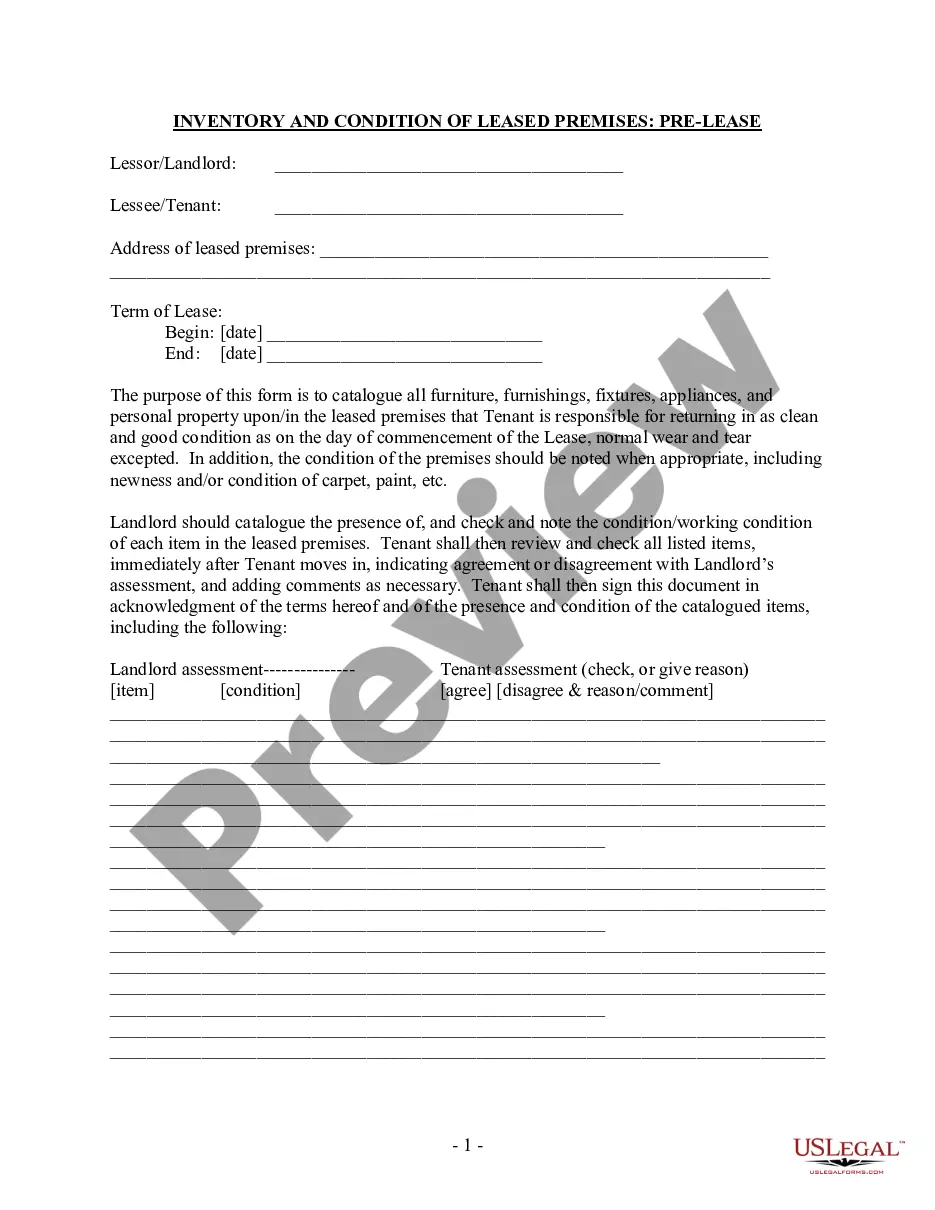

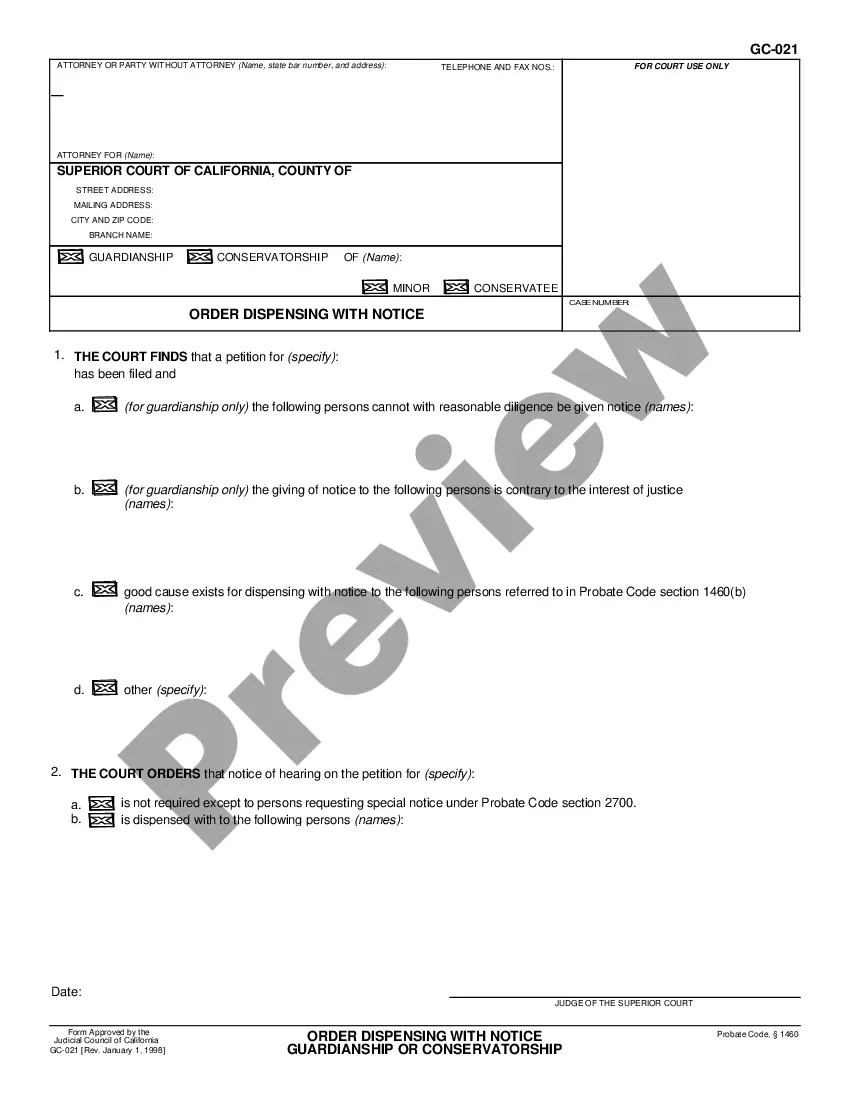

- Make use of the Preview button to analyze the shape.

- Read the description to actually have selected the correct develop.

- In case the develop isn`t what you are seeking, use the Search industry to get the develop that meets your needs and demands.

- Whenever you discover the correct develop, click on Get now.

- Choose the rates strategy you want, fill out the necessary information and facts to create your money, and purchase an order using your PayPal or Visa or Mastercard.

- Choose a convenient data file file format and obtain your version.

Discover all the file templates you have bought in the My Forms food list. You can obtain a additional version of New Hampshire Resolution of Meeting of LLC Members to Sell Assets whenever, if necessary. Just click on the required develop to obtain or print the file design.

Use US Legal Forms, one of the most extensive variety of lawful kinds, to save lots of some time and avoid faults. The support offers expertly produced lawful file templates which can be used for a variety of uses. Produce your account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

How to Write an Operating Agreement Step by StepStep One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

How to Write a ResolutionFormat the resolution by putting the date and resolution number at the top.Form a title of the resolution that speaks to the issue that you want to document.Use formal language in the body of the resolution, beginning each new paragraph with the word, whereas.More items...?

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...