New Hampshire Exempt Survey: A Comprehensive Overview of Tax Exemptions and Surveys Introduction: The New Hampshire Exempt Survey is a vital tool for individuals, businesses, and organizations seeking comprehensive information on tax exemptions available in the state of New Hampshire. This survey serves as a comprehensive guide to understanding and navigating through the complexities of tax exemptions, saving both time and money for those who qualify. Detailed Description: The New Hampshire Exempt Survey provides in-depth information on various tax exemptions and incentives available within the state. It serves as a comprehensive resource, offering detailed descriptions and eligibility criteria for different types of exemptions. Individuals or entities interested in reducing their tax liability or seeking opportunities for financial relief can rely on this survey to explore potential options available to them. Key Benefits and Features: 1. Detailed Explanations: The New Hampshire Exempt Survey offers a clear and concise breakdown of each tax exemption, ensuring individuals understand the specific benefits and requirements associated with each category. 2. Eligibility Criteria: The survey outlines the eligibility criteria for each exemption, helping readers assess their qualification for specific tax benefits. 3. Relevant Keywords: Key terms such as property tax exemptions, income tax exemptions, business tax exemptions, and energy tax incentives are covered in the survey, making it easy for readers to identify the exemptions most relevant to their needs. 4. Updated information: The survey is frequently updated to reflect any changes in exemptions, ensuring readers have access to the most accurate and up-to-date information. 5. Types of Exemptions: The New Hampshire Exempt Survey covers various types of exemptions, including but not limited to: a. Property Tax Exemptions: This category covers exemptions related to primary residences, veterans, senior citizens, disabled individuals, and religious organizations. b. Income Tax Exemptions: Details concerning exemptions for certain types of income, like retirement income or social security benefits, are included in this section. c. Business Tax Exemptions: The survey provides insights on exemptions available to specific industries, start-ups, and small businesses aiming to foster economic development. d. Energy Tax Incentives: This category focuses on incentives encouraging sustainable energy practices and investments in renewable energy sources. Conclusion: The New Hampshire Exempt Survey serves as a comprehensive guide for individuals, businesses, and organizations in understanding the various tax exemptions available within the state. With its detailed explanations, eligibility criteria, and coverage of different exemption types, this survey proves to be an invaluable resource for those seeking to optimize their tax liability and access financial relief opportunities. Stay informed, save money, and maximize your financial benefits with the New Hampshire Exempt Survey.

New Hampshire Exempt Survey

Description

How to fill out New Hampshire Exempt Survey?

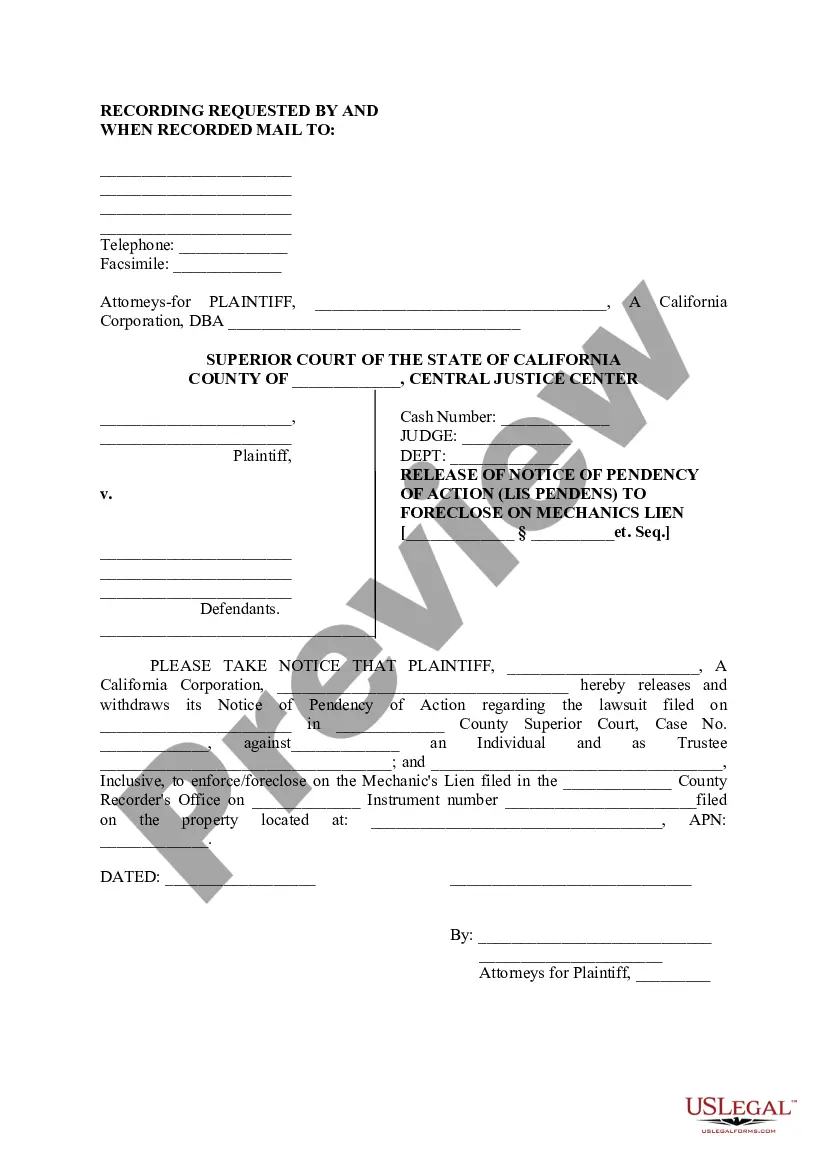

If you need to total, obtain, or print lawful papers themes, use US Legal Forms, the greatest collection of lawful varieties, that can be found on-line. Use the site`s basic and practical look for to obtain the files you want. Different themes for business and person functions are sorted by types and suggests, or keywords. Use US Legal Forms to obtain the New Hampshire Exempt Survey within a few clicks.

Should you be presently a US Legal Forms customer, log in in your profile and then click the Obtain switch to find the New Hampshire Exempt Survey. You can even entry varieties you previously delivered electronically from the My Forms tab of your respective profile.

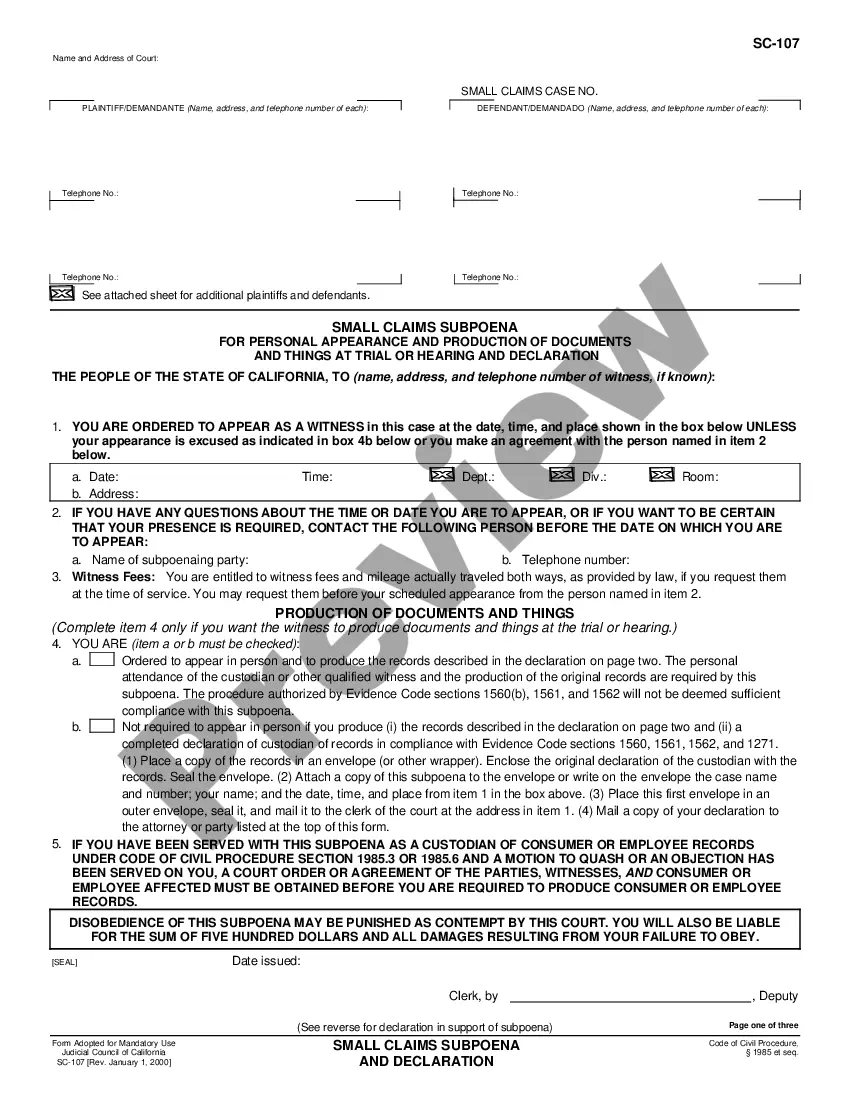

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the shape for that proper town/land.

- Step 2. Use the Review method to check out the form`s information. Never overlook to see the outline.

- Step 3. Should you be unhappy together with the kind, make use of the Look for field near the top of the display screen to discover other types in the lawful kind web template.

- Step 4. Once you have discovered the shape you want, select the Buy now switch. Pick the prices prepare you prefer and add your accreditations to register for an profile.

- Step 5. Process the purchase. You should use your charge card or PayPal profile to accomplish the purchase.

- Step 6. Select the format in the lawful kind and obtain it on your gadget.

- Step 7. Full, revise and print or indication the New Hampshire Exempt Survey.

Each and every lawful papers web template you purchase is your own eternally. You may have acces to every kind you delivered electronically in your acccount. Go through the My Forms portion and select a kind to print or obtain again.

Remain competitive and obtain, and print the New Hampshire Exempt Survey with US Legal Forms. There are many skilled and condition-distinct varieties you may use for your business or person demands.