The New Hampshire Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows retirement plan participants in New Hampshire to waive their rights to receive a specific form of pension benefit. By waiving the JSA, the participant can choose an alternative payout option, giving them more flexibility and control over their retirement income. The JSA, required by federal law, ensures that the participant's spouse is protected by guaranteeing a continuing income stream throughout their lifetime, even in the event of the participant's death. Under the JSA, the participant's retirement benefits are typically paid out as a joint and survivor annuity, where both the retiree and their spouse receive a fixed percentage of the benefits for the rest of their lives. However, the New Hampshire Waiver of JSA allows participants to deviate from the standard joint and survivor annuity and customize their pension benefits according to their personal needs and preferences. This waiver provides an opportunity for individuals who may not have a dependent spouse or have specific financial goals to choose an alternative payout option. Different types of New Hampshire Waiver of JSA may include: 1. Single Life Annuity: This option allows the participant to receive the full retirement benefits during their lifetime, with no survivor benefits for their spouse or other beneficiaries. 2. Lump-Sum Distribution: This option allows the participant to receive the entire accumulated pension benefits in a single, taxable payment, providing them with immediate access to a significant sum. 3. Period Certain Annuity: The participant may select this option to receive retirement benefits for a fixed period, such as 10 or 20 years. If the retiree dies before the end of the chosen period, the remaining payments are passed on to their designated beneficiary. 4. Installment Payments: The participant can choose to receive scheduled payments in regular intervals, such as monthly or quarterly, rather than a continuous annuity stream. This option can provide more control over the timing and frequency of retirement income. It is important to note that the New Hampshire Waiver of JSA should be carefully considered, as waiving the joint and survivor annuity may have long-term implications for both the participant and their spouse. Consulting a financial advisor or retirement planning professional is recommended to thoroughly understand the potential advantages and risks associated with this decision. Keywords: New Hampshire, Waiver of Qualified Joint and Survivor Annuity, JSA, retirement plan, pension benefit, alternative payout, flexibility, control, joint and survivor annuity, spouse, financial goals, single life annuity, lump-sum distribution, period certain annuity, installment payments, implications, financial advisor, retirement planning.

New Hampshire Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out New Hampshire Waiver Of Qualified Joint And Survivor Annuity - QJSA?

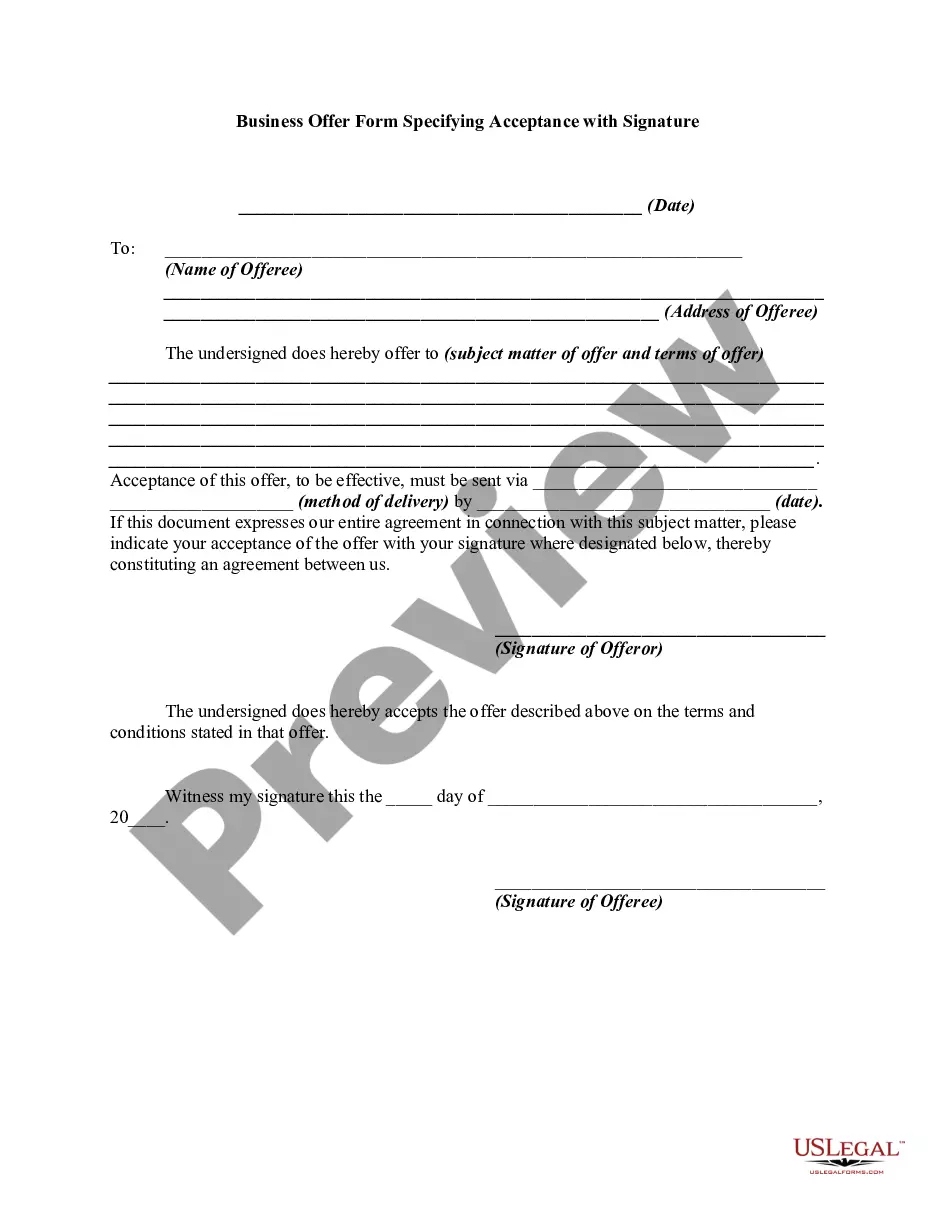

Have you been in the situation the place you require files for either enterprise or personal reasons almost every day? There are a lot of authorized record layouts available on the net, but locating ones you can trust isn`t effortless. US Legal Forms offers a huge number of type layouts, like the New Hampshire Waiver of Qualified Joint and Survivor Annuity - QJSA, which can be written to satisfy state and federal needs.

If you are previously familiar with US Legal Forms site and also have an account, just log in. Following that, you are able to acquire the New Hampshire Waiver of Qualified Joint and Survivor Annuity - QJSA design.

Unless you offer an profile and want to begin to use US Legal Forms, follow these steps:

- Get the type you need and ensure it is for that correct town/area.

- Utilize the Preview option to check the shape.

- Look at the outline to ensure that you have chosen the correct type.

- In the event the type isn`t what you are looking for, use the Lookup field to discover the type that suits you and needs.

- When you get the correct type, click on Buy now.

- Opt for the rates strategy you need, fill in the specified details to make your bank account, and pay money for the order utilizing your PayPal or charge card.

- Pick a practical file format and acquire your duplicate.

Get every one of the record layouts you might have bought in the My Forms food selection. You can obtain a additional duplicate of New Hampshire Waiver of Qualified Joint and Survivor Annuity - QJSA any time, if necessary. Just click the required type to acquire or produce the record design.

Use US Legal Forms, one of the most considerable variety of authorized types, to conserve time and avoid mistakes. The service offers appropriately manufactured authorized record layouts that you can use for a variety of reasons. Make an account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

A joint and survivor annuity is an insurance product designed for couples that continues to make regular payments as long as one spouse lives. A joint and survivor annuity has the advantage of providing income if one or both people live longer than expected. This is not a good choice for a younger couple.

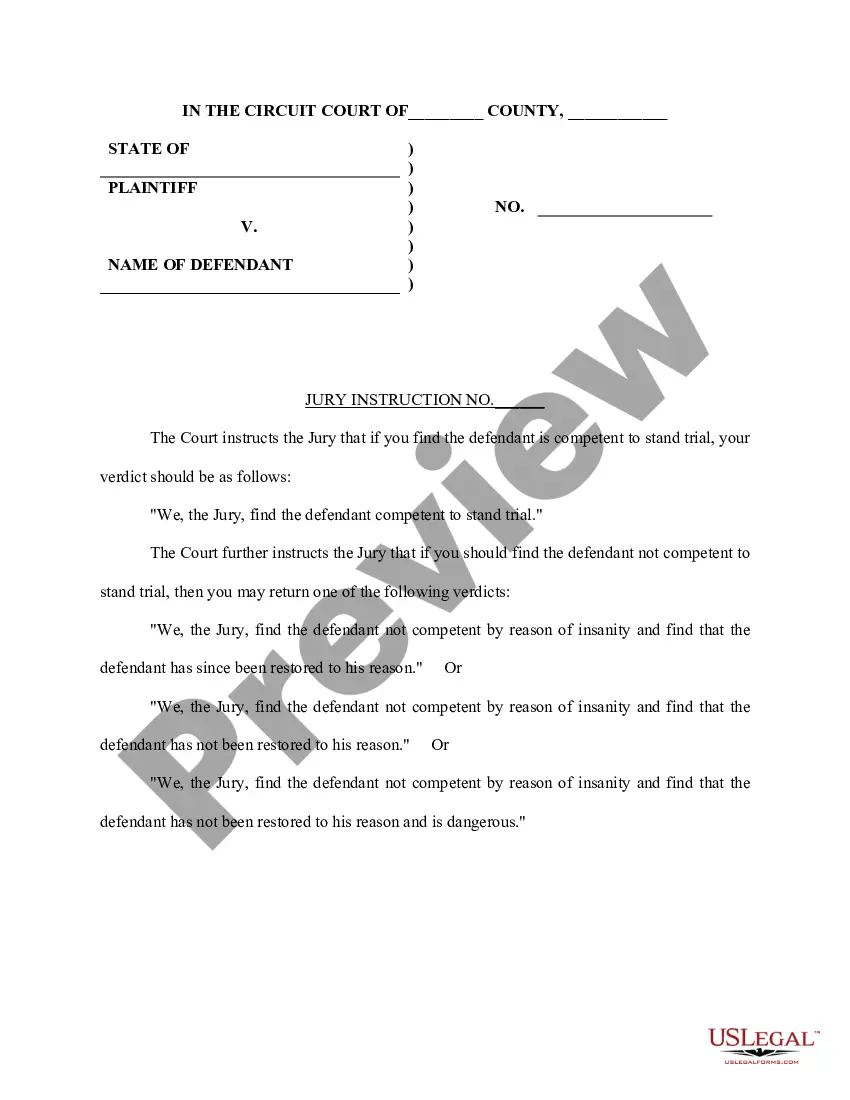

QJSA rules apply to money-purchase pension plans, defined benefit plans, and target benefits. They can also apply to profit-sharing and 401(k) and 403(b) plans, but only if so elected under the plan.

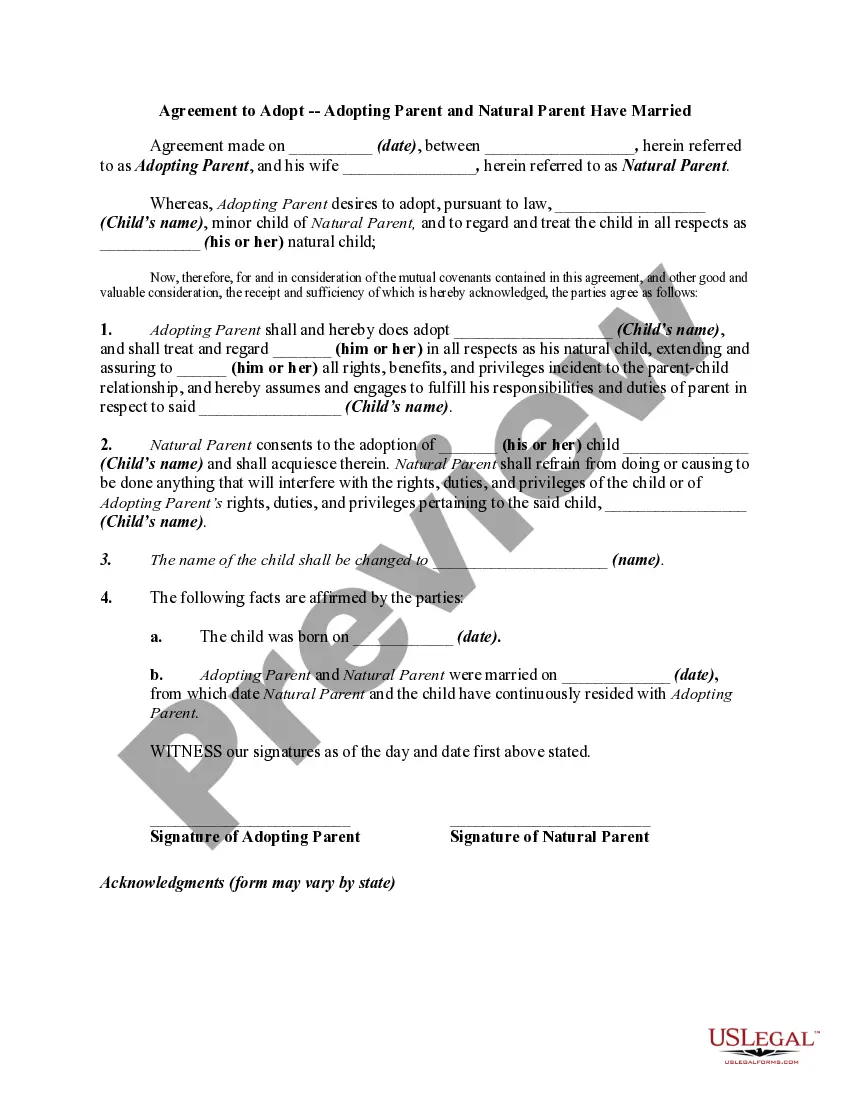

When the participant dies, the spouse will receive lifetime payments in the same or reduced amount. The participant may waive the Qualified Joint and Survivor Annuity with spousal consent and elect to receive another form of payment.

If you do not waive the QPSA, after your death the Plan will pay your spouse the QPSA unless your spouse elects another benefit form. The QPSA will not pay benefits to other beneficiaries after your spouse dies. If you waive the QPSA, the Plan will pay your account to your designated beneficiary.

This special payment form is often called a qualified joint and survivor annuity or QJSA payment form. This benefit is paid to the participant each year and, on the participant's death, a survivor annuity is paid to the surviving spouse.

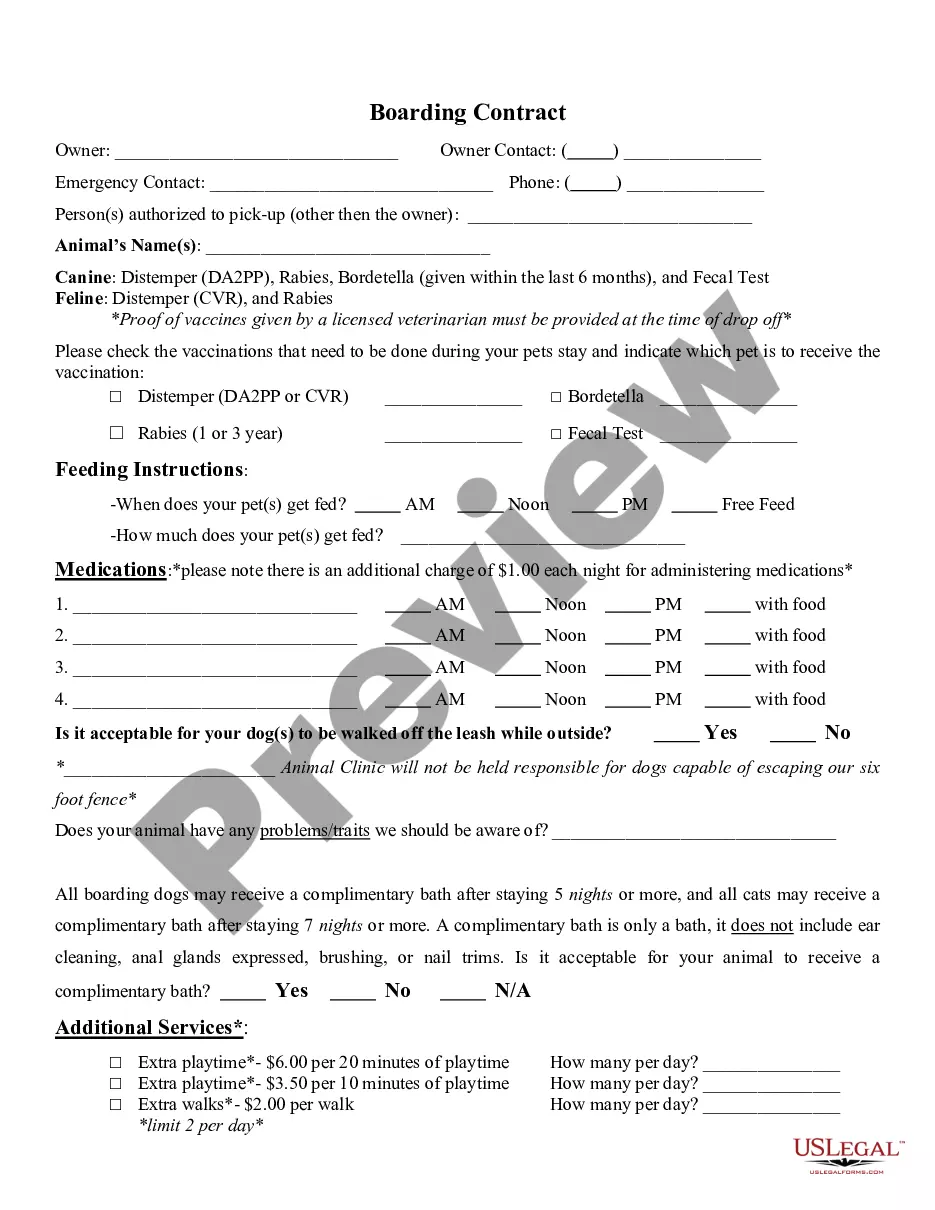

This benefit provides payments to the participant's spouse for his or her lifetime equal to a percentage (as specified in the Pension Plan) not less than one-half of the annuity that would have been payable during their joint lives. The participant may waive the Qualified Preretirement Survivor Annuity.

This benefit provides payments to the participant's spouse for his or her lifetime equal to a percentage (as specified in the Pension Plan) not less than one-half of the annuity that would have been payable during their joint lives. The participant may waive the Qualified Preretirement Survivor Annuity.

Qualified Joint and Survivor AnnuityIf your spouse consents to change the way the Plan's retirement benefits are paid, your spouse gives up his or her right to the QJSA payments. This is referred to as a waiver of the QJSA payment form.

life annuity provides the largest monthly payment but pays only during your lifetime. It's a poor choice if your spouse will need income from your pension to pay routine expenses. A jointandsurvivor annuity pays you during your lifetime and then continues to pay your spouse or other named beneficiary.