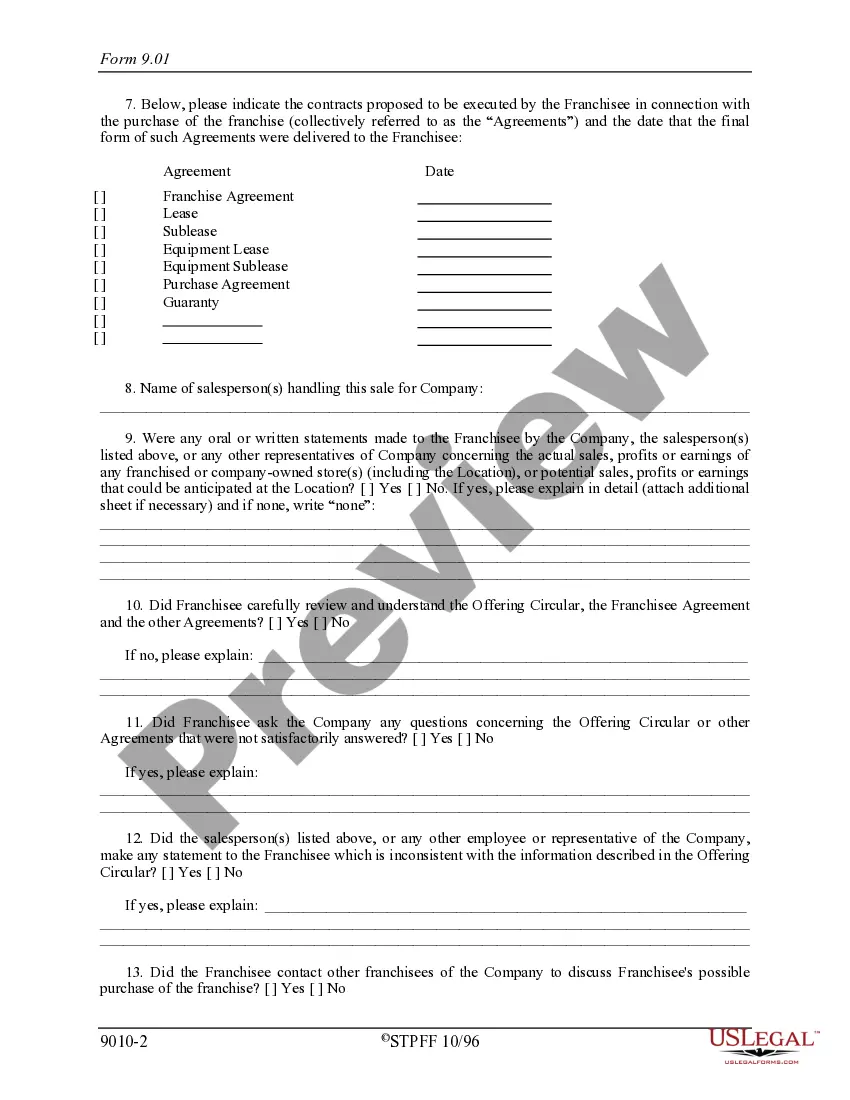

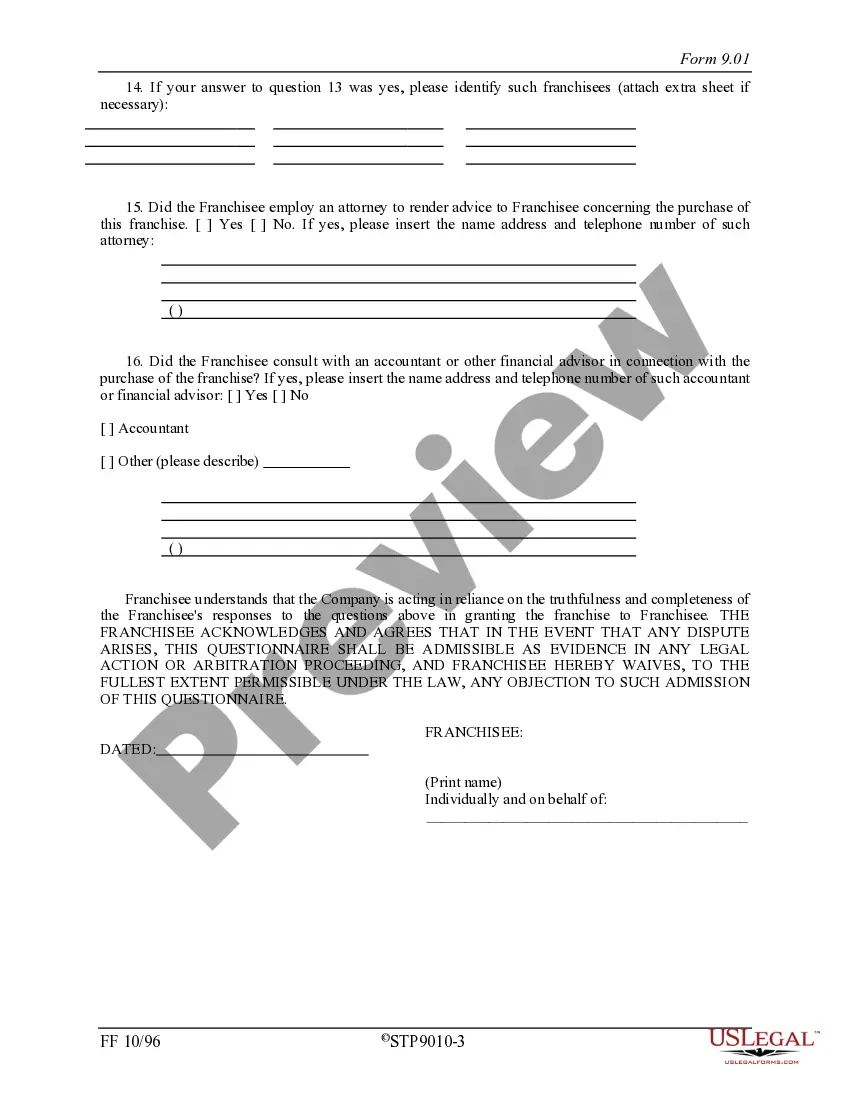

New Hampshire Franchisee Closing Questionnaire

Description

How to fill out Franchisee Closing Questionnaire?

If you have to comprehensive, obtain, or print lawful papers web templates, use US Legal Forms, the largest variety of lawful types, which can be found on-line. Utilize the site`s simple and hassle-free search to obtain the paperwork you require. Various web templates for enterprise and personal purposes are categorized by groups and says, or key phrases. Use US Legal Forms to obtain the New Hampshire Franchisee Closing Questionnaire in just a few mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your profile and then click the Down load button to get the New Hampshire Franchisee Closing Questionnaire. You may also gain access to types you formerly delivered electronically within the My Forms tab of your respective profile.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for that correct city/country.

- Step 2. Utilize the Preview solution to check out the form`s articles. Don`t neglect to learn the outline.

- Step 3. Should you be not satisfied with the type, take advantage of the Look for field towards the top of the display to discover other models of the lawful type format.

- Step 4. After you have identified the shape you require, click the Purchase now button. Choose the prices program you prefer and put your credentials to register for an profile.

- Step 5. Process the purchase. You may use your Мisa or Ьastercard or PayPal profile to perform the purchase.

- Step 6. Select the file format of the lawful type and obtain it in your system.

- Step 7. Comprehensive, edit and print or indicator the New Hampshire Franchisee Closing Questionnaire.

Each and every lawful papers format you acquire is your own property permanently. You possess acces to every type you delivered electronically within your acccount. Click on the My Forms section and decide on a type to print or obtain yet again.

Compete and obtain, and print the New Hampshire Franchisee Closing Questionnaire with US Legal Forms. There are thousands of specialist and status-specific types you can use for your enterprise or personal requires.

Form popularity

FAQ

New Hampshire also has a 7.50 percent corporate income tax rate. New Hampshire does not have a state sales tax and does not levy local sales taxes. New Hampshire's tax system ranks 6th overall on our 2023 State Business Tax Climate Index. New Hampshire Tax Rates, Collections, and Burdens taxfoundation.org ? location ? new-hampshire taxfoundation.org ? location ? new-hampshire

Your New Hampshire LLC's tax classification depends on its number of members. Single-member LLCs (SMLLCs) are taxed like sole proprietors by default, and multi-member LLCs are taxed as general partnerships. New Hampshire LLC Taxes - Northwest Registered Agent northwestregisteredagent.com ? llc ? taxes northwestregisteredagent.com ? llc ? taxes

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920. Forms & Instructions | NH Department of Revenue ... New Hampshire Department of Revenue Administration (.gov) ? forms New Hampshire Department of Revenue Administration (.gov) ? forms

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax. Homeowners in New Hampshire pay some of the highest average effective property tax rates in the country. New Hampshire Income Tax Calculator - SmartAsset SmartAsset ? taxes ? new-hampshire-tax-cal... SmartAsset ? taxes ? new-hampshire-tax-cal...

Self-employed individuals pay a FICA withholding rate of 15.3%. These individuals may deduct from income tax one half of the 15.3% paid for the year as a business expense. The actual rate becomes 7.65% after the deduction. SR 22-02 Dated 01-22 - NH.gov nh.gov ? sr_htm ? html ? sr_22-02_da... nh.gov ? sr_htm ? html ? sr_22-02_da...

Like the BPT, all businesses in NH are obligated to pay the BET unless they do not meet the filing requirement limits. BET is not required for businesses with less than $220,000 in gross receipts or an enterprise value base threshold of less than $111,000. New Hampshire Business Taxes and Changes for 2022 nhbr.com ? nh-business-review ? 2022/01/28 nhbr.com ? nh-business-review ? 2022/01/28

New Hampshire, however, is different: It does require sole proprietorships to pay both the business profits tax and the business enterprise tax. The sole proprietor, however, does not owe state tax on the income they ultimately receive from the business. New Hampshire State Business Income Tax | Nolo nolo.com ? legal-encyclopedia ? new-hamps... nolo.com ? legal-encyclopedia ? new-hamps...

As of 2023, nine states ? Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming ? do not levy a state income tax. 9 States With No Income Tax - NerdWallet nerdwallet.com ? article ? taxes ? states-with... nerdwallet.com ? article ? taxes ? states-with...