New Hampshire FLSA Exempt / Nonexempt Compliance Form

Description

How to fill out FLSA Exempt / Nonexempt Compliance Form?

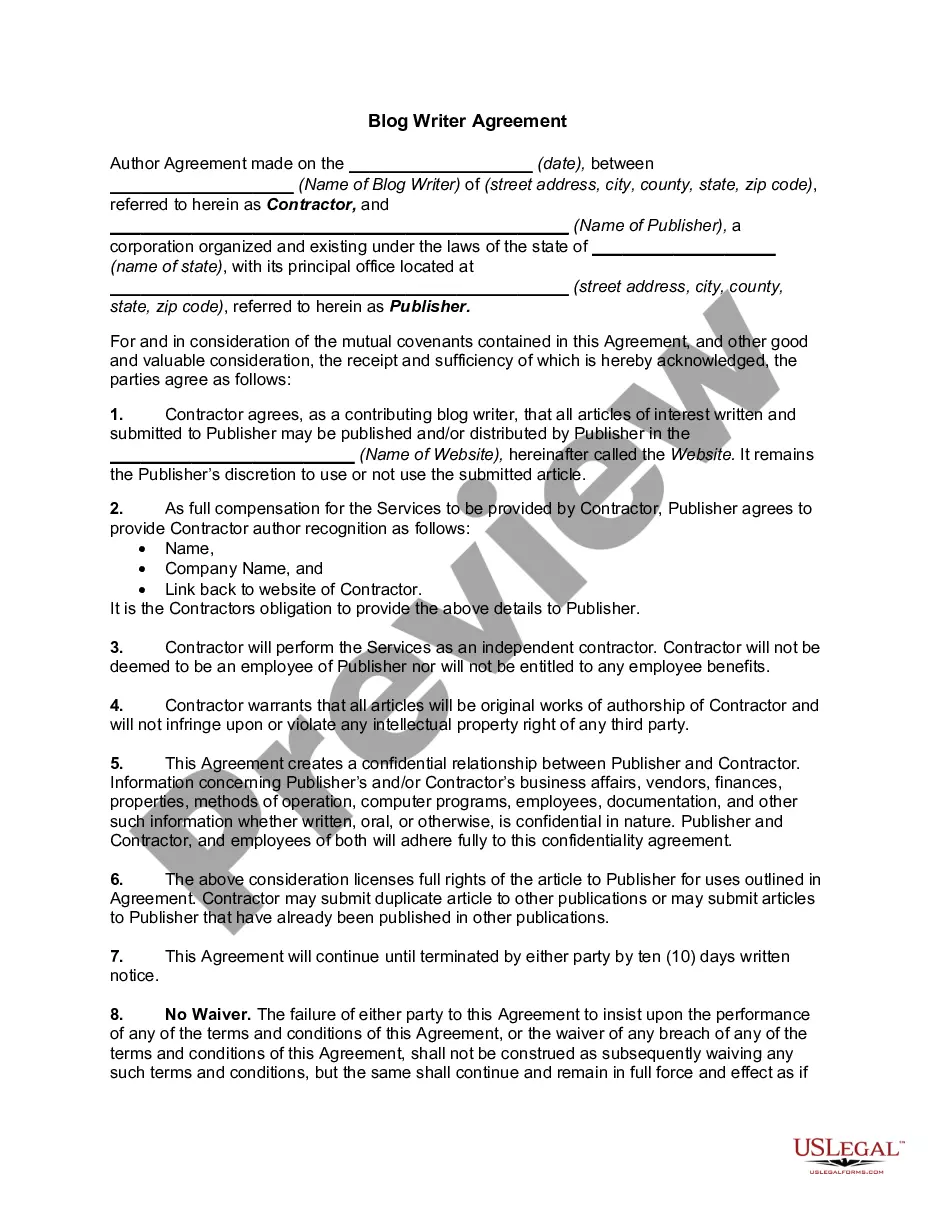

Selecting the appropriate legal document format can be a challenge.

Clearly, there are numerous templates accessible online, but how can you acquire the legal form you desire.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the New Hampshire FLSA Exempt / Nonexempt Compliance Form, which you can utilize for both business and personal needs.

Initially, ensure that you have selected the correct form for your city/county. You can review the form using the Review button and read the form details to confirm it is suitable for you.

- All templates are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire button to locate the New Hampshire FLSA Exempt / Nonexempt Compliance Form.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

Form popularity

FAQ

New Hampshire's state minimum wage rate is $7.25 per hour. This is the same as the current Federal Minimum Wage rate. The minimum wage applies to most employees in New Hampshire, with limited exceptions including tipped employees, some student workers, and other exempt occupations.

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

Simply put, an exempt employee is someone exempt from receiving overtime pay. It is a category of employees who do not qualify for minimum wage or overtime pay as guaranteed by Fair Labor Standard Act (FLSA). Exempt employees are paid a salary instead of hourly wages and their work is professional in nature.

With few exceptions, to be exempt an employee must (a) be paid at least $23,600 per year ($455 per week), and (b) be paid on a salary basis, and also (c) perform exempt job duties. These requirements are outlined in the FLSA Regulations (promulgated by the U.S. Department of Labor).

New Year's Day 2022 and New Hampshire's minimum wage remains $7.25.

It's your turn. Well, it is New Year's Day 2022 and just like every New Year's Day since 2009 New Hampshire's minimum wage remains $7.25 an hour.

The FLSA exempts employees from the minimum wage and overtime requirements who are paid a salary of not less than $455 per week, or $23,660 per year, and who are employed in a bona fide executive, administrative, professional, certain computer professions or creative professions, or outside sales capacity as defined

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.