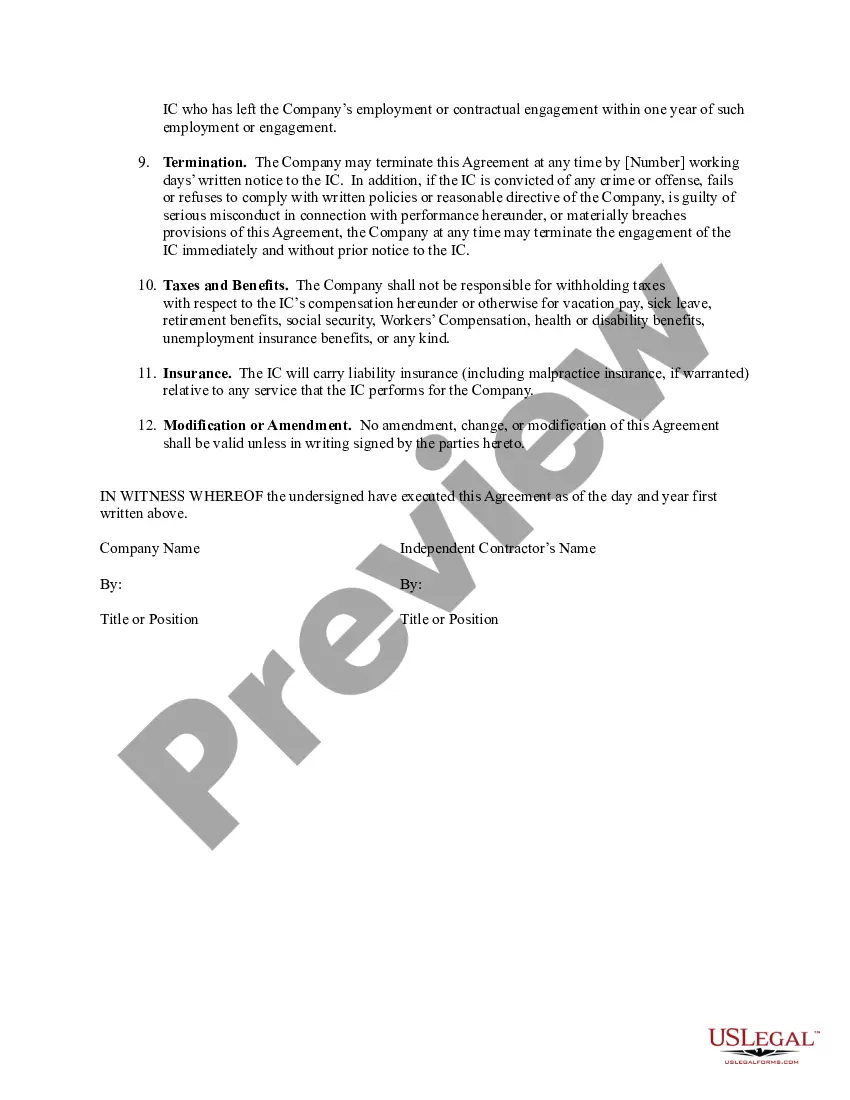

Title: New Hampshire Sample Self-Employed Independent Contractor Agreement — For Ongoing Relationship Introduction: New Hampshire Sample Self-Employed Independent Contractor Agreement is a legally binding document that establishes the terms and conditions of a continuous working relationship between a business or entity (the "Company") and an individual contractor (the "Contractor"). This agreement provides structure and protection for both parties, ensuring a clear understanding of their rights, responsibilities, and expectations. Here, we will explore the key elements of this agreement for an ongoing working relationship in the state of New Hampshire. 1. Agreement Overview: The New Hampshire Sample Self-Employed Independent Contractor Agreement — for ongoing relationship outlines the general provisions of the contract, including the effective dates, scope of work, and compensation. This agreement maintains the independent contractor relationship status while defining the roles, obligations, and deliverables of both parties involved. 2. Terms and Conditions: This section of the agreement covers the terms and conditions that govern the ongoing relationship. It includes crucial aspects such as the payment structure, invoicing procedures, work schedule, project milestones, termination clauses, confidentiality, and any applicable non-compete or non-solicitation clauses. 3. Independent Contractor Status: To maintain legal compliance, the agreement highlights the independent contractor designation, establishing that the contractor is not an employee of the company. This section emphasizes the independence and autonomy of the contractor, including their freedom to control when, where, and how the work is performed. 4. Intellectual Property Rights: Given the nature of ongoing relationships, intellectual property rights become significant. This section clarifies the ownership and management of intellectual property generated during the engagement, ensuring that all rights are appropriately allocated between the parties and any necessary licensing or permissions are agreed upon. 5. Confidentiality and Non-Disclosure: Confidentiality is crucial in many business relationships. This agreement addresses the protection of sensitive information belonging to either party involved. It includes obligations to keep business-related information confidential and may encompass non-disclosure agreements, prohibiting the contractor from revealing proprietary information to third parties. 6. Liability and Indemnification: To protect all parties, this section addresses liability concerns and ensures indemnification in cases of claims, damages, or losses arising from the contractor's performance. It clarifies responsibilities and potential legal repercussions, helping maintain clarity and reducing legal risks. 7. Governing Law and Jurisdiction: This agreement specifies that it is governed by the laws of the state of New Hampshire, ensuring compliance with the state's legal framework. It also determines the jurisdiction where disputes will be resolved, streamlining the resolution process. Types of New Hampshire Sample Self-Employed Independent Contractor Agreements: While the content outlined above applies to ongoing relationships, different types of agreements may exist based on the nature of the work or engagement. Some additional variations may include: 1. New Hampshire Sample Self-Employed Independent Contractor Agreement — Fixed-Term or One-TimProjectec— - Similar to the ongoing relationship agreement, but specifically tailored for a specific period or project completion. 2. New Hampshire Sample Self-Employed Independent Contractor Agreement — Consulting Service— - Focused on consulting services provided by the contractor, which may have different provisions and deliverables. 3. New Hampshire Sample Self-Employed Independent Contractor Agreement Nondisclosureur— - This agreement specifically highlights confidentiality and non-disclosure provisions, suitable for highly sensitive projects. Conclusion: The New Hampshire Sample Self-Employed Independent Contractor Agreement — for an ongoing relationship provides a comprehensive framework and clarity for both parties, protecting their interests while fostering a successful business engagement. It is crucial to consult with legal professionals to ensure compliance and customization according to specific needs and requirements.

New Hampshire Sample Self-Employed Independent Contractor Agreement - for ongoing relationship

Description

How to fill out New Hampshire Sample Self-Employed Independent Contractor Agreement - For Ongoing Relationship?

You are able to invest hrs on the web trying to find the authorized file template that fits the state and federal requirements you need. US Legal Forms supplies thousands of authorized kinds which are analyzed by experts. It is simple to acquire or printing the New Hampshire Sample Self-Employed Independent Contractor Agreement - for ongoing relationship from our support.

If you already have a US Legal Forms accounts, you are able to log in and then click the Obtain key. Following that, you are able to complete, edit, printing, or signal the New Hampshire Sample Self-Employed Independent Contractor Agreement - for ongoing relationship. Every single authorized file template you acquire is yours for a long time. To acquire yet another backup of any purchased type, proceed to the My Forms tab and then click the related key.

If you are using the US Legal Forms internet site the very first time, keep to the easy guidelines below:

- Very first, ensure that you have chosen the right file template to the area/metropolis of your choosing. Browse the type explanation to make sure you have chosen the appropriate type. If offered, make use of the Preview key to check with the file template also.

- If you would like find yet another version of the type, make use of the Look for discipline to get the template that fits your needs and requirements.

- When you have discovered the template you desire, click Purchase now to continue.

- Find the rates plan you desire, key in your accreditations, and sign up for an account on US Legal Forms.

- Full the deal. You may use your Visa or Mastercard or PayPal accounts to pay for the authorized type.

- Find the format of the file and acquire it to your device.

- Make alterations to your file if needed. You are able to complete, edit and signal and printing New Hampshire Sample Self-Employed Independent Contractor Agreement - for ongoing relationship.

Obtain and printing thousands of file themes using the US Legal Forms web site, which offers the biggest variety of authorized kinds. Use skilled and status-distinct themes to tackle your company or individual demands.

Form popularity

FAQ

The fixed, periodic compensation of a partner (often referred to as guaranteed payments or the partner's draw) is therefore self-employment income rather than employee wages. A partner's salary is reported to the partner on a Schedule K-1 as a guaranteed payment rather than on a Form W-2.

Such a partner who devotes time and energy in the conduct of the trade of business of the partnership, or in providing services to the partnership as an independent contractor, is a self- employed individual rather than a common law employee.

Second, as an independent contractor, your spouse will have to pay his or her own self-employment taxes since you will not be doing payroll taxes as if he or she were an employee.

Independent contractors usually offer their services to the general public, not just to one person or company. Government auditors will be impressed if you market your services to the public. Here are some ways to do this: Obtain a business card and letterhead.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Partners in a partnership (including certain members of a limited liability company (LLC)) are considered to be self-employed, not employees, when performing services for the partnership.

Yes. The contractor should receive a 1099 form if the LLC is treated as a partnership as well as a single-member LLC (disregarded entity).

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.