New Hampshire Stock Option and Award Plan

Description

How to fill out New Hampshire Stock Option And Award Plan?

If you have to complete, down load, or printing authorized record web templates, use US Legal Forms, the biggest assortment of authorized forms, that can be found online. Make use of the site`s simple and easy hassle-free research to discover the files you will need. Numerous web templates for company and person purposes are sorted by groups and suggests, or key phrases. Use US Legal Forms to discover the New Hampshire Stock Option and Award Plan in a few click throughs.

In case you are previously a US Legal Forms consumer, log in to your accounts and then click the Down load switch to obtain the New Hampshire Stock Option and Award Plan. You can even entry forms you previously acquired in the My Forms tab of your respective accounts.

If you work with US Legal Forms the first time, follow the instructions below:

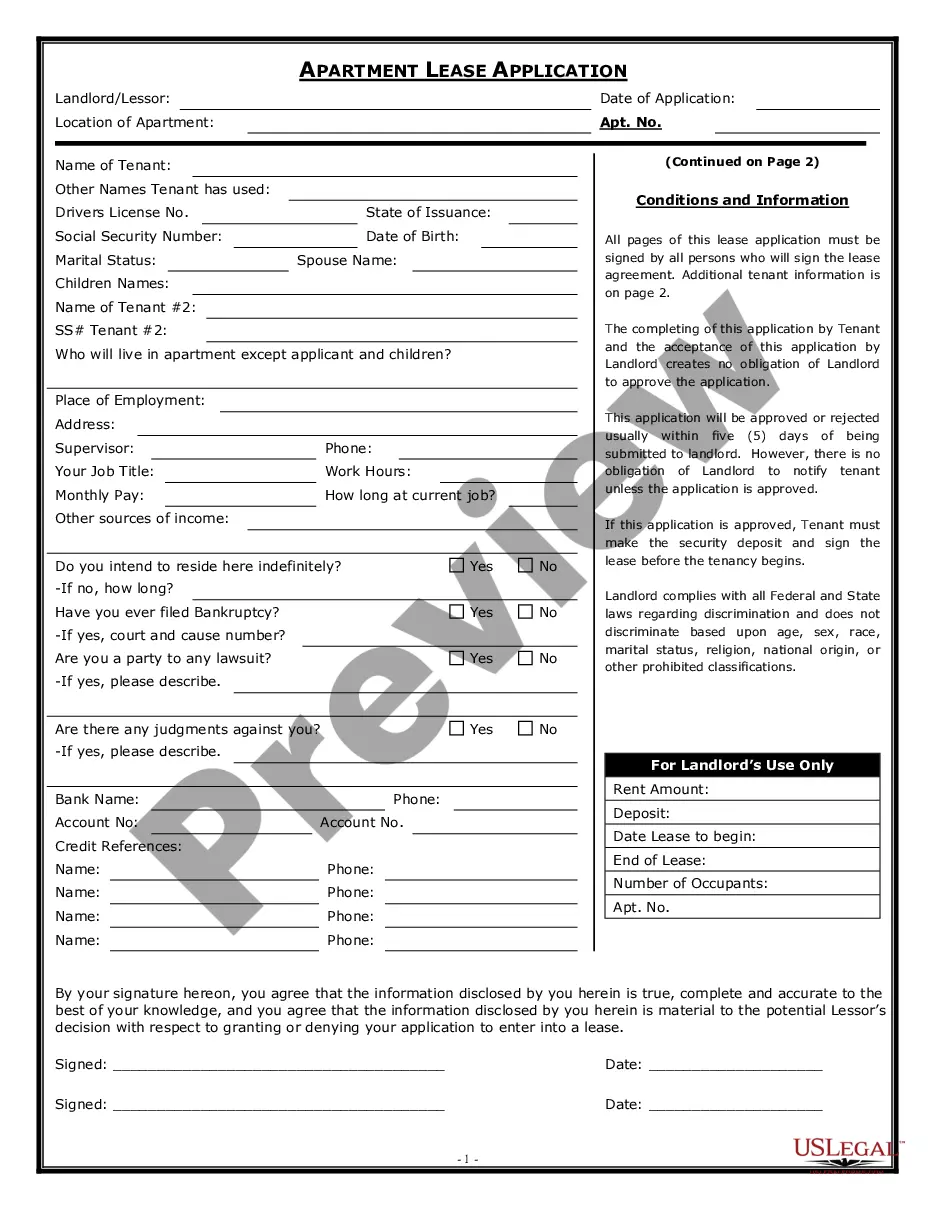

- Step 1. Be sure you have chosen the form for that right area/nation.

- Step 2. Make use of the Preview option to look through the form`s articles. Never forget to read through the description.

- Step 3. In case you are not happy together with the type, utilize the Research discipline towards the top of the screen to find other models in the authorized type design.

- Step 4. When you have identified the form you will need, click on the Acquire now switch. Pick the prices prepare you prefer and put your credentials to sign up to have an accounts.

- Step 5. Procedure the deal. You can use your charge card or PayPal accounts to accomplish the deal.

- Step 6. Pick the format in the authorized type and down load it on your gadget.

- Step 7. Full, change and printing or sign the New Hampshire Stock Option and Award Plan.

Each authorized record design you acquire is your own property eternally. You have acces to every single type you acquired with your acccount. Click on the My Forms area and select a type to printing or down load once more.

Contend and down load, and printing the New Hampshire Stock Option and Award Plan with US Legal Forms. There are millions of skilled and status-certain forms you may use to your company or person requirements.

Form popularity

FAQ

Stock options are usually granted for a specific period (option term) and must be exercised within that period. A common option term is 10 years, after which, the option expires. While time-based vesting remains popular, companies are increasingly granting equity that vests upon meeting certain performance criteria.

Stock options are an employee benefit that grants employees the right to buy shares of the company at a set price after a certain period of time. Employees and employers agree ahead of time on how many shares they can purchase and how long the vesting period will be before they can buy the stock.

Equity Awards means all options to purchase shares of Company common stock, as well as all other stock-based awards granted to the Executive, including, but not limited to, stock bonus awards, restricted stock, restricted stock units and stock appreciation rights.

From the employee's standpoint, a stock option grant is an opportunity to purchase stock in the company for which they work. Typically, the grant price is set as the market price at the time the grant is offered.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").

With a stock award, you receive the company's stocks as compensation. Depending on the type of stock, you may have to wait for a certain period before you can fully own it. A stock option, on the other hand, only gives you the right to buy the company's stocks in the future at a certain price.

Stock Awards means any rights granted by the Company to Executive with respect to the common stock of the Company, including, without limitation, stock options, stock appreciation rights, restricted stock, stock bonuses and restricted stock units. Sample 2.

Statutory Stock OptionsYou have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price.

An award that gives you the ability to purchase shares of company stock at a specified price for a fixed period of time.