New Hampshire Amendments to certificate of incorporation

Description

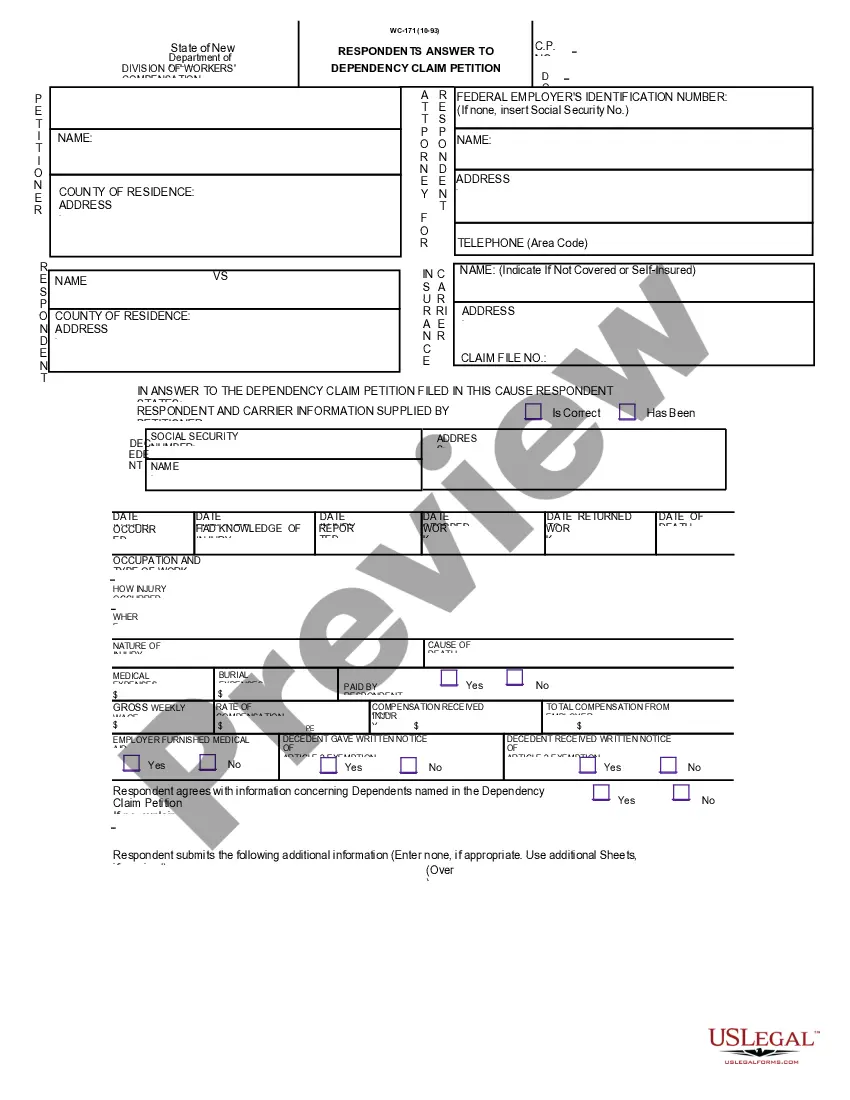

How to fill out Amendments To Certificate Of Incorporation?

If you need to full, obtain, or produce legitimate document layouts, use US Legal Forms, the biggest variety of legitimate varieties, that can be found on the web. Utilize the site`s simple and easy hassle-free lookup to get the files you want. Different layouts for business and personal purposes are sorted by types and says, or keywords and phrases. Use US Legal Forms to get the New Hampshire Amendments to certificate of incorporation within a number of mouse clicks.

Should you be currently a US Legal Forms customer, log in to the account and click on the Down load option to get the New Hampshire Amendments to certificate of incorporation. You can also entry varieties you previously downloaded in the My Forms tab of your respective account.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the shape for your proper town/land.

- Step 2. Utilize the Review method to examine the form`s information. Don`t forget about to learn the information.

- Step 3. Should you be unsatisfied together with the kind, take advantage of the Search industry near the top of the monitor to discover other variations of the legitimate kind design.

- Step 4. After you have identified the shape you want, go through the Buy now option. Opt for the prices strategy you like and add your references to register to have an account.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal account to accomplish the deal.

- Step 6. Select the file format of the legitimate kind and obtain it on your own product.

- Step 7. Total, modify and produce or indicator the New Hampshire Amendments to certificate of incorporation.

Each and every legitimate document design you buy is yours permanently. You might have acces to every single kind you downloaded inside your acccount. Select the My Forms portion and select a kind to produce or obtain once more.

Contend and obtain, and produce the New Hampshire Amendments to certificate of incorporation with US Legal Forms. There are thousands of skilled and condition-particular varieties you may use to your business or personal demands.

Form popularity

FAQ

There are two scenarios for filing a Delaware Certificate of Amendment of Certificate of Incorporation. The Amendment may be filed either before the corporation has issued any stock or after stock has been issued and payment for stock has been received. Either way, executing an Amendment is basically the same.

Changing LLC Ownership in Delaware Most states require lots of information, but in Delaware, all that needs to be filed is a certificate of formation, which must contain three parts: Name of the Delaware LLC. Name and address of the registered office. Name and contact information for the registered agent in Delaware.

An individual's right to live free from governmental intrusion in private or personal information is natural, essential, and inherent. [Art.] 3.

You can amend articles (or in Delaware's case, your ?Certificate of Incorporation?) as desired; however, if you wish to change your original registered agent, you are required to use the Statement of Agent Change form.

Amendments to Section 242 of the DGCL, which governs the requirements to amend the certificate of incorporation of a Delaware corporation, were implemented to address, in part, recent issues encountered by public corporations in securing the stockholder vote required to approve a reverse or forward stock split.

You can easily change your New Hampshire LLC name. The first step is to file a form called the Certificate of Amendment with the Department of State and wait for it to be approved. This is how you officially change your LLC name in New Hampshire. The filing fee for a Certificate of Amendment in New Hampshire is $35.

How to Incorporate in New Hampshire. To start a corporation in New Hampshire, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Corporation Division. You can file this document online or by mail. The articles cost $100 to file.

Section 262 of the DGCL has been amended to (i) expand the transactions pursuant to which statutory appraisal rights are available in order to include transfers, domestications, and continuances and (ii) require that withdrawal of a demand for appraisal rights be made within 60 days following the effective date of the ...