In New Hampshire, the authority to issue additional shares refers to the power granted to a corporation or company to generate and sell new shares of stock beyond its existing holdings. This process allows the corporation to increase its capital and raise funds for various purposes, such as expansion, acquisitions, or debt reduction. The authority to issue additional shares is outlined in the New Hampshire Revised Statutes Annotated (RSA) under Title XXVII, Chapter 293-A, which governs corporations. There are different types of New Hampshire Authority to Issue Additional Shares, including: 1. Authorized shares: Authorized shares are the maximum number of shares a corporation can legally issue as defined in its articles of incorporation. It represents the total available pool from which additional shares can be allocated. 2. Issued shares: Issued shares are the number of shares that have been formally allocated and sold to shareholders. This figure is a subset of authorized shares and represents the company's current ownership structure. 3. Unis sued shares: Unis sued shares refer to the shares that have not been allocated or sold to shareholders. These shares can be held in reserve to accommodate future needs for capital infusion or strategic opportunities. 4. Treasury shares: Treasury shares are the shares that have been issued by the company but subsequently repurchased or acquired. These shares can be held by the company and utilized for various purposes, such as employee stock option plans, acquisitions, or reissuance to raise additional capital. 5. Preferred shares: Preferred shares are a type of stock that provides certain privileges or preferences to shareholders, typically in terms of dividends or liquidation proceeds. The authority to issue additional preferred shares may be separate from the authority to issue common shares, and it may have specific limitations or conditions outlined in the articles of incorporation. It's important for corporations in New Hampshire to abide by the regulations set forth in the state laws and comply with any additional provisions stated in their articles of incorporation or bylaws when exercising their authority to issue additional shares. The process usually involves obtaining approval from the board of directors and, in some cases, shareholder consent or approval at annual meetings. This authority grants corporations the flexibility to adapt to changing business needs and secure the necessary financial resources to drive growth and achieve their strategic objectives.

New Hampshire Authority to Issue Additional Shares

Description

How to fill out New Hampshire Authority To Issue Additional Shares?

Discovering the right authorized papers template might be a struggle. Of course, there are plenty of themes available on the net, but how can you discover the authorized type you need? Utilize the US Legal Forms site. The assistance offers a large number of themes, for example the New Hampshire Authority to Issue Additional Shares, which you can use for business and private demands. Each of the forms are inspected by experts and meet up with federal and state requirements.

When you are presently signed up, log in for your profile and then click the Obtain button to have the New Hampshire Authority to Issue Additional Shares. Make use of your profile to search with the authorized forms you have purchased previously. Visit the My Forms tab of your own profile and have one more copy of the papers you need.

When you are a whole new customer of US Legal Forms, allow me to share straightforward instructions that you should stick to:

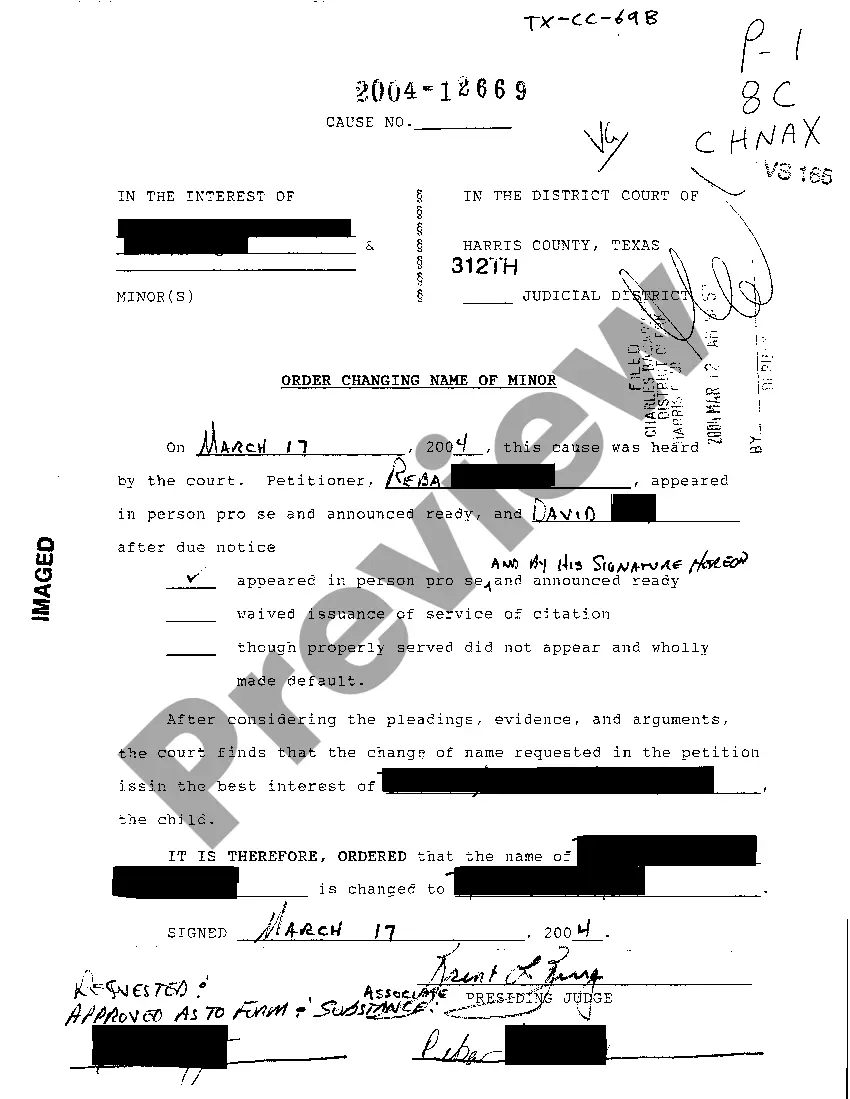

- First, be sure you have selected the right type for your town/region. You can examine the form making use of the Preview button and browse the form explanation to guarantee this is basically the right one for you.

- In case the type will not meet up with your expectations, utilize the Seach discipline to discover the appropriate type.

- Once you are certain that the form is proper, select the Get now button to have the type.

- Select the costs program you desire and enter in the needed info. Design your profile and purchase the order with your PayPal profile or bank card.

- Pick the submit format and down load the authorized papers template for your device.

- Comprehensive, change and printing and indication the attained New Hampshire Authority to Issue Additional Shares.

US Legal Forms is the greatest local library of authorized forms where you will find a variety of papers themes. Utilize the service to down load skillfully-created files that stick to express requirements.

Form popularity

FAQ

Average Cost of Living in New Hampshire: $56,727 per year If New Hampshire exceeds your budget, don't bank on finding an affordable nearby state to move to. All of the states around New Hampshire ? Maine, Massachusetts, Connecticut, Rhode Island, and New York ? are some of the most expensive in the country to live in.

New Hampshire also has the highest economic security of any state. Statistics matter ? In 2019, New Hampshire was the second overall best state in the USA ing to US News and World Report based on eight metrics and in January 2020, Home Snacks picked New Hampshire as the No. 1 best state to live in America.

Ranked #2 on U.S. News and World Report's list of best states to live in the U.S., New Hampshire is known for its excellent quality of life, robust economy and pristine wilderness.

To start a corporation in New Hampshire, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Corporation Division. You can file this document online or by mail. The articles cost $100 to file.