New Hampshire Designation of Rights, Privileges and Preferences of Preferred Stock

Description

How to fill out Designation Of Rights, Privileges And Preferences Of Preferred Stock?

Discovering the right authorized file design might be a battle. Of course, there are a lot of layouts accessible on the Internet, but how can you find the authorized kind you will need? Use the US Legal Forms site. The assistance gives a large number of layouts, including the New Hampshire Designation of Rights, Privileges and Preferences of Preferred Stock, that can be used for company and personal requires. Each of the forms are examined by specialists and meet up with state and federal needs.

If you are currently signed up, log in to your profile and click the Obtain switch to obtain the New Hampshire Designation of Rights, Privileges and Preferences of Preferred Stock. Utilize your profile to search from the authorized forms you might have acquired earlier. Go to the My Forms tab of your respective profile and acquire an additional backup from the file you will need.

If you are a new end user of US Legal Forms, listed below are basic instructions that you should follow:

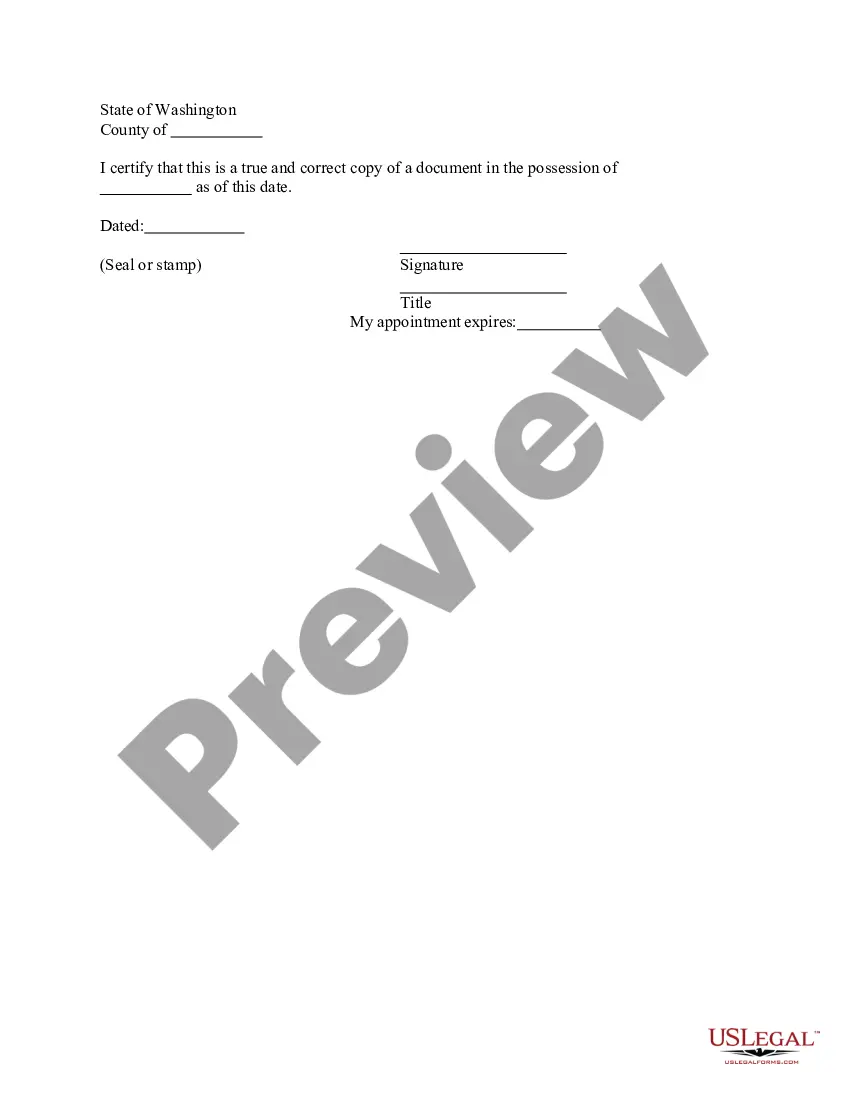

- Initial, be sure you have chosen the appropriate kind for your town/area. You may check out the shape utilizing the Review switch and study the shape description to guarantee it will be the best for you.

- In the event the kind does not meet up with your requirements, make use of the Seach field to obtain the correct kind.

- Once you are positive that the shape would work, select the Purchase now switch to obtain the kind.

- Pick the rates prepare you need and enter in the needed information and facts. Build your profile and purchase the transaction with your PayPal profile or credit card.

- Select the submit formatting and down load the authorized file design to your system.

- Complete, change and print and indication the obtained New Hampshire Designation of Rights, Privileges and Preferences of Preferred Stock.

US Legal Forms is the largest local library of authorized forms in which you can discover different file layouts. Use the company to down load appropriately-created documents that follow status needs.

Form popularity

FAQ

This amount does not have to equal the initial price you paid to purchase the preferred stock. Companies typically call stocks when interest rates are low, so they can reissue a new preferred stock with a lower dividend payment to match the current market rates.

Preferred Designation means the Certificate of Designation with respect to the Series D Preferred Stock, the Series E Preferred Stock, the Series F Preferred Stock, the Series G Preferred Stock, the Series H Preferred Stock and the Series I Preferred Stock adopted by the Board of Directors of the Company and duly filed ...

Preferred Stock Designation means the express terms of shares of any class or series of capital stock of the Corporation, whether now or hereafter issued, with rights to distributions senior to those of the Common Stock including, without limitation, any relative, participating, optional, or other special rights and ...

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, they can compare it to other financing options.

We can also define preferred stock through an illustration of how they work. As an example, suppose that a Company 'C' has a total of 10,000 preference shares to distribute among its investors. These shares are priced at ?100 earning interest at 8% per annum.

Preferred typically have no voting rights, whereas common stockholders do. Preferred stockholders may have the option to convert shares to common shares but not vice versa. Preferred shares may be callable where the company can demand to repurchase them at par value.

Preferred stock is a different type of equity that represents ownership of a company and the right to claim income from the company's operations. Preferred stockholders have a higher claim on distributions (e.g. dividends) than common stockholders.

Key Takeaways. The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.