New Hampshire Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

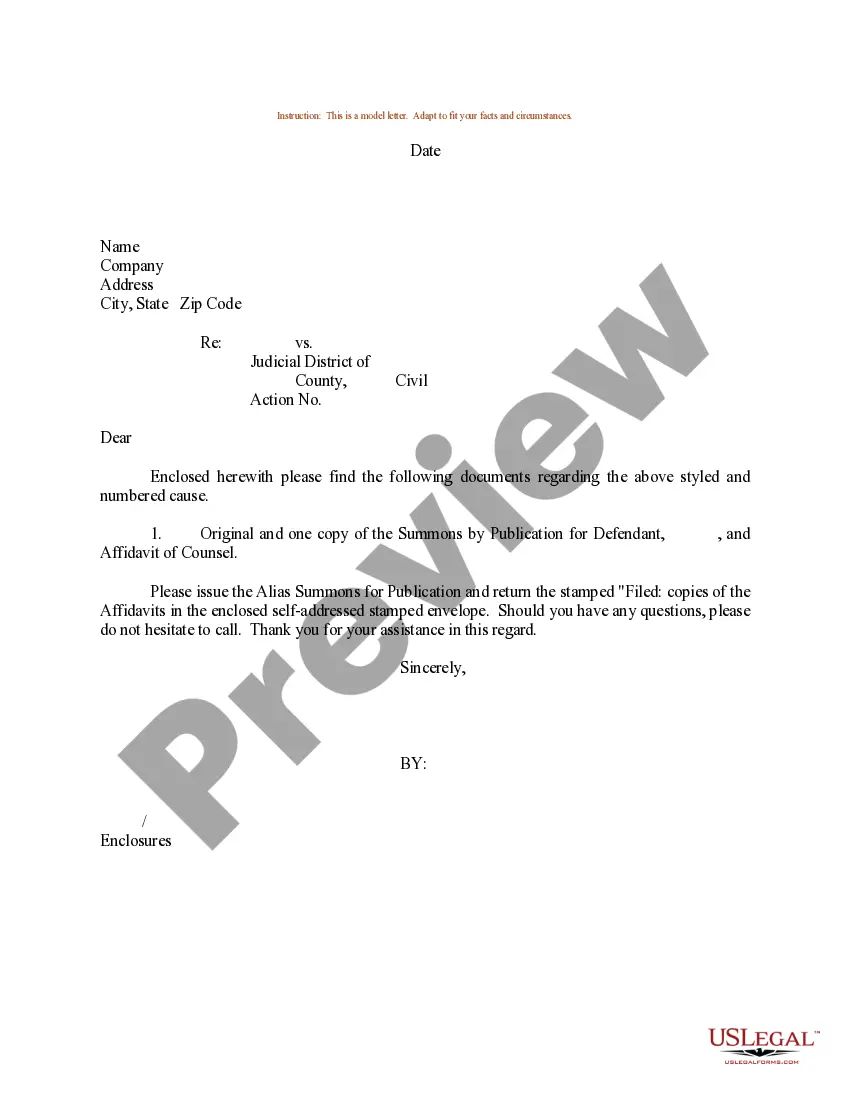

How to fill out Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

US Legal Forms - one of many biggest libraries of authorized varieties in the States - gives an array of authorized papers templates you may acquire or print. Utilizing the website, you may get a huge number of varieties for business and individual functions, categorized by classes, says, or search phrases.You can find the latest types of varieties just like the New Hampshire Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan in seconds.

If you already possess a registration, log in and acquire New Hampshire Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan in the US Legal Forms catalogue. The Down load switch will appear on every single type you view. You have accessibility to all previously downloaded varieties inside the My Forms tab of your own account.

In order to use US Legal Forms the very first time, here are straightforward directions to obtain began:

- Be sure to have selected the proper type for your town/region. Click the Preview switch to examine the form`s articles. Read the type description to ensure that you have chosen the right type.

- In case the type does not fit your demands, make use of the Search industry on top of the screen to discover the the one that does.

- In case you are happy with the form, verify your decision by clicking on the Get now switch. Then, opt for the rates prepare you like and offer your accreditations to sign up on an account.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal account to complete the financial transaction.

- Pick the format and acquire the form in your gadget.

- Make alterations. Complete, revise and print and sign the downloaded New Hampshire Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan.

Each template you included in your account does not have an expiry date and is the one you have forever. So, in order to acquire or print yet another version, just go to the My Forms section and click on around the type you will need.

Obtain access to the New Hampshire Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan with US Legal Forms, by far the most extensive catalogue of authorized papers templates. Use a huge number of skilled and condition-distinct templates that fulfill your organization or individual demands and demands.

Form popularity

FAQ

In the United States, the IRS classifies any employee who works an average of 32 to 40 hours per week or 130 hours per month as full-time. This maximum amount began in 1938 when Congress passed the Fair Labor Standards Act, which required employers to pay overtime to all employees who worked more than 44 hours a week. What Are Full-Time Hours? - BambooHR bamboohr.com ? resources ? hr-glossary ? f... bamboohr.com ? resources ? hr-glossary ? f...

5 consecutive hours All employees in the state of New Hampshire, regardless of the working sector, are entitled to a 30-minute meal break after working for 5 consecutive hours. New Hampshire Labor Laws Guide Clockify ? state-labor-laws ? new-hampshire... Clockify ? state-labor-laws ? new-hampshire...

Employers must only follow their policies. Whether earned but unused vacation time is paid upon separation from employment is determined by the employer's policy or the employee's contract.

Employees who usually work more than 35 hours per week (at all jobs within an establishment) regardless of the number of hours actually worked. Persons who were at work for 35 hours or more during the survey reference week are designated as working full time.

Full-Time Employee. One who is hired to work at least the normal number of hours in a workweek as defined by an employer or a statute, usu. 35 to 40 hours. Massachusetts law about employment - Mass.gov mass.gov ? info-details ? massachusetts-law-... mass.gov ? info-details ? massachusetts-law-...

You're still owed holiday pay If you leave part-way through the year, you might not have taken all the holiday you're entitled to. Your employer has to pay you for any holiday you're legally entitled to but haven't taken. This is called pay in lieu of holiday.

For full-time California employees, the 40-hour workweek and 8-hour shift is the norm. Employers must pay overtime for time worked over eight hours in a day. What Is Considered Full Time in California? - Starpoint Law starpointinjurylaw.com ? articles ? what-considere... starpointinjurylaw.com ? articles ? what-considere...