New Hampshire Nonqualified Stock Option Plan of the Banker's Note, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of The Banker's Note, Inc.?

US Legal Forms - one of several most significant libraries of legitimate kinds in the USA - delivers an array of legitimate record themes you may obtain or print. Utilizing the website, you will get a large number of kinds for organization and individual purposes, categorized by categories, says, or key phrases.You can get the newest versions of kinds just like the New Hampshire Nonqualified Stock Option Plan of the Banker's Note, Inc. within minutes.

If you have a subscription, log in and obtain New Hampshire Nonqualified Stock Option Plan of the Banker's Note, Inc. from your US Legal Forms collection. The Obtain option will show up on every type you see. You have accessibility to all previously downloaded kinds from the My Forms tab of your respective account.

If you want to use US Legal Forms initially, listed below are straightforward guidelines to obtain started off:

- Make sure you have chosen the correct type to your area/area. Go through the Preview option to check the form`s content material. Browse the type information to ensure that you have selected the appropriate type.

- If the type does not fit your demands, make use of the Search discipline towards the top of the display to get the one that does.

- Should you be pleased with the form, affirm your decision by visiting the Acquire now option. Then, opt for the pricing strategy you like and supply your qualifications to register to have an account.

- Process the transaction. Utilize your credit card or PayPal account to complete the transaction.

- Pick the format and obtain the form on your own device.

- Make alterations. Fill up, modify and print and indication the downloaded New Hampshire Nonqualified Stock Option Plan of the Banker's Note, Inc..

Each format you included with your money does not have an expiration date which is the one you have forever. So, if you wish to obtain or print yet another duplicate, just proceed to the My Forms area and click on in the type you require.

Obtain access to the New Hampshire Nonqualified Stock Option Plan of the Banker's Note, Inc. with US Legal Forms, one of the most considerable collection of legitimate record themes. Use a large number of specialist and state-particular themes that fulfill your business or individual requirements and demands.

Form popularity

FAQ

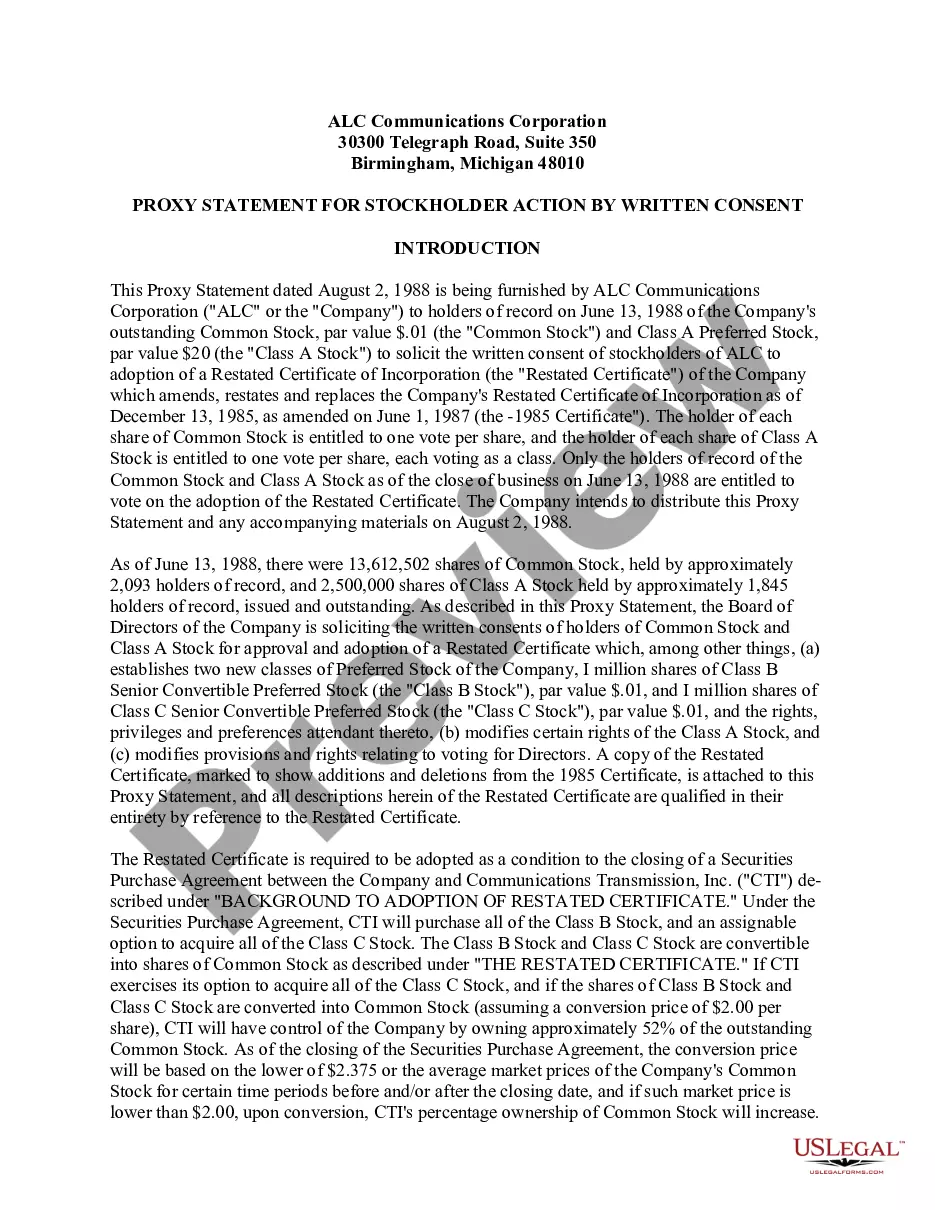

Sell to Cover* When you exercise your stock options and sell enough shares to cover the option exercise costs, taxes, commissions and fees. You then receive the remaining shares.

The Cost Basis of Your Non-Qualified Stock Options The cost basis, generally speaking, is equal to the exercise price, multiplied by the number of shares exercised. In our example above, the cost basis is equal to 2,000 shares times $50/share, or $100,000.

What Is a Non-Qualified Stock Option (NSO)? A non-qualified stock option (NSO) is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option.

Initiate an Exercise-and-Sell-to-Cover Transaction Exercise your stock options to buy shares of your company stock, then sell just enough of the company shares (at the same time) to cover the stock option cost, taxes, and brokerage commissions and fees.

If you sell right away at the current FMV of the stock, you will not have any capital gain and will only have to pay ordinary income tax on the spread. If you sell your stock within a year of when you exercised your options, you'll pay short-term capital gains tax on any increase in value since the exercise date.

In addition to the previously discussed buy to cover, there is also "sell to cover." Sell to cover refers to employees with stock options that are in the money cashing them in and then immediately selling a portion of the stock to cover the cost of buying them.

Taxation on nonqualified stock options As mentioned above, NSOs are generally subject to higher taxes than ISOs because they are taxed on two separate occasions ? upon option exercise and when company shares are sold ? and also because income tax rates are generally higher than long-term capital gains tax rates.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.