A New Hampshire Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation refers to a financial benefit that individuals possessing non-exercisable stock options are entitled to receive when a merger or consolidation takes place. This description aims to provide a comprehensive understanding of this arrangement, highlighting its purpose, eligibility criteria, process, and potential variations. Keywords: New Hampshire, cash award, holders, non-exercisable stock options, merger, consolidation, benefits, financial compensation, eligibility, process, variations. Overview: A New Hampshire Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation is a type of financial compensation granted to individuals who hold non-exercisable stock options in a company involved in a merger or consolidation process. This payment serves as recognition of the employees' contributions and the potential loss they would incur due to the non-exercisability of their stock options after the completion of the merger or consolidation. Eligibility: The eligibility criteria for receiving the New Hampshire Cash Award may vary based on the specific terms and conditions set by the company. Generally, employees who hold non-exercisable stock options at the time of the merger or consolidation are eligible to receive the cash award. These stock options must have been granted prior to the announcement of the merger or consolidation. Process: 1. Announcement: The company announces an upcoming merger or consolidation, providing information on the terms, timeline, and impact on stock option holders. 2. Eligibility Assessment: Eligible employees with non-exercisable stock options are identified by the company. 3. Determining the Award: The specific calculation method for determining the cash award is often outlined in the company's policies or agreements. Factors such as the number of non-exercisable stock options, their original grant value, the merger's financial impact, and any applicable company valuation are taken into account. 4. Communication and Confirmation: The company informs eligible employees about the cash award, including its amount, payment date, and any associated tax implications. 5. Payment: The cash award is disbursed to the eligible employees in a timely manner, often through direct deposit or payroll processing. Types of New Hampshire Cash Awards: While the general concept of a New Hampshire Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation remains consistent, there can be additional variations based on company-specific policies or agreements: 1. Merger-Specific Cash Award: Companies may offer different cash awards based on the degree of ownership change resulting from the merger. 2. Consolidation-Specific Cash Award: Cash awards may differ depending on the nature and complexity of the consolidation process, such as a vertical or horizontal consolidation. 3. Tiered or Scaling Cash Awards: Companies might offer a sliding scale of cash awards based on factors like the employee's position, length of service, or the value of non-exercisable stock options. 4. Performance-Based Cash Awards: In certain cases, the cash award may also incorporate performance-based metrics or individual contributions to the company's success. In conclusion, a New Hampshire Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation is a financial benefit provided to eligible employees with non-exercisable stock options when their company undergoes a merger or consolidation. Despite potential variations in the award structure, this compensation aims to acknowledge the employees' value, contributions, and the impact resulting from the non-exercisability of their stock options after the transaction.

New Hampshire Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

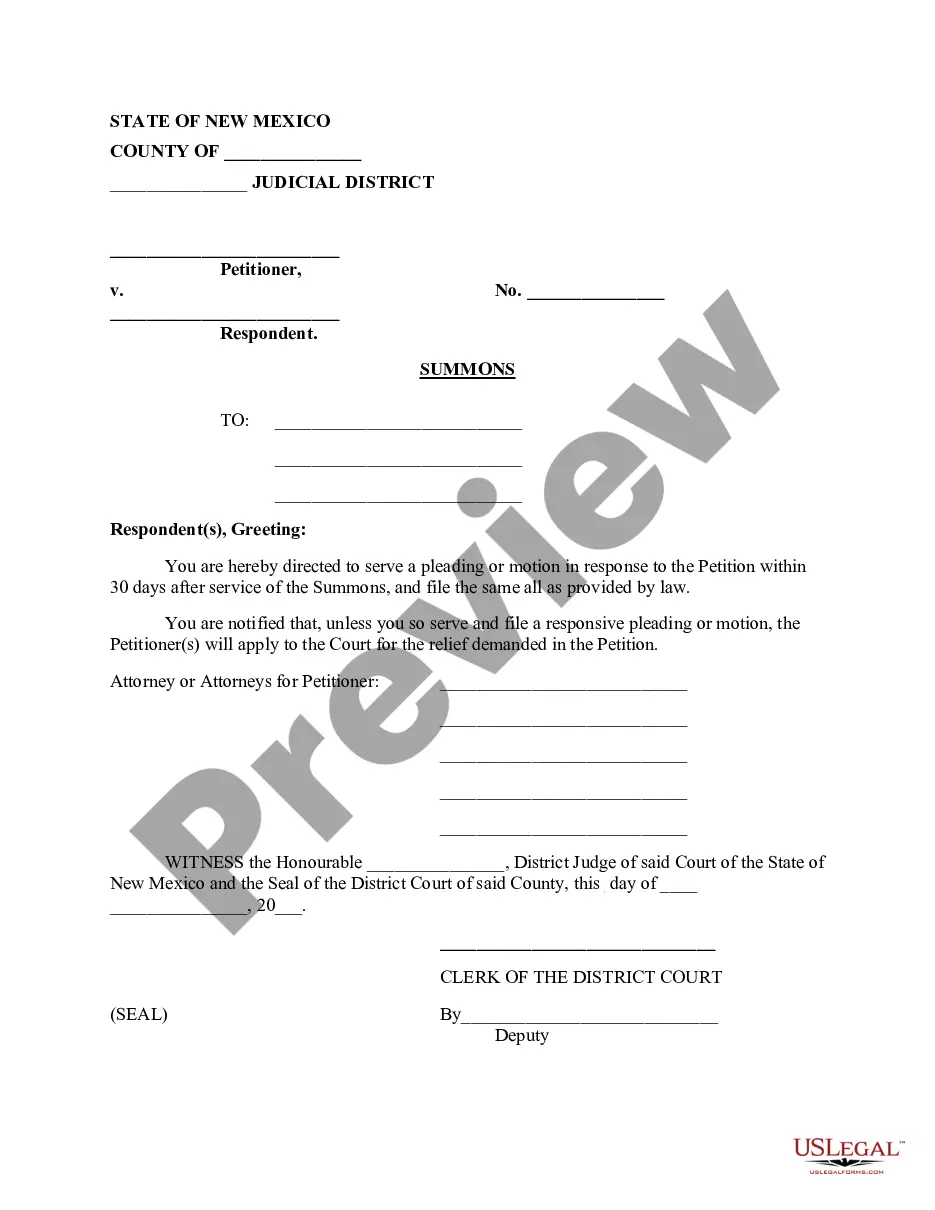

How to fill out New Hampshire Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

Are you in the position in which you require papers for either business or individual purposes almost every time? There are plenty of authorized document web templates available on the Internet, but discovering ones you can rely on is not straightforward. US Legal Forms provides thousands of develop web templates, just like the New Hampshire Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, which are published in order to meet state and federal needs.

If you are presently informed about US Legal Forms website and possess a merchant account, basically log in. Following that, you are able to down load the New Hampshire Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation web template.

Unless you come with an accounts and would like to start using US Legal Forms, adopt these measures:

- Find the develop you need and ensure it is to the right metropolis/area.

- Use the Preview key to review the shape.

- Read the information to ensure that you have chosen the proper develop.

- In the event the develop is not what you are trying to find, take advantage of the Research industry to get the develop that fits your needs and needs.

- Once you discover the right develop, just click Buy now.

- Select the costs prepare you want, fill in the required information and facts to produce your money, and purchase the order making use of your PayPal or charge card.

- Decide on a hassle-free file formatting and down load your copy.

Get all the document web templates you may have purchased in the My Forms menu. You can aquire a extra copy of New Hampshire Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation at any time, if necessary. Just go through the required develop to down load or produce the document web template.

Use US Legal Forms, probably the most considerable assortment of authorized forms, in order to save efforts and avoid errors. The service provides expertly produced authorized document web templates which you can use for a selection of purposes. Produce a merchant account on US Legal Forms and start producing your life a little easier.